Weekly BulletinCboe resubmits the VanEck/SolidX Bitcoin ETF proposalI mentioned last week how the Cboe VanEck/SolidX ETF proposal has been "strategically" withdrawn. This week ETF has been resubmitted. Once the proposal is published in the Federal Register, the SEC will have up to 240 days to decide whether to approve or reject the proposal. You can look at the proposal here. My general thoughts on this haven't changed.The meme that a Bitcoin ETF will help bring fresh money into the space is real. And when I say it's real I mean that it will have a bullish effect on price. With that said, a bitcoin ETF is largely irrelevant to bitcoin becoming "internet gold" and a "money." Side note: This not so subtle distinction in perspectives between folks who focus on bitcoin's price (mostly traders) and folks who focus on bitcoin as a money/gold (bitcoin monetary maximalists?) causes unnecessary bickering and friction. Try to avoid arguing with people who don't disagree with you.

Fidelity targeting March launch for Bitcoin custodyFidelity which administers over 7.2 trillion in clients assets is targeting a March launch date for its Bitcoin custody service. At least that's according to this Bloomberg article. Two more companies receive a BitLicenseThe first company is Robinhood. The other is LibertyX, which "is the first DFS virtual currency licensee to allow customers to use debit cards to purchase Bitcoin from traditional ATMs." Wyoming Senate passes bill to treat crypto as moneyThis isn't a law yet. The Wyoming Senate passed the bill, but the House hasn't voted and it isn't a law yet. Nonetheless, I this this is a notable mention. I think it's worth checking out the proposed bill (in the source above) and reading the language and definitions used. i.e.,

QuadrigaCX debacleI don't want to get into this. TL;DR - A CEO of a Canadian exchange dies (allegedly?) with the private keys to $145M of cryptocurrency. And now those funds are lost (or are they?). Lots of drama around this, lots of folks lost money, some folks are claiming money is being moved out (source), etc… The key takeaway here is…Your keys, your coins. Not your keys, not your coins. Please take take of your keys. And teach your loved ones how to take care of your keys. So this can be you when you give your bitcoin private keys to your child in 20 years.

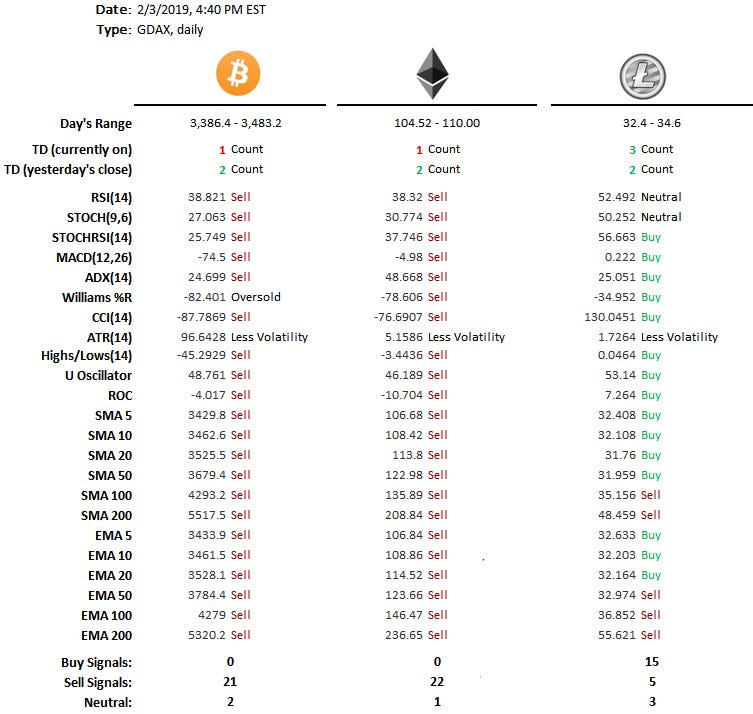

Market SentimentTechnicals

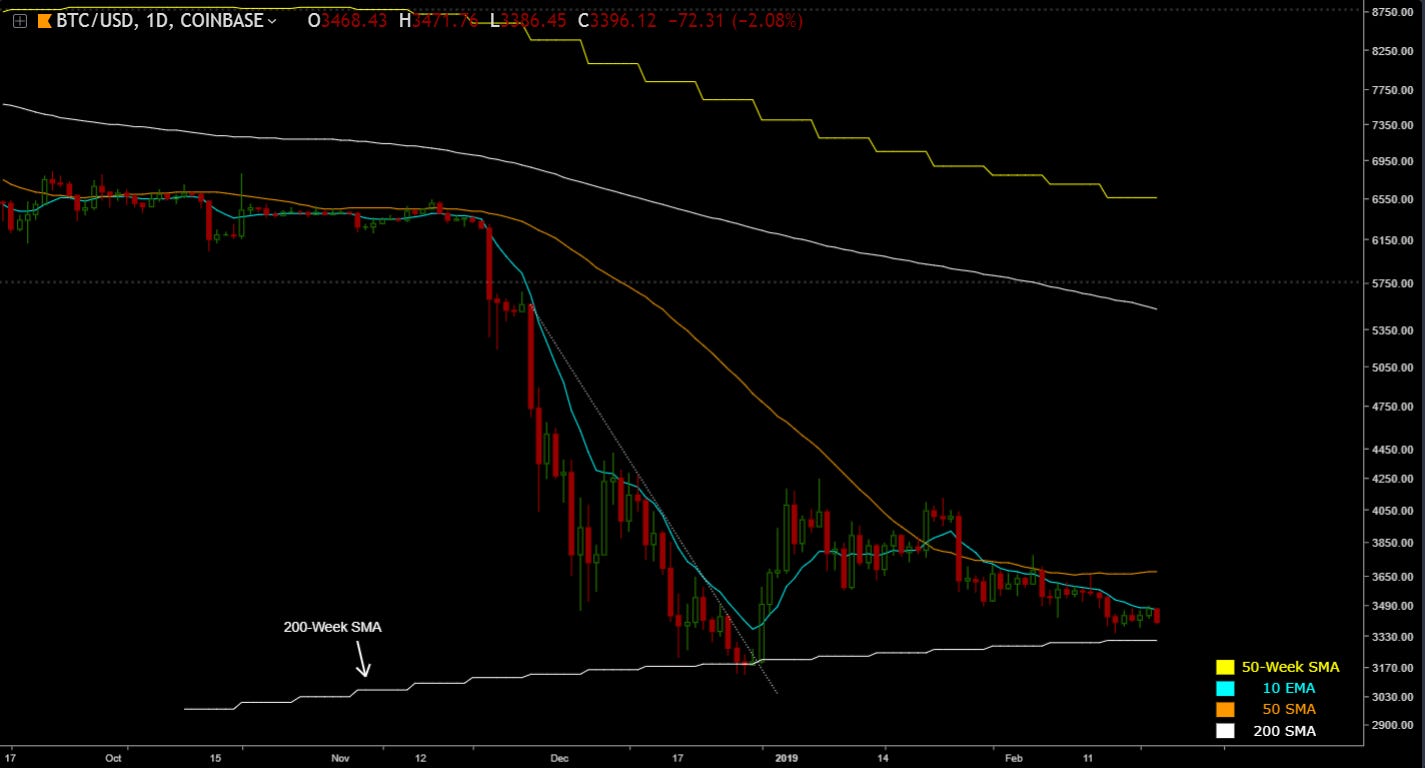

Bitcoin (Daily Overview)

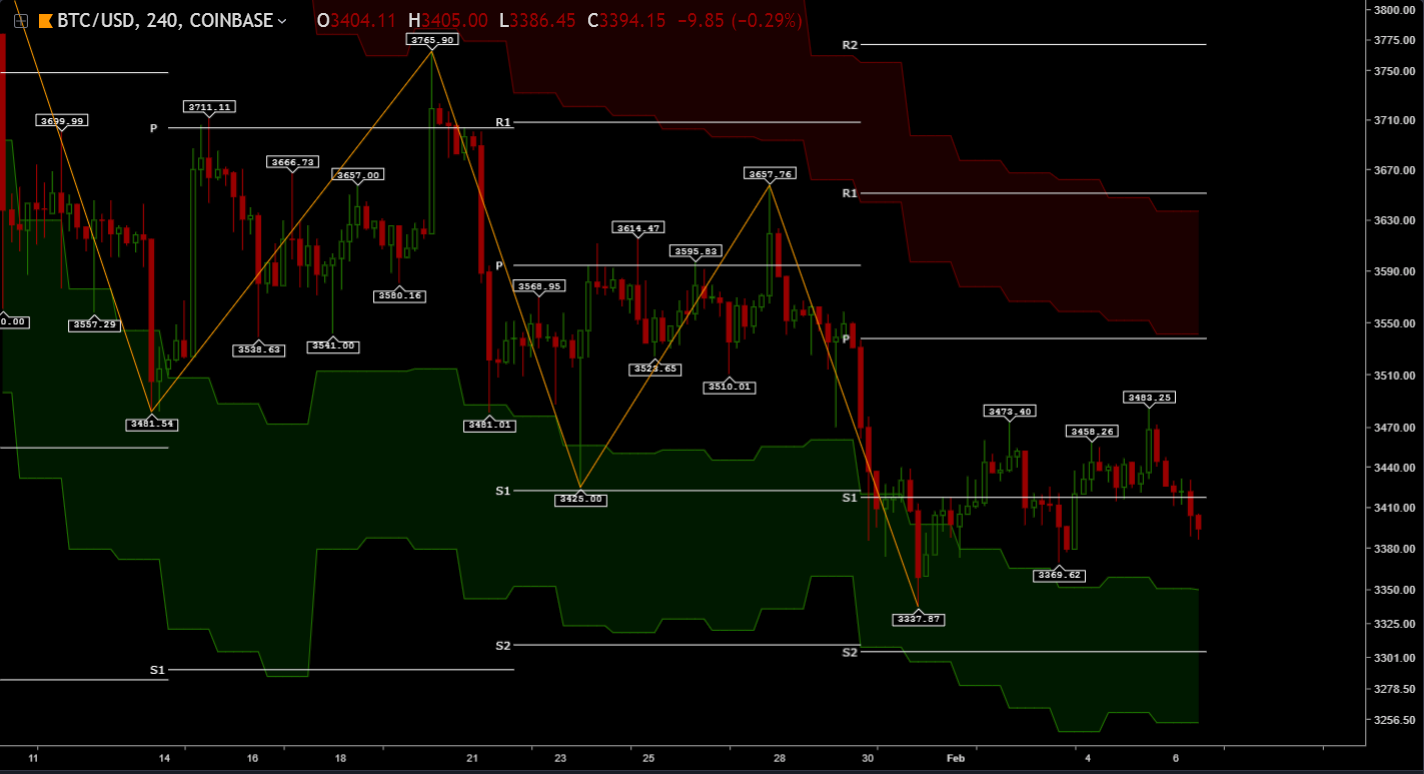

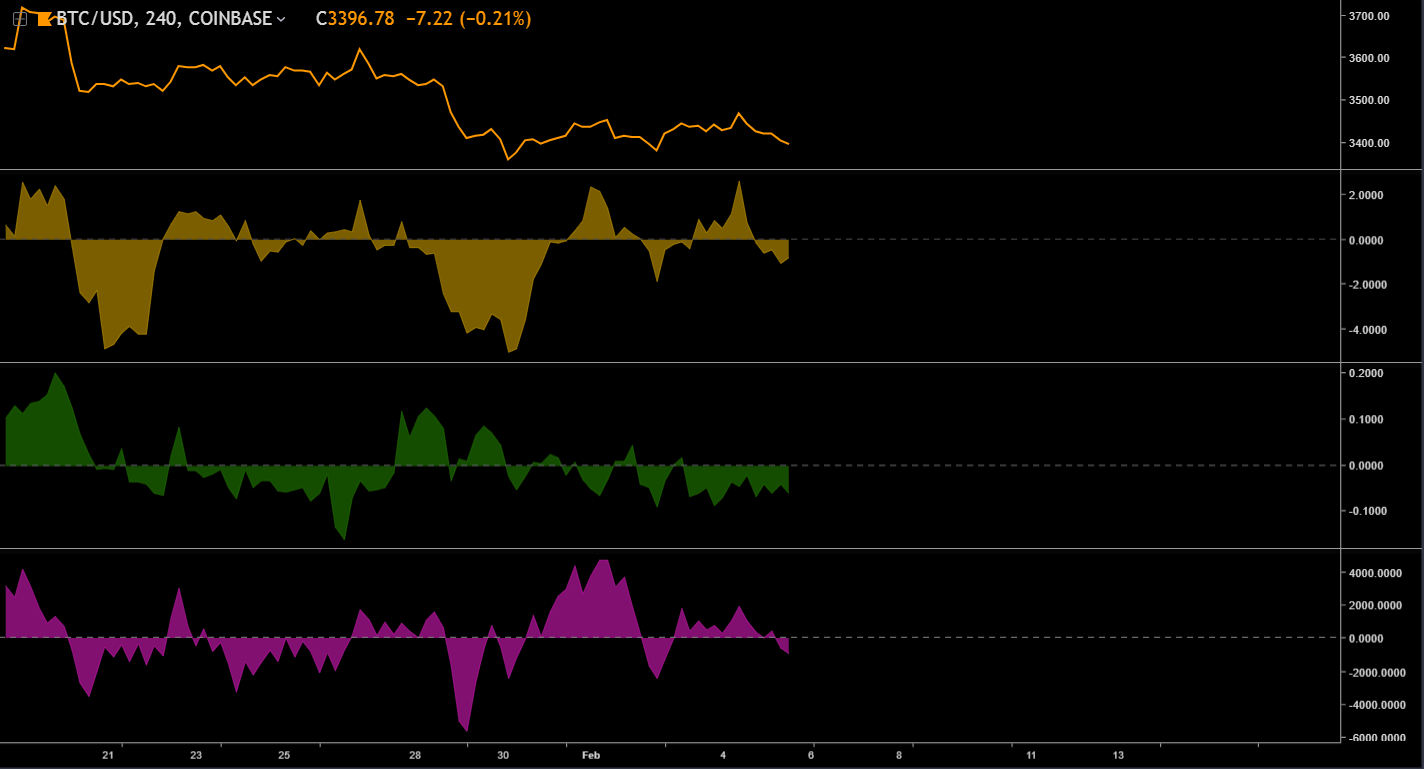

Bitcoin (4h Support/Resistance Levels)Resistance 2: ~3,770

Bitcoin (4h Volume)

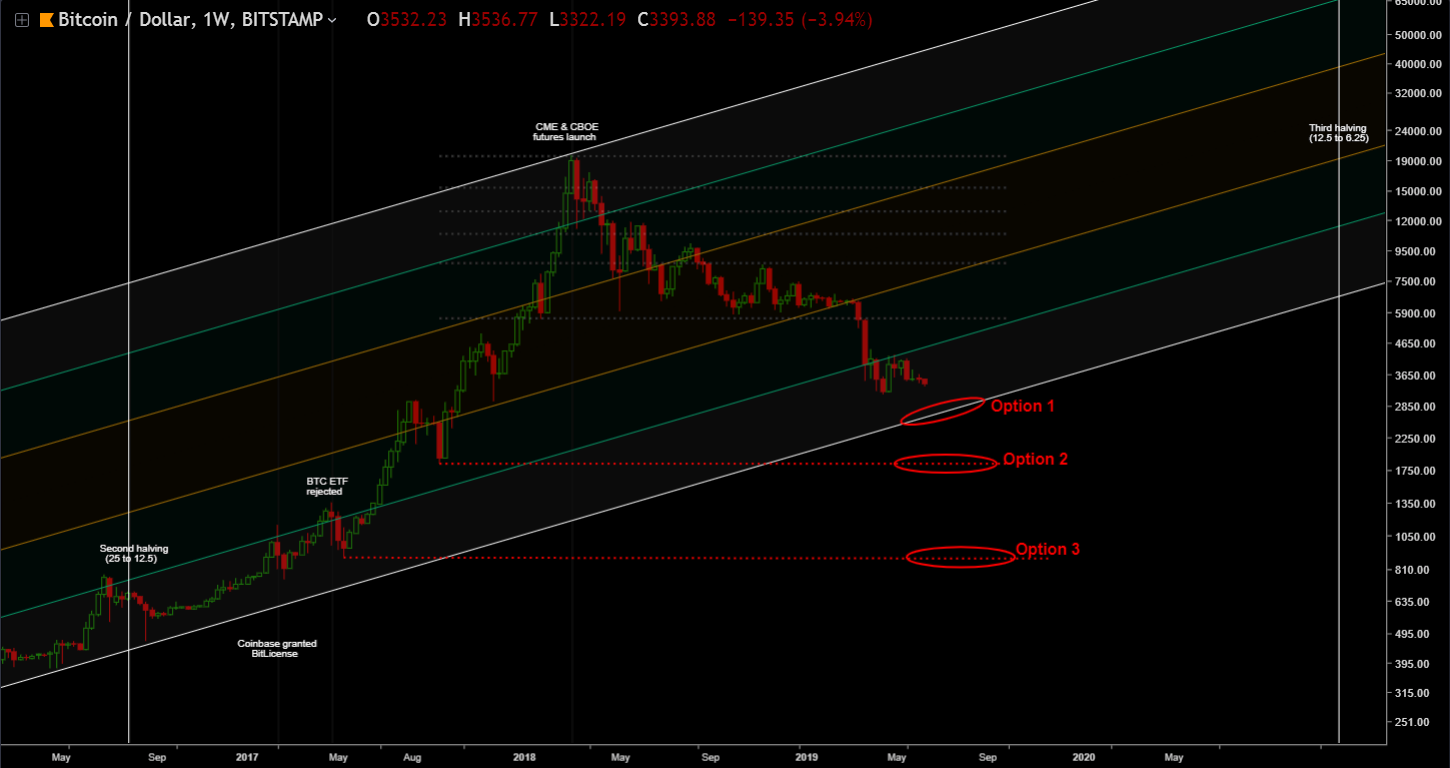

Bitcoin (Macro Overview)Below are the 3 most common bottom scenarios.

As of Feb 3, 2019 my confidence level are: A bottom between 1,700 and 2,600 = about 70%.

Recommended ReadingsA Conflict of Crypto Visions

But you can read the article here.

The endIf you think something important happened last week and we missed it, let us know! Continue the discussion in our Telegram group. That's all for now. See you later space Cowboy You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |

Sunday, February 3, 2019

Weekly Bulletin (Feb 3, 2019)

Subscribe to:

Comments (Atom)