Weekly BulletinHello folks! The delay in today's newsletter is brought to you by the 1.5Mbps internet connection I have over here in Mississippi. I should be getting back to NYC in about a week or so (and I'll be shipping the t-shirts you folks keep harassing me for). YouTubeAlso, If you're interested in whatever it is I'm doing, subscribe to this YouTube page. I'm planning on releasing some crypto-related videos that you folks might like. Youtube: Click here, and then click subscribe (It costs you nothing, but will motivate me to produce more content for ya'll)

And now moving on to the crypo happenings of last week… Bitcoin ETF filing has been withdrawnAs of January 22nd, the Cboe VanEck SolidX ETF proposal has been withdrawn (Source). In a CNBC interview, VanEck's founder and CEO Jan van Eck said the following about pulling the proposal:

Brb, checking my notes for prepared canned responses. >ETF Approved: MOON! LAMBO! MOON!

(Lord Antonopoulos pictured above) What we can deduce from this withdrawal and Jan van Eck's statement is that they expected a rejection. We can also deduce that the SEC has not made its decision before the shutdown started. So it looks like the government shutdown gave VanEck a perfect excuse to save face and voluntarily delay its ETF launch.

In Bakkt news…

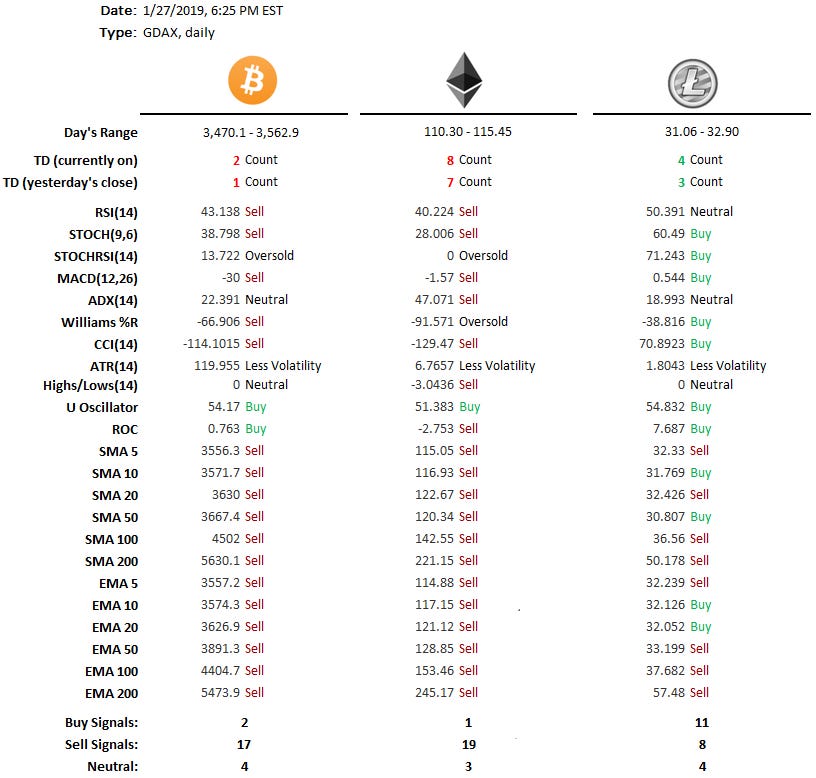

There was this tweet that had some traction:  Bakkt has launched the details of its BTC futures product on its site. It's a physically settled product which means actual BTC must be bought to close the transaction. https://t.co/2yvFFa9tZ3 Bakkt has launched the details of its BTC futures product on its site. It's a physically settled product which means actual BTC must be bought to close the transaction. https://t.co/2yvFFa9tZ3But as a nice twitter person pointed out: So nothing has changed. Bakkt is still pending full regulatory approval. Q4 2018 XRP Markets ReportIt's that time of year again when we take a look at how much XRP was sold this quarter (source). Let's take a look. It looks like Ripple sold $129.03 million worth of XRP in Q4 2018. That brings the total to $535.56 million for the full 2018 year. I've said it time and time again, the actual business plan for Ripple is to dump their shitty bags on plebs.  Somewhere in a #Ripple executive meeting... "Here's the plan! 1. We get $XRP exchange listings 2. Dump on plebs 3. Give them stats of how we dumped on them 4. Profit and collect praise But sir! That will never work! People are not THAT stupid!" Somewhere in a #Ripple executive meeting... "Here's the plan! 1. We get $XRP exchange listings 2. Dump on plebs 3. Give them stats of how we dumped on them 4. Profit and collect praise But sir! That will never work! People are not THAT stupid!"  I understand that people will orchestrate the most spectacular displays of mental gymnastics in order to defend their "investment." But what does it say about us when a company is transparent in their pilfering, and we simply look the other way (this is the 9th quarterly report released by Ripple). I have noticed more folks talking about this (as compared to a year ago), so I guess things are moving in the right direction, at their own pace. Market SentimentTechnicals

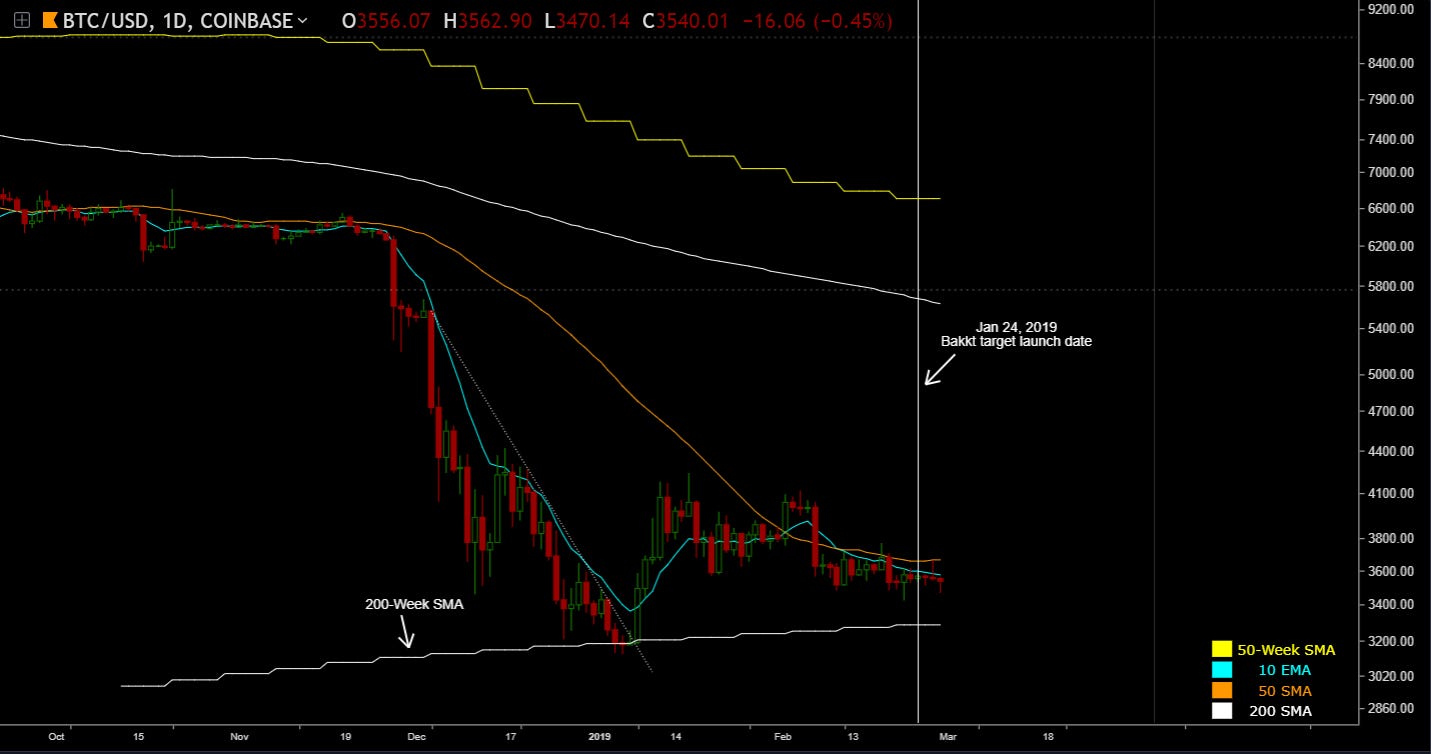

Bitcoin (Daily Overview)So this is interesting. In hindsight it's easy to say that no one expected a Q1 Bitcoin ETF, and that this event was priced in. This lack of price action makes me think that we've actually seen the worst of capitulation and we're beginning to enter a year'ish-long period of accumulation.

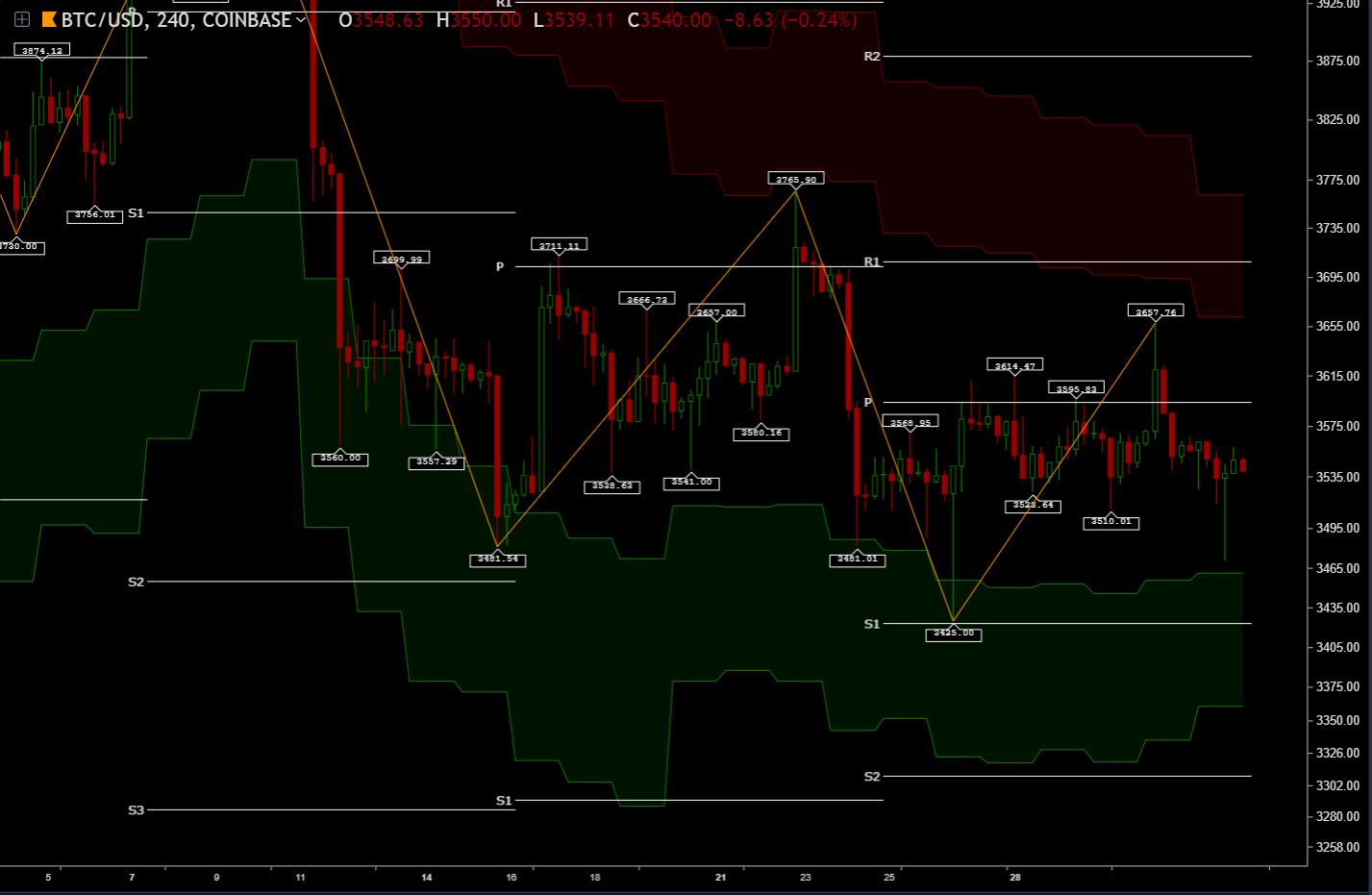

Bitcoin (4h Support/Resistance Levels)Resistance 2: ~3,875

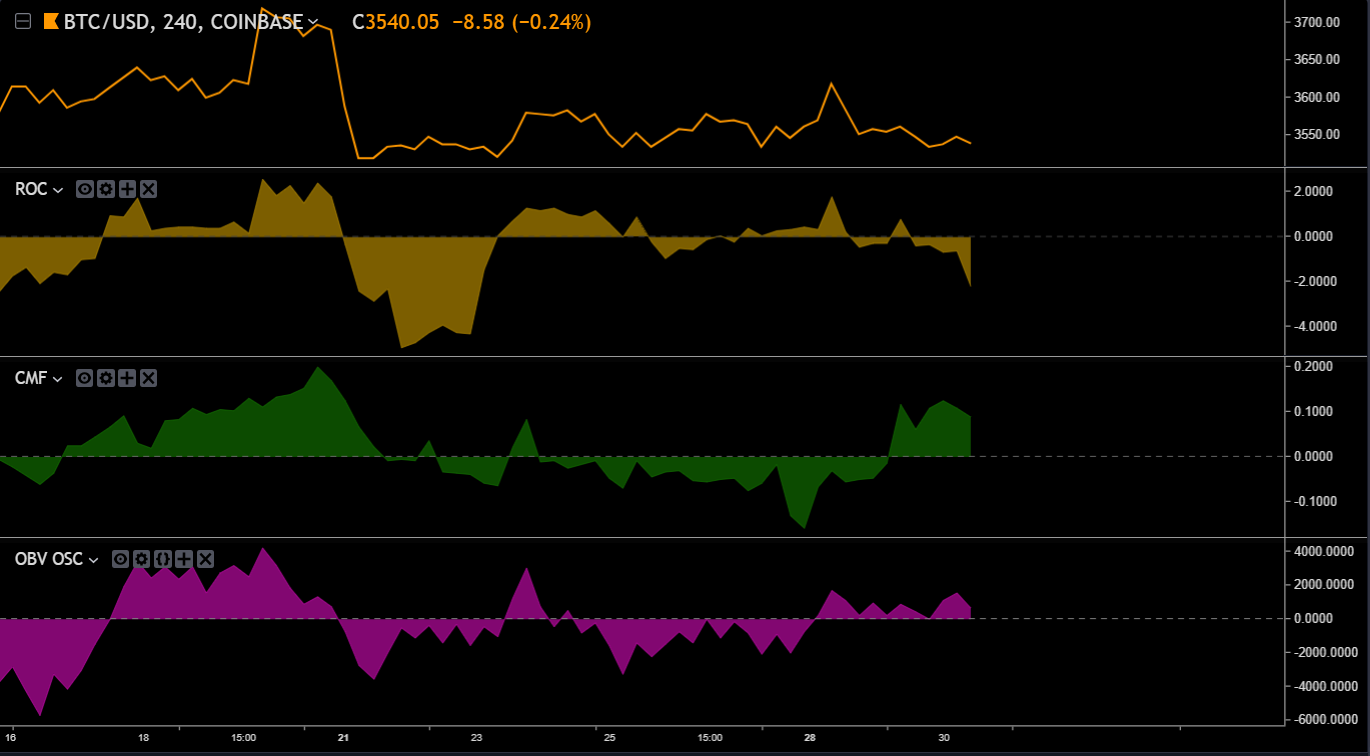

Bitcoin (4h Volume)

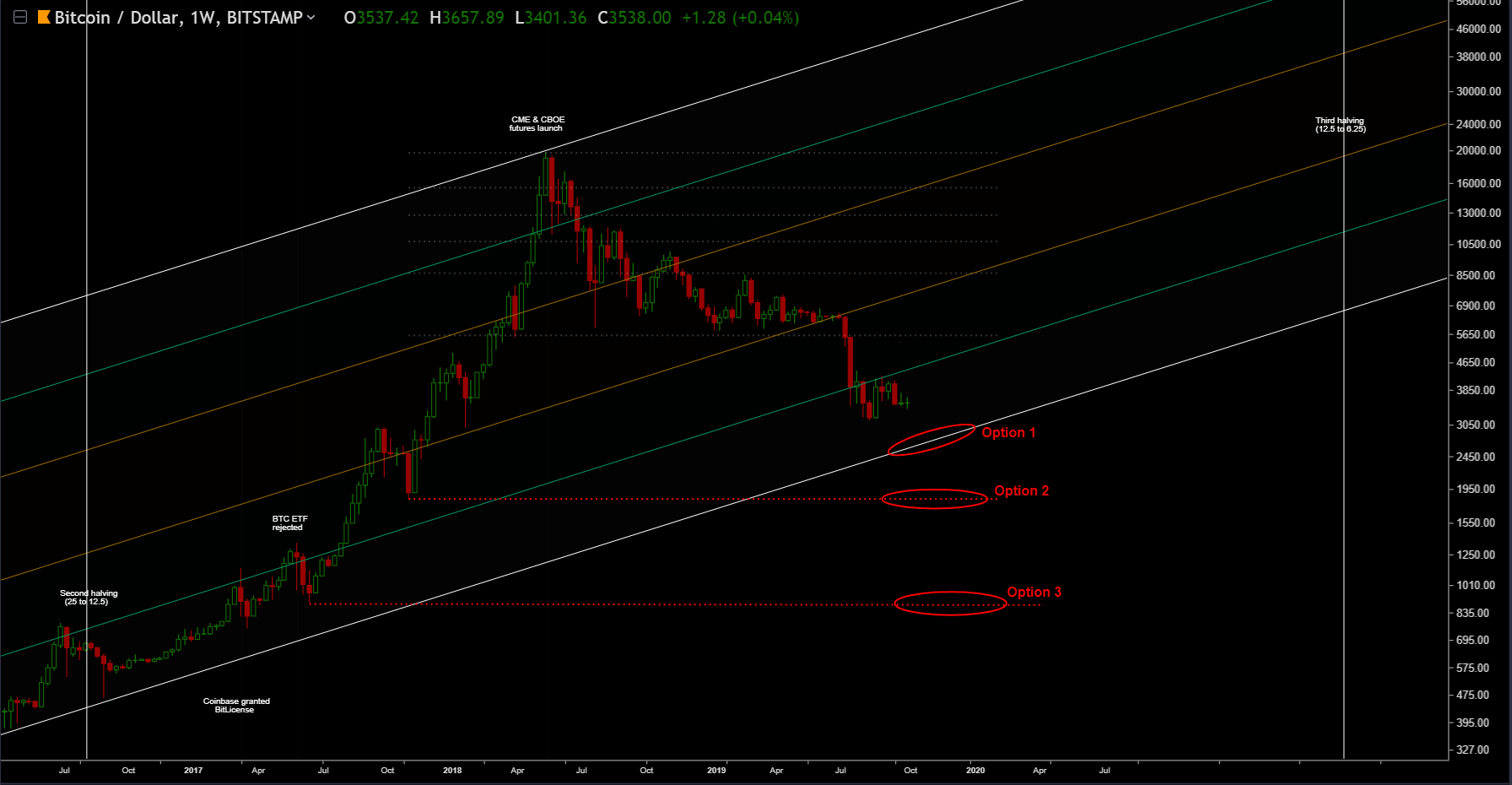

Bitcoin (Macro Overview)Below are the 3 most common bottom scenarios.

As of Jan 27, 2019 my confidence level are: A bottom between 1,700 and 2,600 = about 70% (down from 80%).

Recommended ReadingsEvaluating Bitcoin forks with network dataNew research from coinmetrics.

You can read it here. Grin and the Mythical Fair LaunchFew folks have asked about Grin. I'm not super interested in Grin. But you can read about it here. The endIf you think something important happened last week and we missed it, let us know! Continue the discussion in our Telegram group. That's all for now. See you later space Cowboy You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |