Thoughts on Calling the BottomIn a tough market, people seek solace in anyone that can offer a semi-coherent theory on when things will turn. Yet bulls calling for imminent rallies to new heights are met with the repeated disappointment experienced by doomsday cults waking up to another uneventful Armageddon. While cult members usually stick around for the revised calendar entry for "the end of the world," crypto bulls chasing each failed breakout are likely to have their conviction dampened by deeper financial losses. As this piece goes to press, Bitcoin prices sliced below lows that have been maintained for most part of the year. The conversations across crypto suggests that the end is still not in sight. The more ferocious bears claim the pain could easily last for another year or two. But fanaticism in crypto investing is never in short supply. In the near term Bitcoin can go to $5000, $3000, and even $1000, yet many long-term investors believe that astronomical bitcoin prices in the hundreds of thousands are nothing short of categorical truth. But on this journey to financial nirvana, obstacles mount one after another:

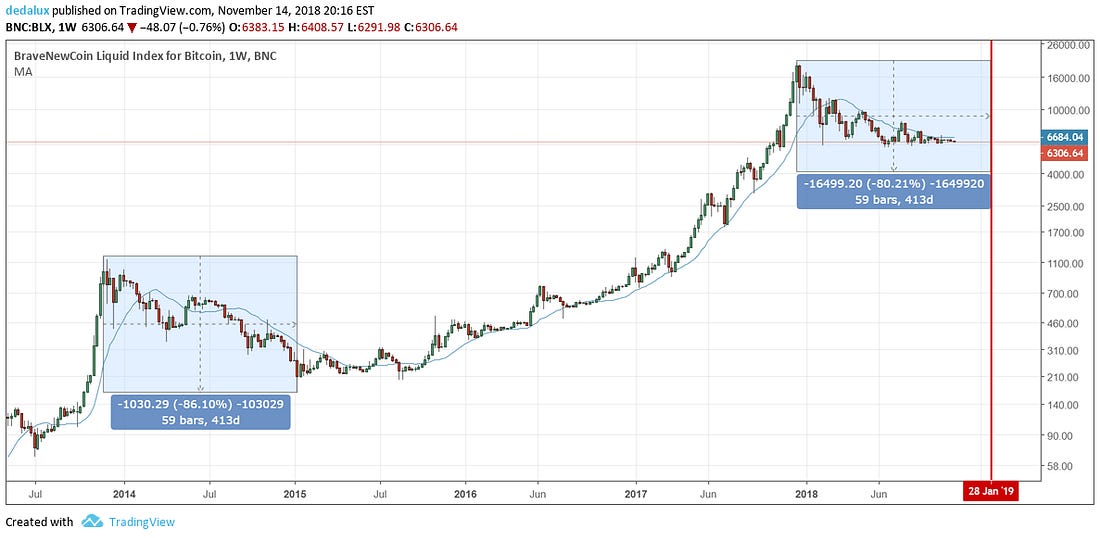

Here I will not attempt to throw another meaningless price target or date into the bottom-calling contest. However, recently I've come to see one particular narrative taking hold that bothers me: namely, being overly reliant on price actions in past cycles to predict outcomes in the current one. Follies of FractalsVarious forms of the chart below are posted across crypto Twitter. The method underpinning this analysis is what many call fractal analysis, or finding similar shapes of price patterns and use them to infer future outcomes. In my reproduction below, I assume the message conveyed here is: "the previous macro downtrend took 413 days from top to bottom, this time around it should take around a similar duration." Before I say anything about this, my artistically stunted brain doesn't see the two price trends as triangles, not mentioning whether a triangle can even be applied to the 2014 cycle. Presumably because it's bullish leaning, this argument keeps finding its supporters.

Any undergrad that had the misfortune of sitting through an intro to financial markets course, including yours truly who once was, can effortlessly regurgitate that markets are mostly efficient. In the academic sense, efficiency describes how well a market processes information so that there are no pricing discrepancies that could last more than a short period. The consensus among participants in mature markets markets are generally "semi-strong" efficient. In another word, over the long run, using price based technical analysis (TA) or even incorporating existing public information is not profitable. Only using private information, or more familiarly known as insider trading, is the only way to to remain profitable in the long run (duh?). Theory is often far off from practical realities and crypto is light of centuries of financial history. A quick stroll through crypto Twitter and you will find countless "experts" who have a knack for practicing basic studio arts skills on financial charts. Some of them have done unbelievably well for themselves and their followers using TA. However, my intuition is that this type of stuff works until it doesn't. It is likely to work for short term trades in bullish markets because crypto is thinly traded in general and it doesn't take much to move prices. If people are looking at similar patterns and making decisions based on these patterns and there are no clear fundamentals to keep prices in check, then sooner or later price trajectory would align with the predictions based on technical analysis. In my traditional career, I had the chance of studying and debating with hundreds of the best hedge fund managers in the world. Among the best stockpickers, a small cohort could manage to be right 50% of the time with their calls. The best I've seen was somewhere around the mid-60%. Mind you, these are supposedly the most brilliant business minds in the world who spend an average of 60-100 hours a week studying their positions. If TA has worked for you for short term trades in crypto, keep doing what you are doing but analyze why it has worked for you and be mindful of new information. However, I would be strongly averse to using TA to make any meaningful conclusion regarding long term trend, especially attempting to call a price and time for an exact bottom. As we shall see, instead of being an apples to apples comparison, using 2014 fractals to call the 2018-19 bottom is more like comparing apples to 3D-printed oranges. The 2013 Run and Aftermath

Let's examine some key events from the 2013 run-up:

Some events referenced from memory, but highly recommend Chapter 25-26 of Digital Gold by Nathaniel Popper for a more detailed account. People who have been through the 2017 run would scoff at these weak sounding drivers. Yet traders in 2013 saw these as big deals, if not made them into big deals with great determination. This was the genesis of shifting the narrative of Bitcoin from being an obscurity in the arsenal of criminals to a legitimate tool that established companies can leverage for a potential variety of use cases. For what they were worth, these drivers lead to a price increase of around 10x in the span of 3 months before correcting close to 85% over the next year. The general sentiment led to the influx of short term swing traders, while not giving many investors the incentive to hold over long term. Looking back, the announcements seemed too vague and the implementation of the potential uses too experimental. Imagine these announcements came out during the 2017 run; most traders would've tossed them straight into the garbage bin. Examining the volume over the 9-week period in late 2013 run, a total of around 10mm BTC changed hands. Assuming an average traded price of $500 per coin, this run had a total turnover of $5 billion. Though the precise number for the net inflow of fiat money that went into supporting the mania doesn't exist, I'd estimate no more than $100-500mm went into the space given leverage was still liberally allowed in China and fees weren't as much of a friction back then. $5 billion may seem like a pretty big number, but in comparison, in the 2017 run up total volume across fiat exchanges exceeded $5bn on multiple days. For the last 9 weeks in 2017, around 15 million bitcoins were traded, with average prices one or two orders of magnitude greater than the 2013 average. As expected, the number of eyeballs glued onto Bitcoin charts have grown by millions. Among the newcomers, many of them brought in ever-greater financial backing and trading prowess. As for real investment into the space, it has expanded far beyond a few amateur exchanges and dice games. Hundreds of millions have been poured into mining farms, payment processors, newer and better exchanges, supporting a more well-rounded ecosystem, whether the users are here or not. More than 20mm accounts have been opened on Coinbase. Premier VCs like Andreessen Horowitz are no longer coy with reporting their Bitcoin holdings to their investors and have even started sizable new funds devoted exclusively to the crypto space. In light of these simple facts, I'd shy away from using insights derived from a previous regime to predict the next one. To wrap up this piece, I'll leave you some of the 2014 headwinds as food for thought:

Systemic risk was ubiquitous in the 2013-2014 era and crypto persecution loomed around every corner. Each headwind here seemed to hold the power of breaking the entire space, leaving only the most risk-seeking buyers willing to gamble on an optimistic Bitcoin future. Compared to the countless persecutions looming around the corner, the current finds more constructive conversations being held: how do we make infrastructure better and safer? Who will step in to provide custodian solutions to promote the long term holding of coins? Now with more established individuals with serious skin the game, the stakes have shifted greatly. If you are blessed with the talent of spotting the inflection points of these events through triangles drawn on a chart, then I congratulate you, enviously. I only have a feeling that fundamentally everything about the space is better than before, even if it's nowhere near perfect. As for when that will play out, my only support line is my own patience. In the next few installments, I'll expand on more bottom-calling insights by examining the evolution of Bitcoin's narrative, namely from an underground payment method to a financial asset that might stand the test of time. I'll try to shine more light on the players and market infrastructure of back then vs. those now. By now, if you were looking for some hardcore tea leaf reading, I apologize for the disappointment. However, if there's any solace, I'll attempt to round up a few signs that the pros look at to signal that it's safe to come out and play again. I can't tell you when it'll happen, but I can try to prepare you to be ready when it does. You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |

Thursday, November 15, 2018

Thoughts on Calling the Bottom

Hard Fork / Bitcoin Futures / Stablecoins / Lolli Investment

| ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||