Weekly BulletinFor the first time in history, the US has sanctioned 2 bitcoin addressU.S. Department of the Treasury (Office of Foreign Asset Control) is adding two crypto addresses to its sanctions list. (Source) These addresses belong(ed) to two Iranian men who have launched ransomware attacks for the last 5 years. First of all…imagine that…being in bitcoin since 2013 and still reusing addresses.

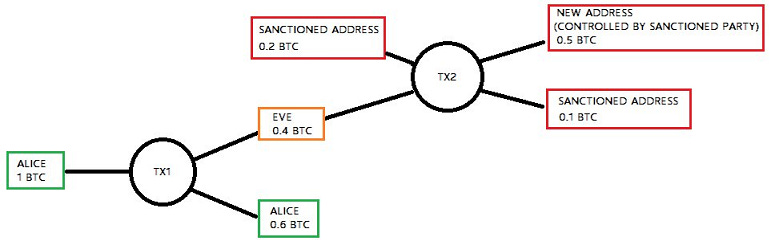

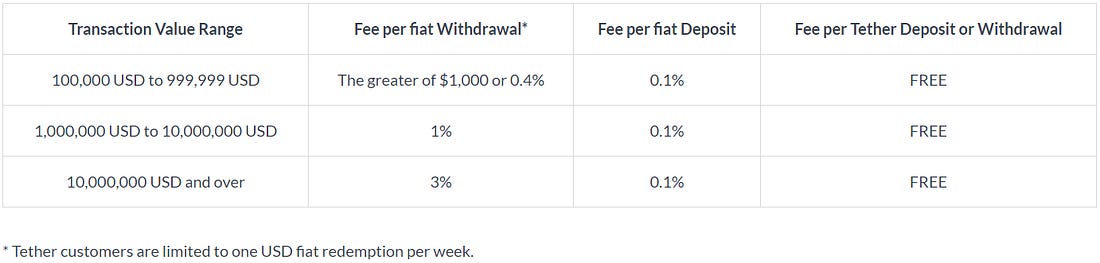

Folks, please don't reuse addresses, especially the same two for 5+ years. So what is this list?  2/ First, what list? OFAC administers and enforces lists of very high-level bad actors. Quite bad, in fact. They're often Enemies of the State and are added as a tool to exert pressure for diplomatic purposes. Osama Bin Laden, for example, was on the list. 2/ First, what list? OFAC administers and enforces lists of very high-level bad actors. Quite bad, in fact. They're often Enemies of the State and are added as a tool to exert pressure for diplomatic purposes. Osama Bin Laden, for example, was on the list. 3/ The list typically contains names, categories, other lists include geographical regions. Never, though, has the list included a Bitcoin address. Until today. 3/ The list typically contains names, categories, other lists include geographical regions. Never, though, has the list included a Bitcoin address. Until today.This list means that…  5/ So, nobody subject to OFAC's jurisdiction is permitted to engage in any transaction with the persons on the list or associated with the two addresses on the list. 5/ So, nobody subject to OFAC's jurisdiction is permitted to engage in any transaction with the persons on the list or associated with the two addresses on the list.And from a legal perspective this means…  8/ It means that OFAC believes, today, that it has the tools it needs to enforce the law. It didn't ask for more legislation, nor did it didn't propose new prohibitions. The Treasury is fighting crypto bad guys using the tools already at its disposal. 8/ It means that OFAC believes, today, that it has the tools it needs to enforce the law. It didn't ask for more legislation, nor did it didn't propose new prohibitions. The Treasury is fighting crypto bad guys using the tools already at its disposal.This last of Marco's analysis is interesting. As Marty points out, chain analysis companies have tracking techniques that are heuristic based and don't provide 100% certainty.  The problem that is going to naturally arise for chain analysis companies and the regulators they obediently serve is that their tracking techniques are completely heuristic based, meaning they will never have 100% certainty that their assumptions are correct. The problem that is going to naturally arise for chain analysis companies and the regulators they obediently serve is that their tracking techniques are completely heuristic based, meaning they will never have 100% certainty that their assumptions are correct.Now, imagine telling someone who isn't familiar with cryptocurrencies about bitcoin and these sanctions. They would probably respond in a way similar to this:  @propelforward If your current software doesn't already check addresses against a prohibited list before authorizing a transaction, then you may need code changes. But seriously, who would have built a transaction engine without that capability????? @propelforward If your current software doesn't already check addresses against a prohibited list before authorizing a transaction, then you may need code changes. But seriously, who would have built a transaction engine without that capability?????Good point, right? Why isn't there a mechanism to prevent people from interacting with folks on the SDN list (Specially Designated Nationals list)? Well, because bitcoin doesn't work like that. As Pierre points out:  If the US Federal government wants Bitcoin full nodes to blacklist certain addresses when validating blocks and transactions, it will have to design and implement this feature themselves, and then persuade people around the world to run their software. Very big challenge! If the US Federal government wants Bitcoin full nodes to blacklist certain addresses when validating blocks and transactions, it will have to design and implement this feature themselves, and then persuade people around the world to run their software. Very big challenge! Steve Middlebrook@stmdc @propelforward If your current software doesn't already check addresses against a prohibited list before authorizing a transaction, then you may need code changes. But seriously, who would have built a transaction engine without that capability?????TL:DR - This will be an interesting case study in the ability of regulators to actually regulate Bitcoin.Oh, and again, don't be reusing 5 year old bitcoin addresses. And if you want some more technical thoughts on this, you can check out this tweet thread. Tether now allows for direct redemption of USDT for USDLast week announced that it has launched "a redesigned platform allowing for the verification of new customers and direct redemption of Tether to fiat." There is a minimal issuance and redemption requirements equal to 100,000 USD and $100,000 USD₮.

Hopefully this clears most of the Tether FUD. And with that said, Tether still isn't particularly interesting and stablecoins are still stupid. Recommended ReadingsRequired reading if you still think that miners control bitcoin. You can read the article here.

That's all for now. If you think I missed anything important, mention it in the Telegram group. Have a great week folks! You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |