| Greetings, Here are the top business stories for the next week: - Non-farm payroll data will show the state of the labor market.

- Rivian will unveil a more affordable EV

- Retail giants Costco and Target will announce the latest earnings.

Thanks for reading! Stjepan

p/stjepan-kalinic | |

| 1 | | The United States Department of Labor will release the February nonfarm payroll data on Friday, March 8. Analysts anticipate the addition of 188,000 jobs, partly attributed to milder weather conditions. More: - A 188,000 payroll addition would represent a slowdown from January's 353,000, which crushed the market's expectations of an early rate cut. The FED's economists observe the labor market strength as inflationary.

- Skepticism persists regarding a genuine labor demand resurgence, as various indicators suggest cooling conditions and average hourly earnings are expected to rise by 0.2%, cooling from January's +0.6%.

- The unemployment rate is forecasted to remain at 3.7%.

- Danske Bank's recent research emphasized solid hard market data while indicating mixed leading signals. Analysts noted February's optimistic outlook for manufacturing, while the Conference Board survey showed an unexpected downtick in general economic sentiment.

|     | |

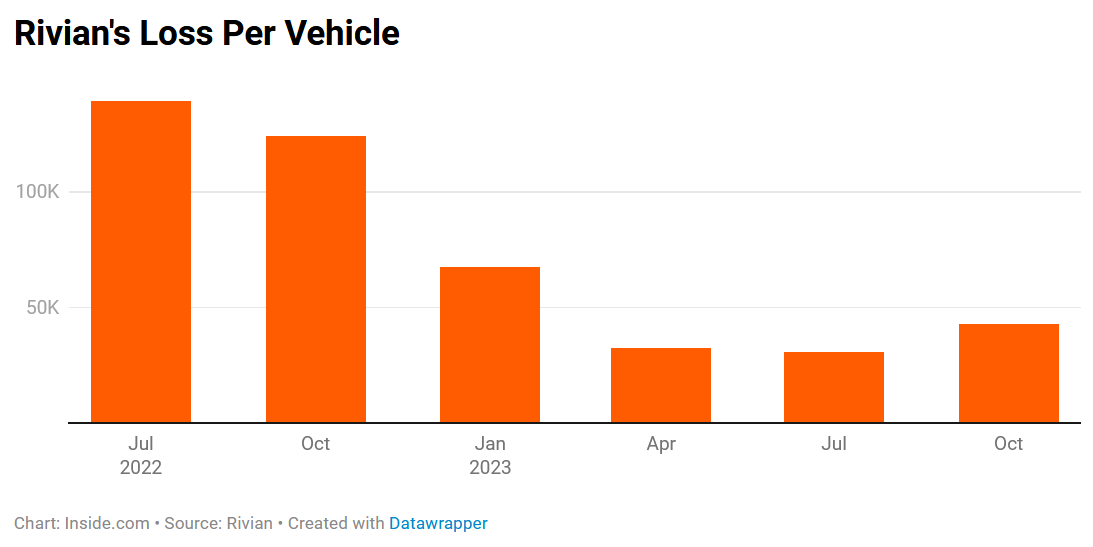

| 2 | | Rivian Automotive will unveil its R2 model on March 7, signaling a potential turnaround for the company that has lost over 80% of its market cap since its IPO. Recent challenges, including bad earnings and analyst downgrades, have pressured Rivian's outlook and financial performance.

More: - Per the latest data, Rivian has been losing around $43,000 per vehicle for its R1T and R1S models, starting at $69,000 and $74,900. This number represents an uptick from the previous two quarters.

- Rivian R2 is rumored to be an SUV costing between $40,000 and $60,000, signaling the desire to appeal to a broader market.

- Rivian reported disappointing Q4 results, with a larger EPS loss than anticipated despite a 99% year-over-year revenue increase. Production of 17,541 vehicles in Q4 represents the company's strongest quarter to date, with an annualized rate of over 70,000 units. Total operating expenses in the quarter grew to $975M, while the company had a cash position of $9.37B at the end of the quarter.

- The management expects to produce 57,000 vehicles in 2024 with a projected full-year EBITDA loss of $2.7B and anticipates reducing salaried employees by approximately 10%.

- Truist downgraded the stock from "Buy" to "Hold", citing an elongated path to positive free cash flow, and lowered the price target to $11.

|     | |

| 3 | | Costco will announce Q2 fiscal 2024 earnings on Thursday, March 7, with estimates anticipating a 10% increase in net income to $1.62B and an EPS of $3.62. The company's membership model, crucial to its fiscal growth, is forecasted to reach 72.8 million. More: - Costco has already posted sales results for December and January, at $26.2B and $22.1B, respectively.

- Costco's membership model, with a forecast of 72.8 million members, is crucial for fiscal growth. Analysts will be closely monitoring the impact of Costco's membership sharing crackdown.

- Richard Galanti, Costco's CFO since 1985, will be stepping down. Customers will remember Galanti as the executive who kept the hot dog and drink combo at $1.50 since its introduction in 1984. Gary Millerchip, former Kroger Co.'s CFO, will be his successor.

|     | |

| 4 | | The European Central Bank (ECB) will announce the main refinancing rate on Thursday, March 7. The analysts place a 94% expectation that the Governing Council remains put, waiting to see more economic data before deciding on a change. More: - Recent data including a pullback in February's harmonized index of consumer prices (HICP) to 2.6% and the Q4 GDP at 0% suggests a cautious approach.

- ECB officials, led by President Christine Lagarde, have signaled no immediate rate cuts, with potential considerations after April's wage data.

- Bank of Greece's Governor Yannis Stournaras, known for his dovish stance, doesn't anticipate a first-rate cut until June.

- The market outlook suggests 86 basis points policy loosening for the entire year, with Reuter's survey showing 46 of 73 analysts expecting the first reduction in June.

|     | |

| 5 | | Target Corporation (TGT) will report Q4 earnings on March 5 with the consensus expectations of growth in EPS and revenue but with a moderate same-store decline. Target has trailed its peers like Costco and Walmart in recent months, owing to weakening customer traffic trends. More: - Expected EPS of $2.41 has been revised upwards. It represents a year-over-year EPS growth of 27.5%.

- Revenues are expected to be $31.88B, up 1.5% from last year's quarter. The gross margin is projected to be 25.0% of total sales.

- Same-store sales are expected to drop 4.6% for Q4 and 3.6% for the year, according to LSEG estimates. The 2024 sales are expected to rise by about 1%.

- Analysts expect lower customer traffic and average ticket during the quarter, with adjusted EBITDA of $2.23B and cautious guidance from management.

|     | |

| 6 | | Bank of Canada will announce its rate decision on Wednesday, March 6. The consensus anticipates the Bank of Canada (BoC) to maintain its policy interest rate at 5.00%, with analysts projecting a potential rate cut in June as policymakers assess lingering concerns about inflation and elevated shelter costs. More: - Inflation has cooled to 2.9% YoY, but uncertainties persist, leading analysts to expect the BoC to keep its policy interest rate at 5%. They anticipate the possibility of the first-rate cut discussed at the June meeting.

- There is no clear consensus on the timing of rate cuts in 2024, but around 70% of economists surveyed anticipate 100bps of cuts or less, with potential risks of a delayed rate cut beyond June.

- The BoC's tightening cycle has influenced the housing market, with average home prices falling by 19% from their peak in February 2022, highlighting a significant shift in the real estate landscape.

- Economists note that the BoC may have underestimated inflation in the early stages of its tightening cycle, leading to delayed rate hikes and potential impacts on the effectiveness of the policy.

|     | |

| 7 | | Quick Hits: - Top Performers are seeing a 56% increase in deal generation and productivity when they use this sales framework.*

- The Morgan Stanley Technology, Media, and Telecom Conference starts on March 6 in San Francisco. The event will cover updates on the latest trends in generative artificial intelligence and other hot technology topics. Participating companies include Nvidia, AMD, Intel, Disney, Coinbase and more.

- General Electric is holding an Aerospace Investor Day event on March 7. Following a much-anticipated conglomerate break-up, GE Aerospace will start trading as a stand-alone company on April 2.

- Speculative traders will watch Beyond Meat, as its stock hits a 6-month high on a short squeeze. Shares of the beaten-down stock climbed as high as $11.48. A high short ratio, exceeding 30% of the float, might prompt more volatility during March.

*This is a sponsored listing. |     | |

| Upcoming Events | | MAR

7 | | Portfolio Diversification - Learn from knowledgable experts on the latest trends in alternative investment assets like private equity, crypto, real estate, and the art market. | | | | | | | MAR

27 | | Discover how generative AI can speed up your enterprise, expand your business model, and improve your value proposition. Network with hundreds of AI leaders.* | | | | | | * This is a sponsored event | | | |

| Freelance Writer | | Stjepan Kalinic is an analyst and writer with a background in institutional investment research. He's passionate about reading, playing music, lifting weights, and practicing martial sports. He values interesting books above everything else, and you can send recommendations through LinkedIn. | | This newsletter was edited by Megan LaBruna | |

| |

| |