Weekly BulletinWe've had a rather slow week in important news. Which makes sense. The big dates everyone is waiting for are still:

This weekAs much as I want to write about how disgusted I am with the Government of Venezuela for taking pensioners' bolivars from their accounts and replacing them with their shitty Petro coin, I am going to try to keep the Weekly Bulletin information based, and save my rants for the miscellaneous letters. Today we've got a market analysis from CryptoCore (and a dose of hopium from Dmitriy). Tether dominance drops?

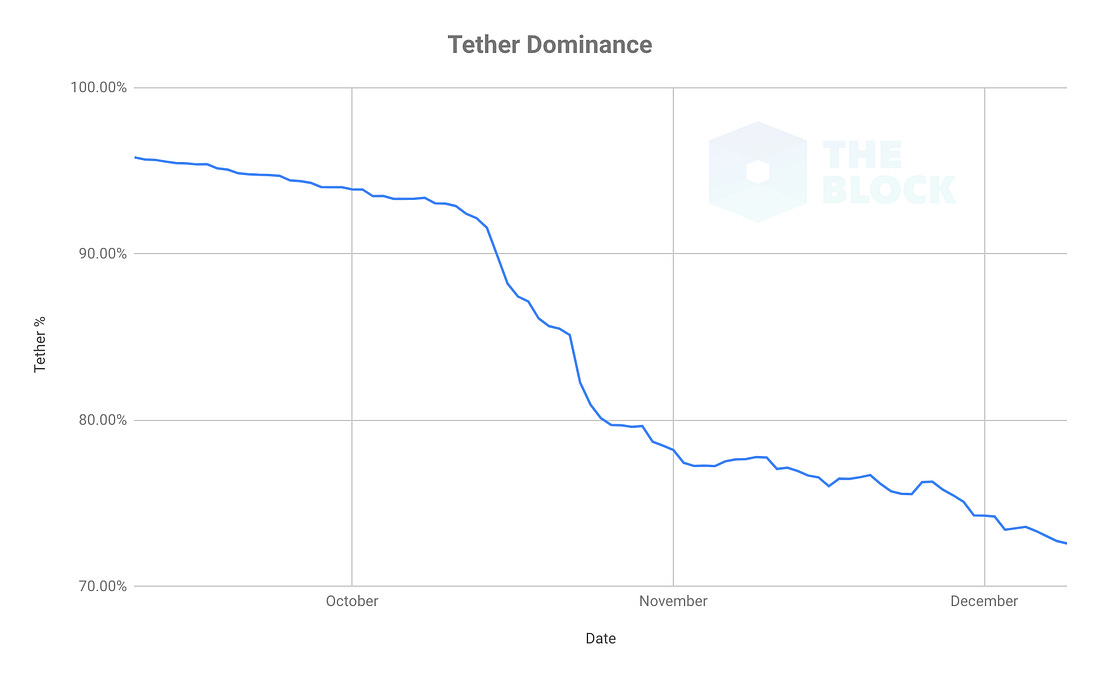

At least that's according to this article. Does anyone see anything wrong with this?

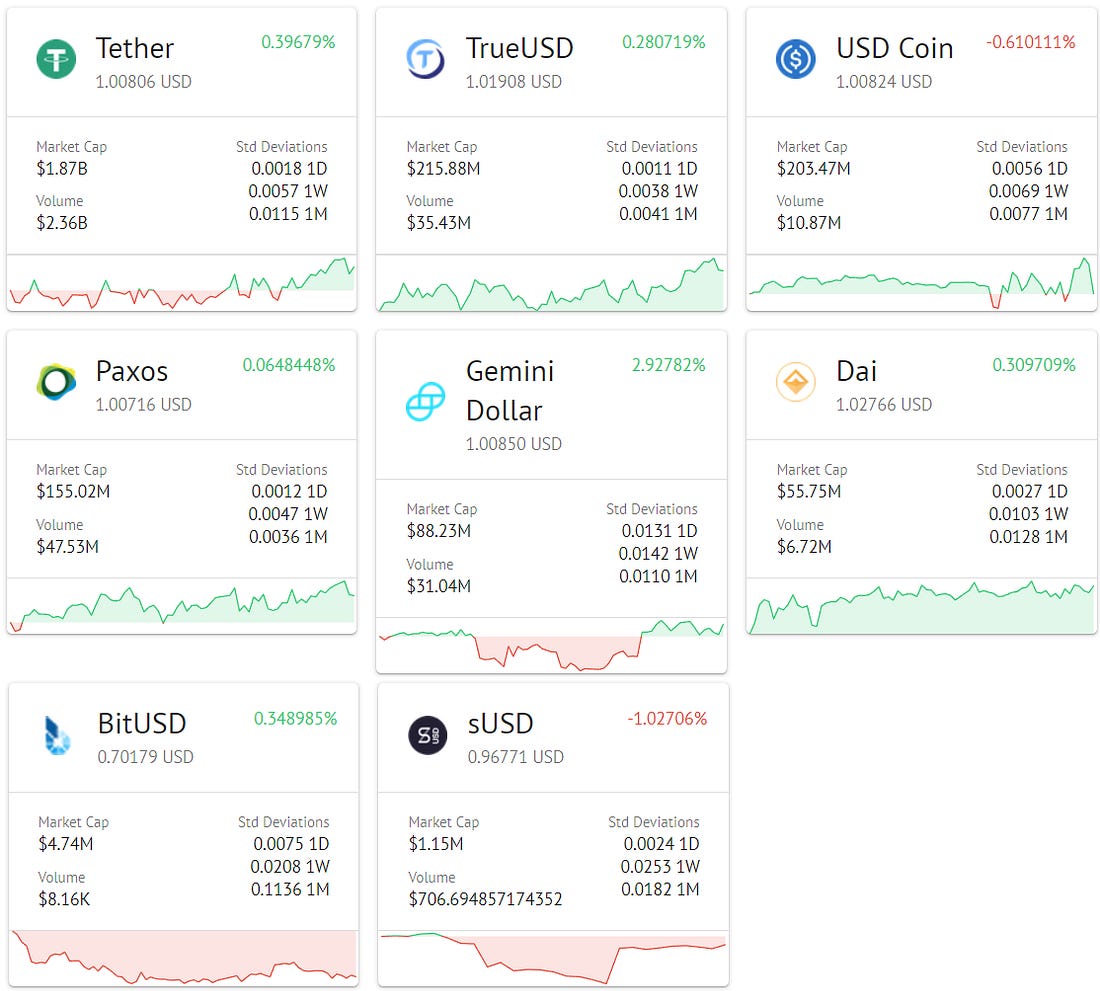

I'm sure you all do, because you're smart. The author correctly wrote that the decline in dominance could explained by the rise of new stablecoins and Tether destroying almost a third of its supply. But the question remains, why is this important? Because it's not. Measuring stablecoins by their market-cap is stupid. Let's take a look at the daily volume of the top 10 stablecoins.

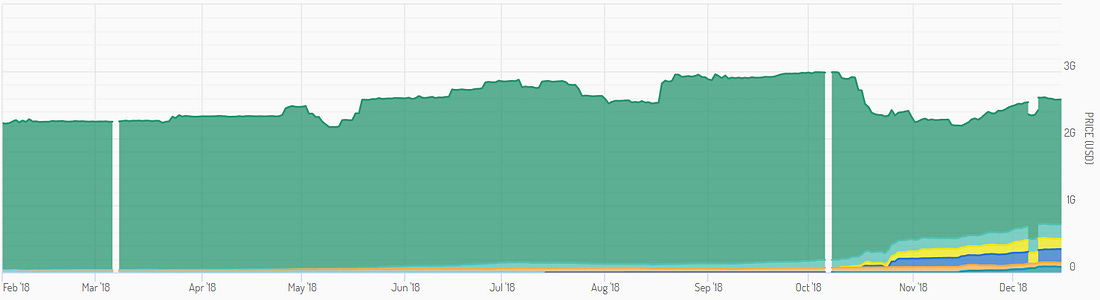

Tether accounts for ~95% of the "stablecoin" trading volume (in the last 24 hours). Below is a chart of stablecoin market-caps. All that green color is Tether, and those colors below the green are other stablecoins. Wow, it still almost looks like Tether is losing dominance.

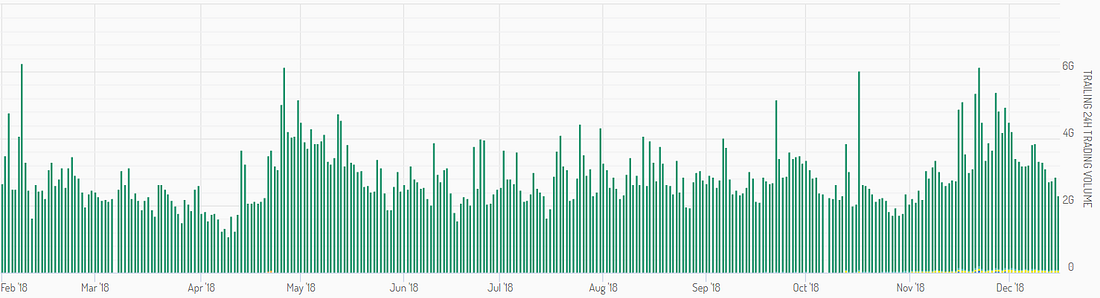

Now let's look at the same chart, but this time with trading volume instead of market-cap.

You get it? And besides, a stable coin isn't actually stable. It's most likely something that's going to be pegged to the dollar. If you're going to have a stable coin pegged to the dollar, your coin is going to depreciate just like the dollar. And now you also have to worry about counter-party risk… Okay, stablecoins are stupid. End of rant. Source for all of these charts: https://stablecoinindex.com/volumeRandom thoughts about Boaz Manor/BCT

You can read the story here. The reason I bring this up is because Kunyi and I were both in Puerto Rico for a conference in 2018 and we've taken a look at their product. I vividly remember us chuckling and trying to control ourselves from flat out laughter at how shitty their product was (it's rude to laugh as a sales persons / representative face, he's only trying to do his job). It was so bad though. We tried to change up a few indicators, see what was under the hood, and it looked like there were some make-shift API connections to Microsoft Excel or Tableau. Oh, and it wasn't live, all the data was static/historical. We walked away shaking our heads joking about how much of a scam it was. Market SentimentNick's POVAs the weekly candle closes with a ridiculously bearish trend I can't help but wonder when we'll have a week of relief. Taking a look a the Guppy Multiple Moving Averages, the weekly shows us oversold conditions. Typically when I see a trend this strong, with a bearish bias, I either stay out of the markets or retain a portfolio hedge.

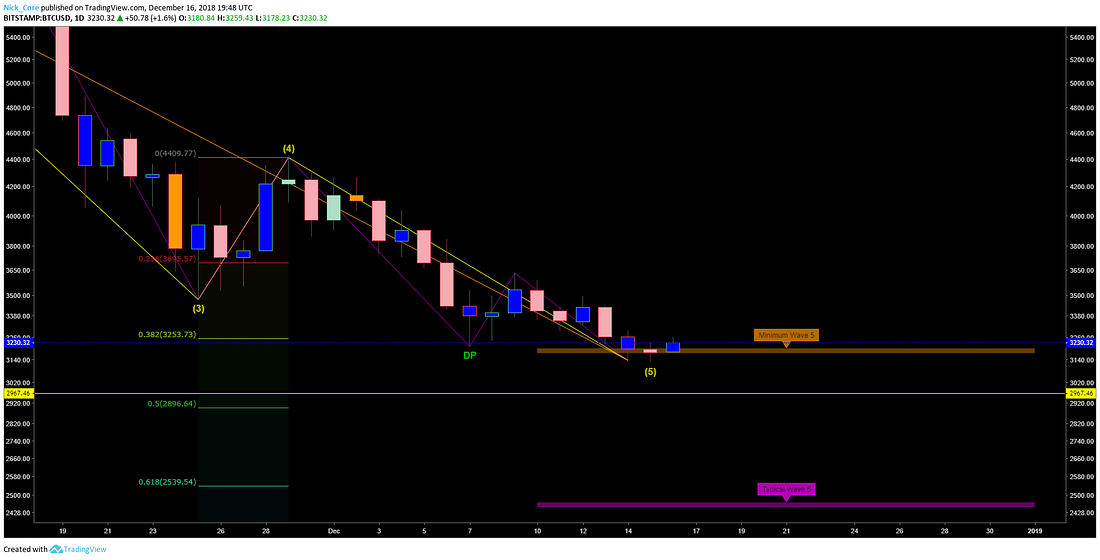

Moving on to the daily to see where our potential bottom is on the current wave; I can see the 5th wave has met the minimum criteria needed for a reversal. However, nothing is absolute with technical analysis let alone Elliott waves.

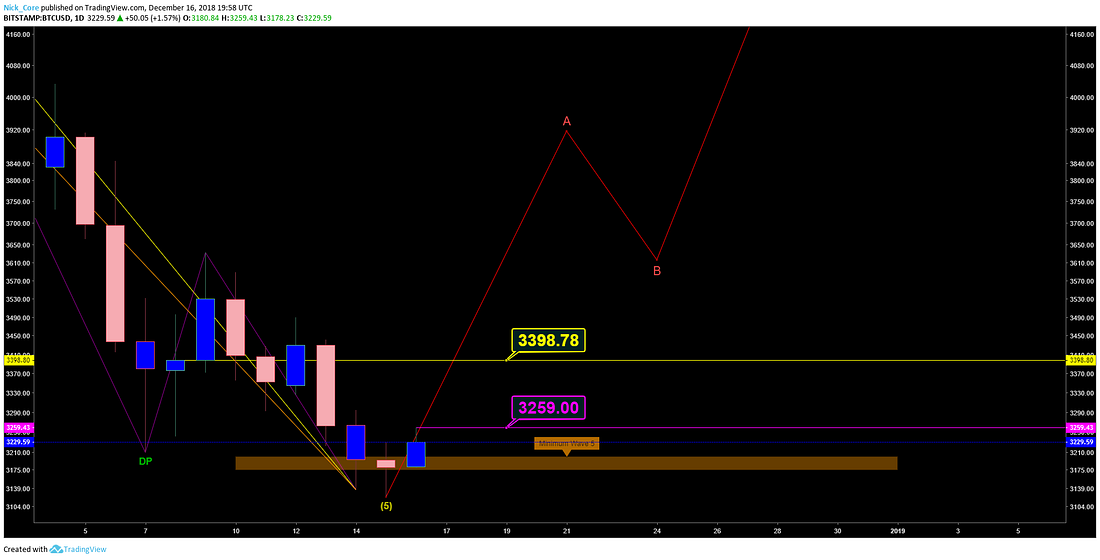

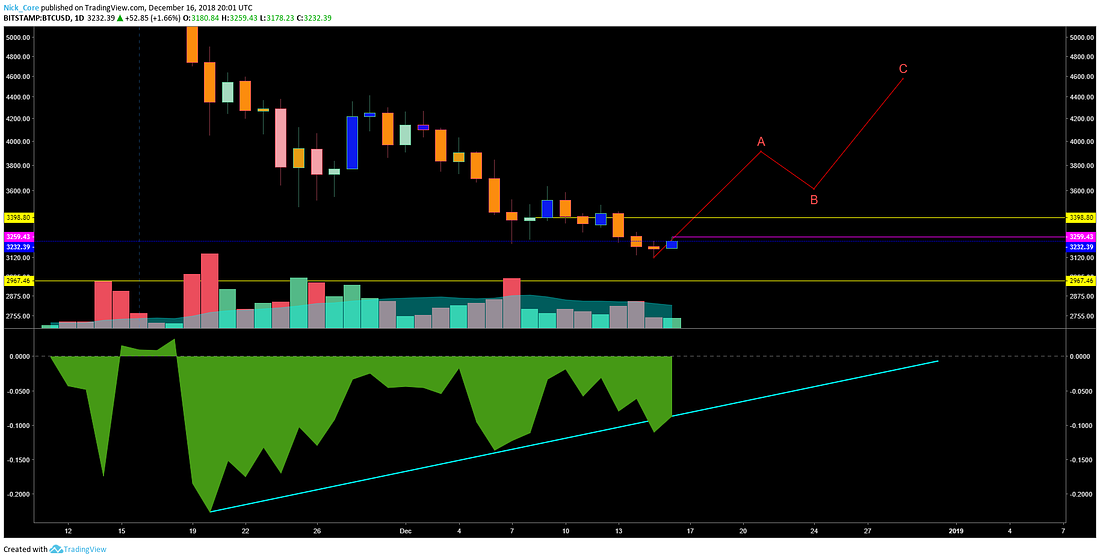

The 5th wave is extremely truncated considering the strength of the sell off lately. More reasonably I think the support range between 2800 to high 2900's (depending on the exchange) is a better ending that matches the strength of prior waves. That being said, we are in a price level scenario that is extremely complex, a rally upwards above 3259 would cause a breakout upwards, and ultimately a test of 3398.

At that point if volume can maintain a trend upwards on the daily Chaikin Money Flow to the median line then I would expect this ABC correction to take place and confirm on the 3398 break. Daily support definitely needs to be found at this level and I need to see a daily close above this level in order for me to confirm the ABC correction upwards.

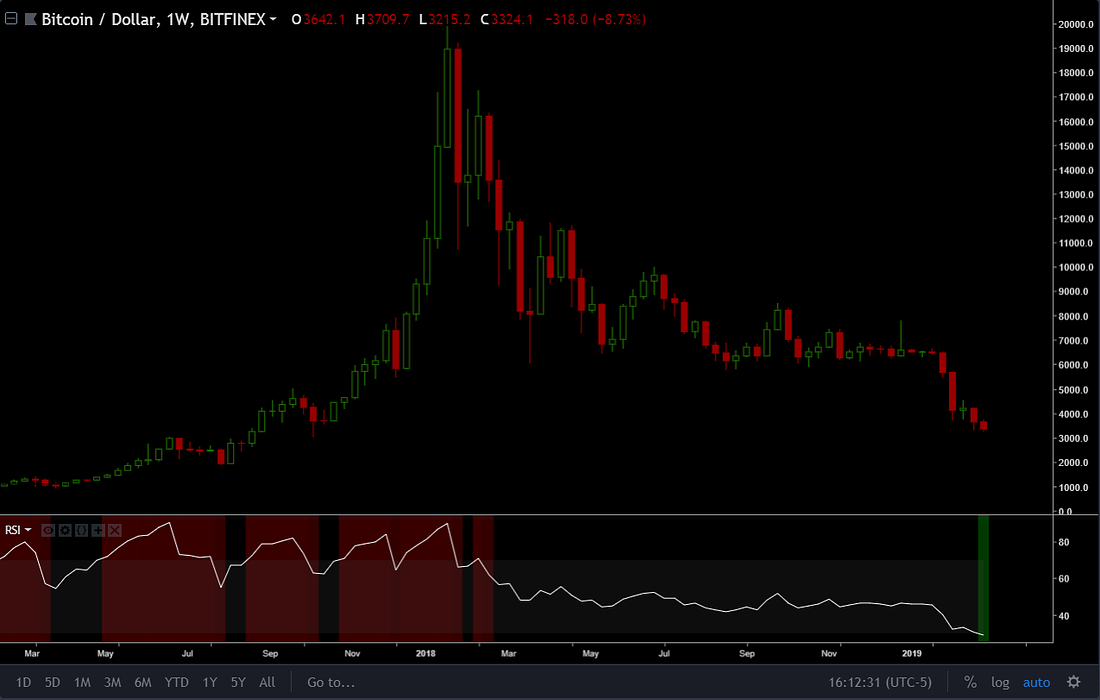

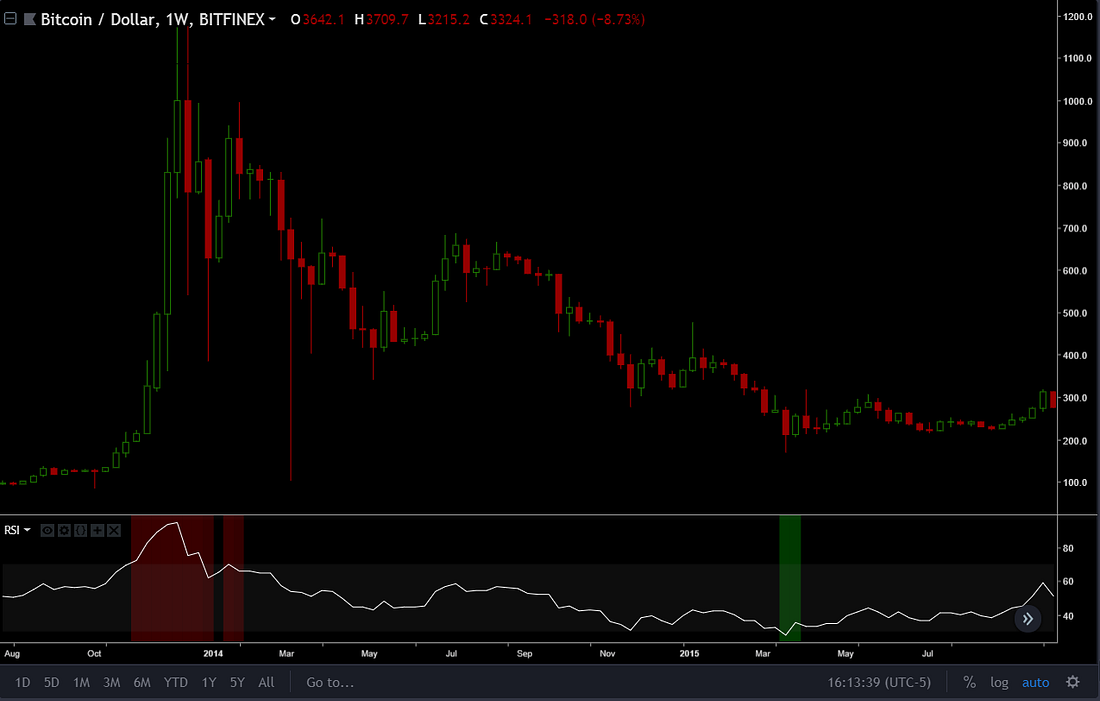

Volume is key in predicting resistance rejections. I believe it's really the core in any form of predictive analysis. So as this approaches I will be watching for severe spike ups from the sellers to determine if the trend can be broken or if my more "reasonable" 5th wave will transpire. There is multiple bull divergences on the daily time frames and higher that have been forming for several weeks. At some point this market will need to allow those to breath. Will it be the bottom? There is nothing on the technicals CONFIRMING a bottom. I would be wary of anyone who says with absolute certainty we have bottomed at any point without providing a technical confirmation. When the market is bullish and out of the bear, you'll know. Bitcoin screams when it needs to establish its dominance, technicals will only offer an exact entry metric. You'll feel the bull without even having to do TA. So I ask... do you feel it? Not at all. Trade safe and let things confirm. You can find Nick on Twitter and on Youtube.Also, if you're a subscriber, feel free to ask Nick questions in the CoinSheet Telegram group.Dmitriy's POVFolks, look at that weekly RSI.

The last time the weekly RSI was that low, the 2014 bear market ended.

Your weekly dose of hopium.

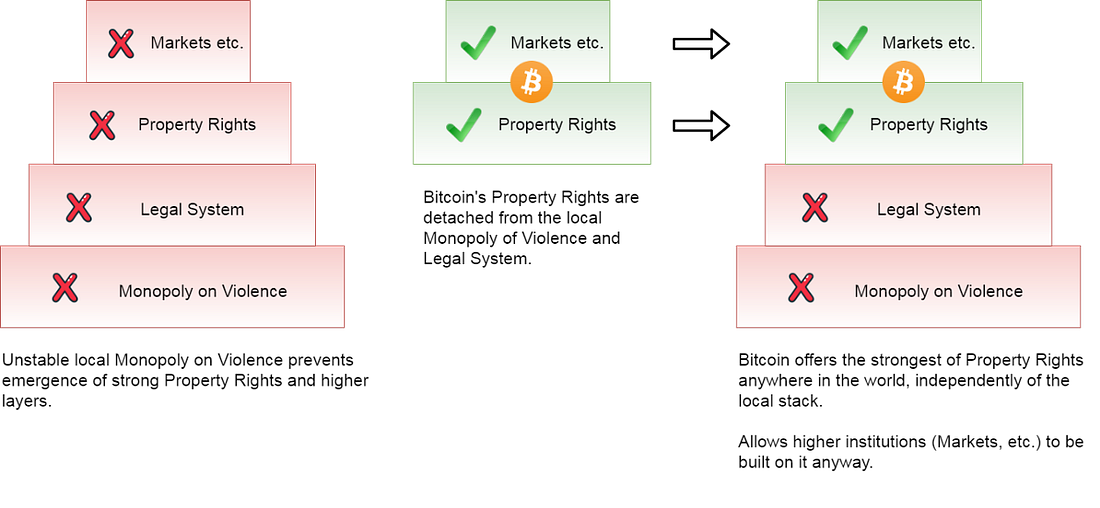

Recommended ReadingsBitcoin and the Promise of Independent Property RightsPart 3 of the Skeptics series.

You can read the article here.

If you think something important happened last week and we missed it, let us know! Continue the discussion in our Telegram group. That's all for now. Have a great week folks! You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |

Sunday, December 16, 2018

Weekly Bulletin (Dec 16, 2018)

Subscribe to:

Comments (Atom)