QUOTE OF THE DAY QUOTE OF THE DAY  |

| "Anyone who is not investing now is missing a tremendous opportunity." - Carlos Slim |

Happy Sunday! Today we have a treat from @CryptoBulld0g as he shares his crypto story, strategy, advice, and even his hidden gem picks. Give him a follow on Twitter to show your support if you love his content!

Cheers,

Blockchain Brew Team

| COIN | PRICE | 24H |

|

| BTC | $6,520.92 | +0.61% |

|

| ETH | $500.841 | +0.98% |

|

| XRP | $0.530615 | +0.06% |

|

| BCH | $852.785 | +0.3% |

|

| EOS | $10.5282 | -0.07% |

|

*Information as of 9:30 AM EST

Experts Weigh in on Cause of Current Bear Market

In an article published by CoinTelegraph, experts shared their opinions on the various causes of the current crypto bear market.

SECURITY AND REGULATION

- According to Naeem Aslam, Chief Market Analyst at ThinkMarkets, exchanges are not taking cybersecurity seriously and are thus unprotected from hacks

- The large amount of unsecure exchanges and growing number of hacks is a product of loose regulation

- Thus, as more hacks continue, investor sentiment is negatively effected and less traditional investors will assume the risks of the crypto market

MARKET MANIPULATION

- Emin Gün Sirer, an associate professor at Cornell University, turns not only to market manipulation involving Tether, but also the law enforcement crackdown of market manipulation as reason for the bear market

- The perceived risk of entering a market that is manipulated and the fact that cryptocurrencies have not yet decoupled correlation from Bitcoin is scary for new investors

Sirer believes that the crackdown on market manipulation will provide more clarity to the markets and ease new investor's worries:

"The fact is that these technologies are poised to transform the way we do business. They should not need market manipulation to sustain their value. I'm looking forward to a decoupled world where markets are able to evaluate each coin on its own merits."

REACHING EQUILIBRIUM

- As for Alistair Milne, CIO of Altana Digital Currency Fund, he believes that the crypto markets are just taking a breather and correcting after a parabolic rise in December 2017

- Milne believes it is a combination of "slowdown in adoption, user-growth, and profit-taking, as well as hedging" that are causing the current bear market

Milne shared his thoughts on the current state of the market and why it doesn't compare to other Bitcoin bear markets that have occured over the years:

"Altcoins particularly became very over-valued and were overdue a correction. We are now searching for equilibrium again, where demand meets supply. From a macro point of view, it has never been better, so I feel comparisons to 2014/15 are misplaced."

TAKEAWAY

- Traders, investors, analysts and everyone else all have their reasons for the current bear market however nothing can be for sure

- One thing is for sure, 2018 will be an interesting year for cryptocurrencies as they have burst on to the scene in a attention-grabbing manner

16 Arrested in Japan for Cryptojacking

CRYPTOJACKING

- Cryptojacking is the practice of using a computer user's processing power to mine cryptocurrencies without the user's permission

- This practice has been growing in popularity to mine the privacy coin Monero and is distributed through malicious links

- Just recently, Palo Alto Networks reported that 5% of all Monero in circulation were estimated to be mined by cryptojacking

16 ARRESTED

- According to The Asahi Shimbun, 16 Japanese men have been arrested for installing malware onto victims' computers through their own websites

- The suspects used the Coinhive program to mine Monero and the largest sum of money discovered to be linked to the cryptojacking case was $1,084

- Since this is the first circumstance of cryptojacking in the Japanese legal system, it is unknown how the case will be handled

What is the story behind your "crypto identity"?

Hi, my name is Bulldog. You can find my profile on Twitter @cryptobulld0g . I chose this user name because well... I am a bulldog.

How did you get started investing in crypto?

I am an engineer with a MBA degree. I have started several businesses so far. Some successful, some failed. I started trading cryptocurrencies for over 1.5 years now. Just before I started trading, I was planning to buy a drone just for fun. After couple of weeks research I thought they are expensive and decided to look into this thing called Bitcoin. Best decision of my life.

It takes great effort to make me get attracted to a subject but once I am hooked, I dive deep. I see myself as a Google research master. If something is on Google, I find it. No exceptions. I read about that a lot and try to learn as much as possible.

What is your trading strategy?

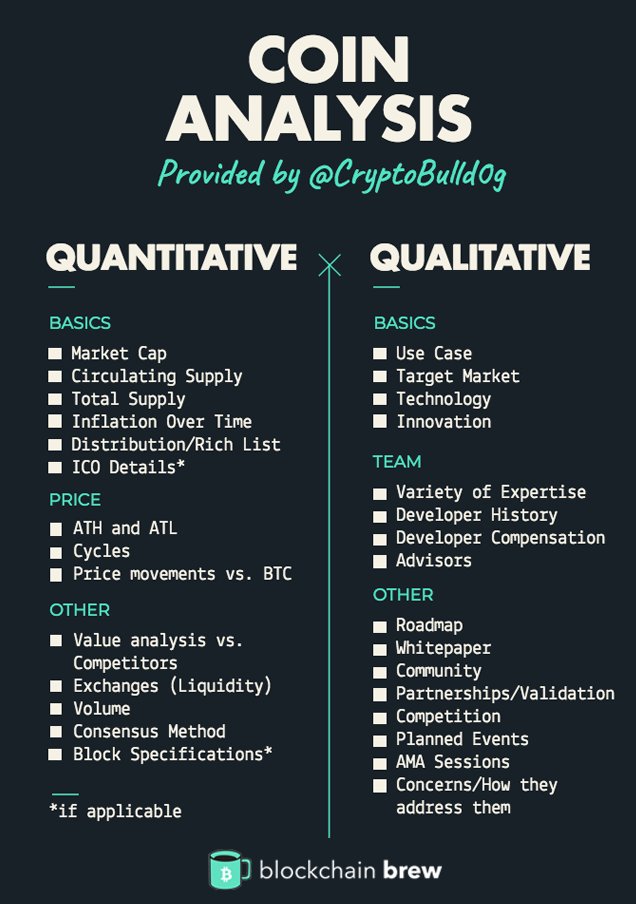

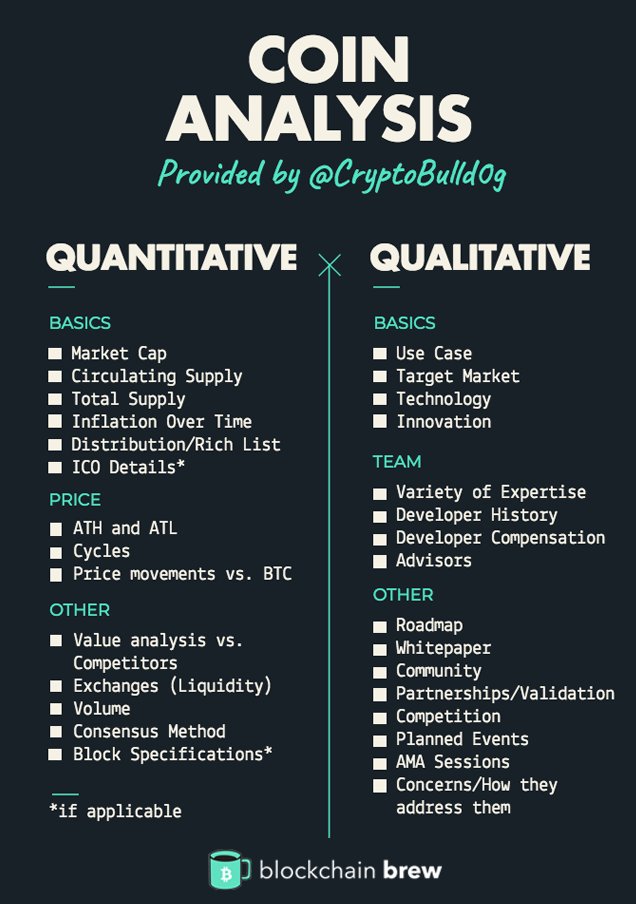

I am still pretty busy with my day job, so I learned day trading is not for me. I saw the potential in cryptocurrencies and decided to find a different way to become an active member of the ecosystem. I directed my focus on Fundamental Analysis. Finding low cap gems and growing with them is my passion. You can see most of my FA work pinned to my profile on Twitter.

My fundamental analysis work opened many doors for me. I grew my network quickly and became a writer for 21 Cryptos Magazine 6 months ago. Networking is the name of the game in this market. Most of my profitable trades fell onto my lap from my network. I don't blindly invest. Whenever I hear about a project, I take my note about it to research it later. After I finish my initial research, I find suitable entry points and put my buy orders and wait patiently. Low cap gems have a lot higher potential than the established projects.

Advice to crypto investors?

My suggestion to new investors is the same as other people. Do your own research and create an investing strategy. I never put more than 3% of my portfolio to any given trade or ICO. Small, steady growth with minimum risk. On your research, you can refer to my FA checklist to see the most important aspects to look into before making your decision.

Hidden gem pick:

One of my most favourite hidden gems is Akroma, $AKA. Here is why.

Today in Crypto is powered by coinmarketcal.com

- Mining Consumes Half as Much Power as BECI Estimates – Coinshares

- South Korea May Launch Dedicated Cryptocurrency Zone for Companies

- Founder of BitGrail Francesco Firano says, “I can’t do anything”

| Apex (CPX) |

| Using blockchain technology to build stronger 1-to-1 relationships between enterprises and consumers - transforming how interactions, information, and value is exchanged in the B2C engagement process. |

| WEBSITE | | REDDIT |

| The above is not intended to be investment advice. |

| 1317 8th Street SE, Minneapolis, MN 55414. |

| If you don't absolutely love us, drop us, click here. |

| Copyright © 2018 Blockchain Brew, All rights reserved. |