|

Friday, November 23, 2018

CryptoWeekly #84 - Is the ICO party over?

Thursday, November 22, 2018

Happy Turkey Day

CoinSheet #226 If you see no reason for giving thanks, the fault lies in yourself. — American Indian Proverb Happy Turkey Day! The fact that you're reading this probably means that you live in a nation that is extremely prosperous and wealthy when compared to most nations in the world.

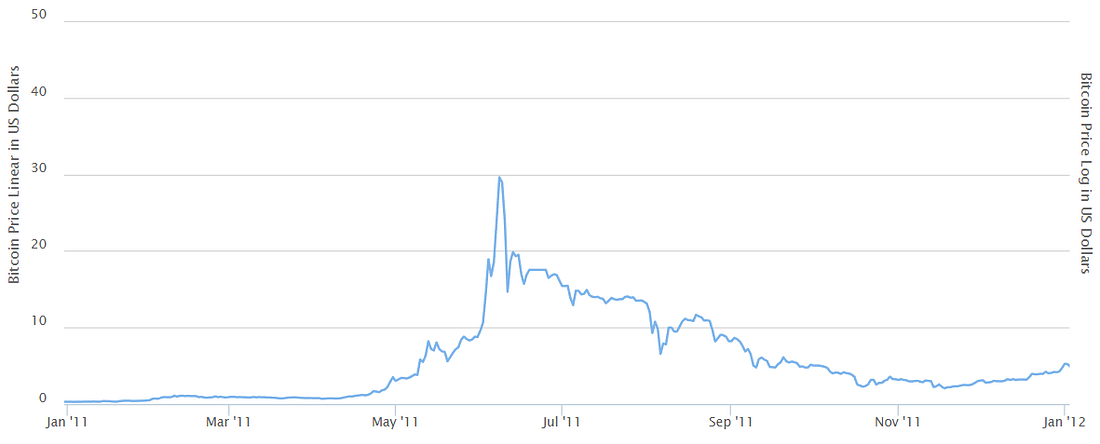

Happy Turkey Day!The fact that you're reading this probably means that you live in a nation that is extremely prosperous and wealthy when compared to most nations in the world. Our economy is competitively based, our civil liberties heavily concerned with the rights of the individual, and success can often be achieved through excellence and merit (as opposed to fist and fire). I think Thanksgiving is an opportunity to recognize how fortunate we are to have what we have. And if you're a cynic and you think Thanksgiving has lost its meaning, that's ok, no judgement. But also understand that Thanksgiving is one of the few holidays overworked Americans get to stay home for. So if you start being a shithead, they might just get upset with you. And if that's not enough for you, just stick around until after Black Friday. The WorldStar videos where folks are getting elbowed in the face should all be worth it. Is Bitcoin Dead?Yes, just like it died in 2011. January 2011 - January 2012

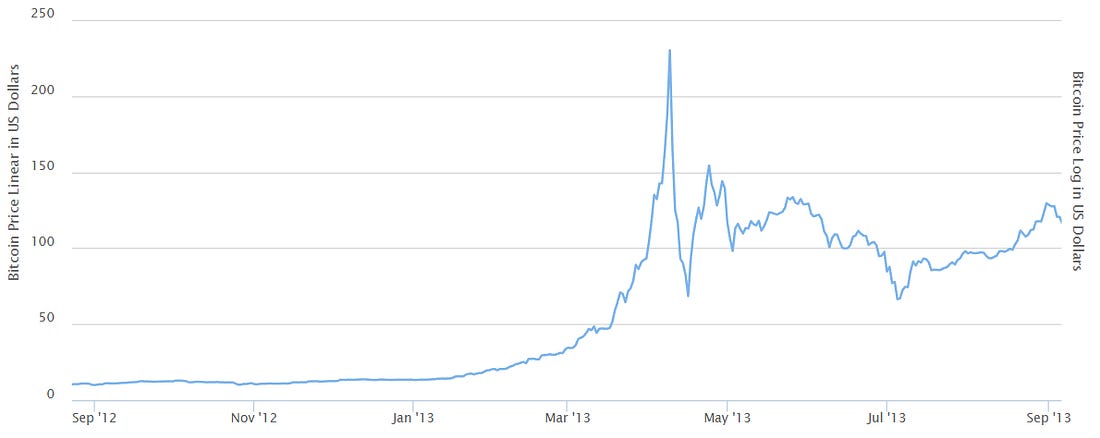

And in 2012. September 2012 - September 2013

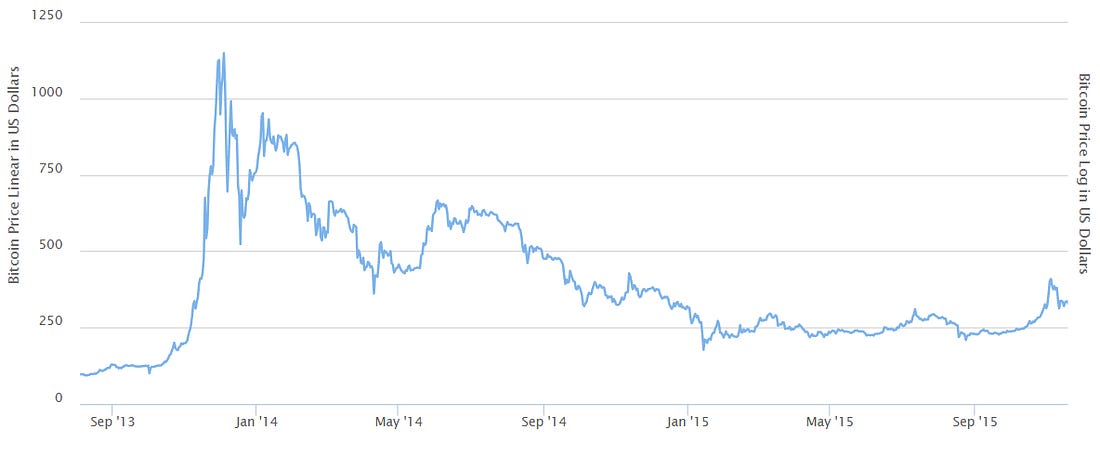

And in 2014. September 2013 - September 2015

And now in 2017. January 2017 - November 2018

It is somewhat funny though how every time bitcoin died, the scale on the Y-axis we use to measure it with goes up by a magnitude or two.

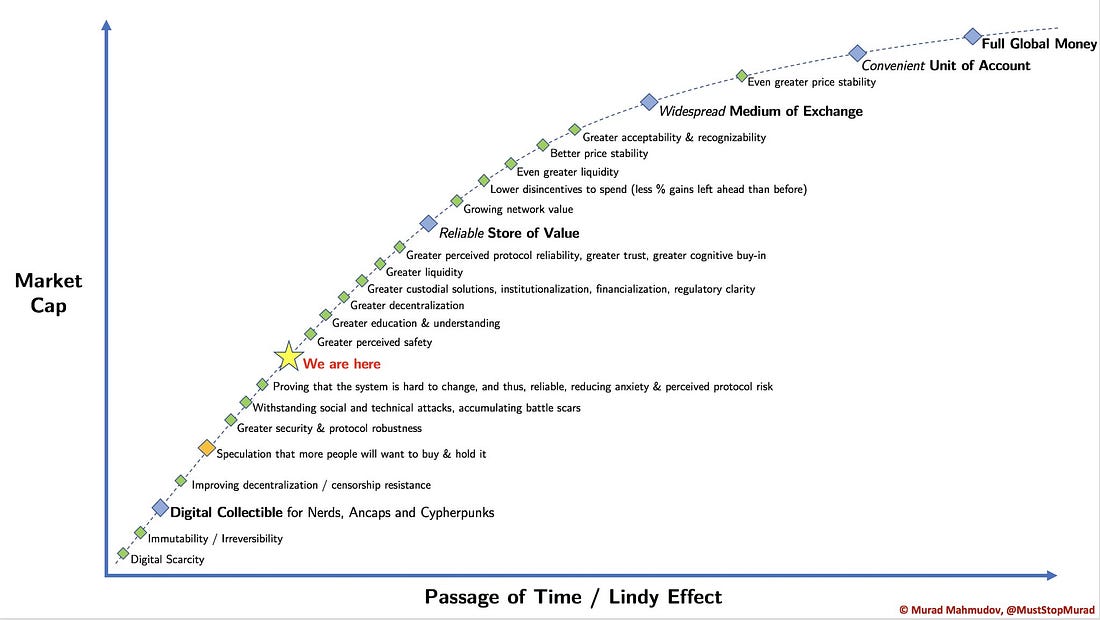

The Bitcoin Thanksgiving Dinner PitchThe 1 linerBitcoin is a currency that is borderless, neutral, censorship resistant, open to all participants and is a trusted network despite having a lack of central governance. The 1 minuteFor the minute pitch, I'm going to use Murad's pitch from his interview with Pomp (edited for clarity since this was a transcription from a podcast). Source Bitcoin is the soundest, hardest currency that has ever been invented in the history of human civilization. Its disinflation is second to none. Its monetary policies are known years in advance and it's becoming increasingly credible. It will also be a growing threat to the very currencies banks and nations control. I think getting in before most other central banks and most other sovereign wealth funds and most other rich people will, in the next decade, prove to be one of the smartest investment decisions in the course of human history. ***You then proceed to whip out the chart below and point to "We are here."***

The anything longer than 1 minute pitchThe chutzpah on you to think they actually want to hear it. I'm surprised they keep inviting you to Thanksgiving dinner. If you really think they care, wait for Hanukkah or Christmas and get them a copy of The Bitcoin Standard by Saifedean Ammous. Anyways…That is all for now. We'll speak with you soon. You're on the free list for CoinSheet. For the full experience, become a paying subscriber. © 2018 CoinSheet LLC Unsubscribe A Substack newsletter |

Coinbase complaint continues

| To view this email as a web page, go here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||