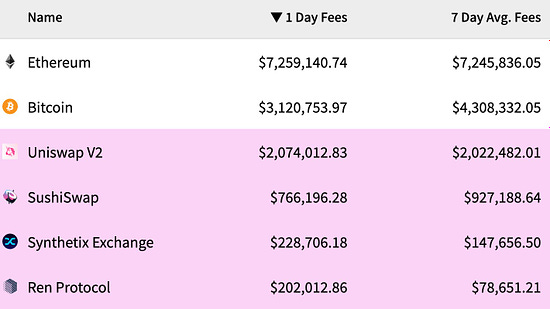

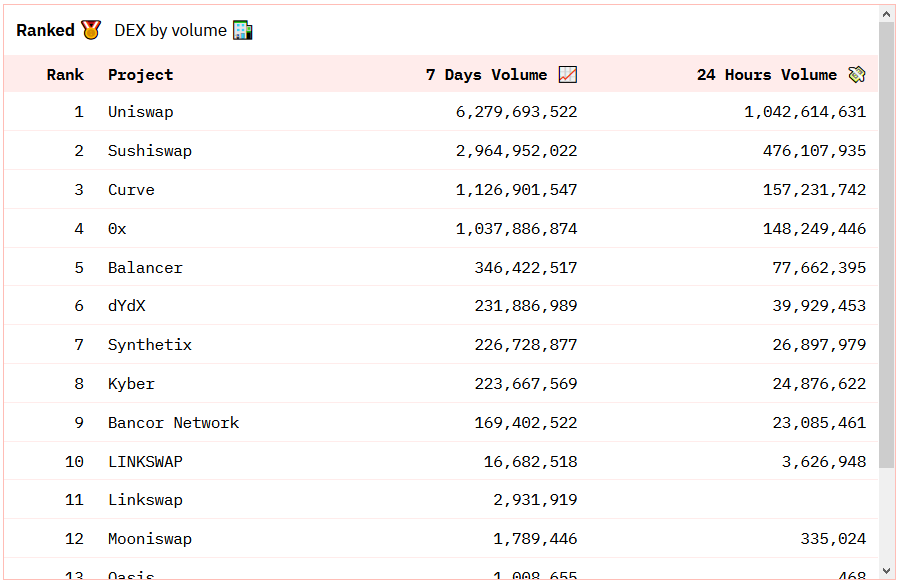

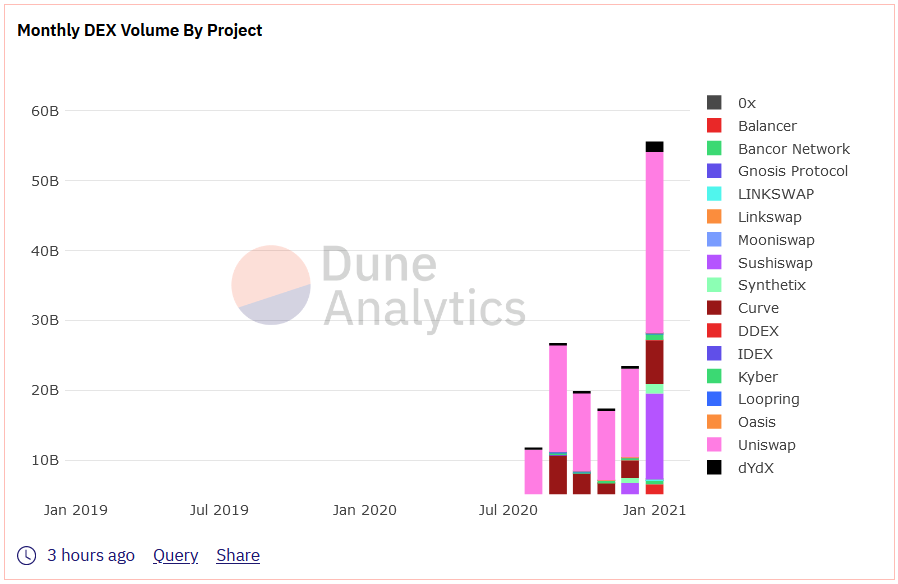

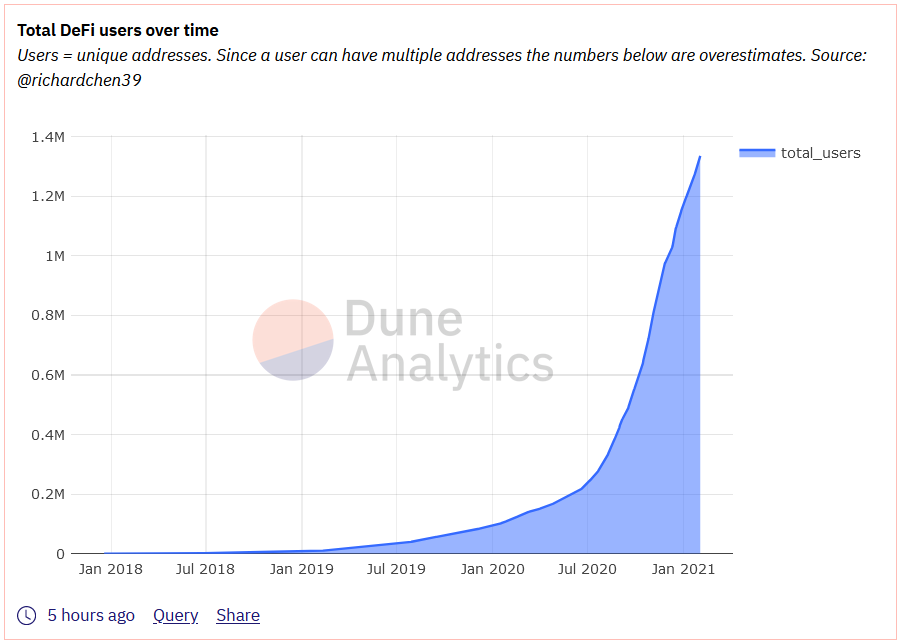

This letter is brought to you by myself and Perdix. You’re probably following me on Twitter, but you’re not following him. So go follow him. 1. Fees/cashflowEthereum generates a lot of fees itself, as a platform, and supports a variety of decentralized yield/fee-generating products in its ecosystem. These products are mostly for trading tokens, called decentralized exchanges (DEXs). These are daily fees that are remitted/awarded directly to participants. Yes, crypto has cashflow now. 2. High turnoverOn average the fee of trading on DEXs is 15-35bps per transaction, not including the cost of going through Ethereum’s pipes which is another fee layer depending on congestion. Hence Uniswap is averaging nearly $1bn in turnover daily. The fees go directly to liquidity providers (crypto market makers) who populate the books. It’s not your cabbies playing this. It’s people who work(ed) at Jane St, Jump Trading, Renaissances etc - but also early crypto whales. Owner of Uniswap (UNI, diluted 19bn market cap) and Sushiswap (SUSHI, diluted ~$2.5bn) tokens gets a % of fee revenue sharing. Try to put a ratio on that and the valuation seems reasonable. 3. DEX volumeDEX volume has been exploding with the bubble becoming more mainstream. Breaching $55bn monthly turnover. 4. Decentralized Finance (DeFi)Decentralized Finance (DeFi), under which these DEXs fall, has been adding active users in a rapid pace. From nothing to nearly 1.2mm unique addresses to this year. Same user could own different addresses and this data is not a 1:1 correspondence to number of user, but does show some activity 5. DeFi AUMDeFi AUM’s (assets under management) meteoric rise - from sub-1bn beginning of 2010 to now reaching over $30bn. Yes, Ethereum did appreciate over 10x+ from its March bottom so keep that in mind. 6. DeFi Lending Protocols$14bn+ deposited into lending DeFi protocols. This process unlocks liquidity via a collateralized loan (conventionally, overcollateralized 3x for 7% APR) for long-term holders of ETH and tokens who don’t want to sell. User receives stable dollar tokens to do participate in more “gambling stuff.” 7. Ethereum’s hashrateEthereum’s own hashrate, an indicator of total amount of computing power put towards securing the system and unlocking new Ethereum inflation as reward for mining, has breached its all time high. For reference, the AMD Radeon RX 480 has been the standard, costs about $200 if you can find one, outputs 25Mh/s. For scale, 12.5mm RX 480s gives the current 313 Th/s computing power - implying a CAPEX of at least 2.5bn in equipment alone mining ETH, not counting operational expenditures. 8. Address activityEthereum’s active daily address has been exploding. 9. ETH leaving exchangesETH are rapidly leaving exchanges, implying accumulation or usage in DeFi and other activities. 10. TechnicalsWhen most people (with capital) believe that the VALUE of something will go up, and the technicals look good, the price usually follows. It doesn’t hurt when the meme lines look good are in full effect. As of writing this, ETH/USD is 20 minutes away from closing its all-time high daily candle.Macro weekly ETH/USD look goodGolden cross on ETH/BTCMacro weekly ETH/BTC chart looks good too, will retesting 200 Weekly SMAAt the end of the day, if BTC looks good, ETH will look good too. 11. ETH futures launch in less than a weekCME Group to is launching ETH Futures on February 8, 2021. To be honest, I don’t yet know if this is necessarily bullish. Last time they launched BTC futures, they popped the bubble and bragged about it. From an excerpt from CoinDesk: Christopher Giancarlo, who left the U.S. Commodity Futures Trading Commission (CFTC) at the end of his five-year term as chairman in April, told CoinDesk in an interview:

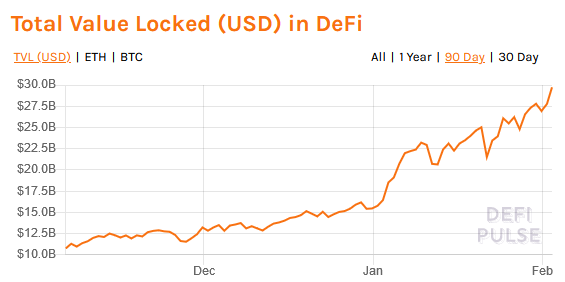

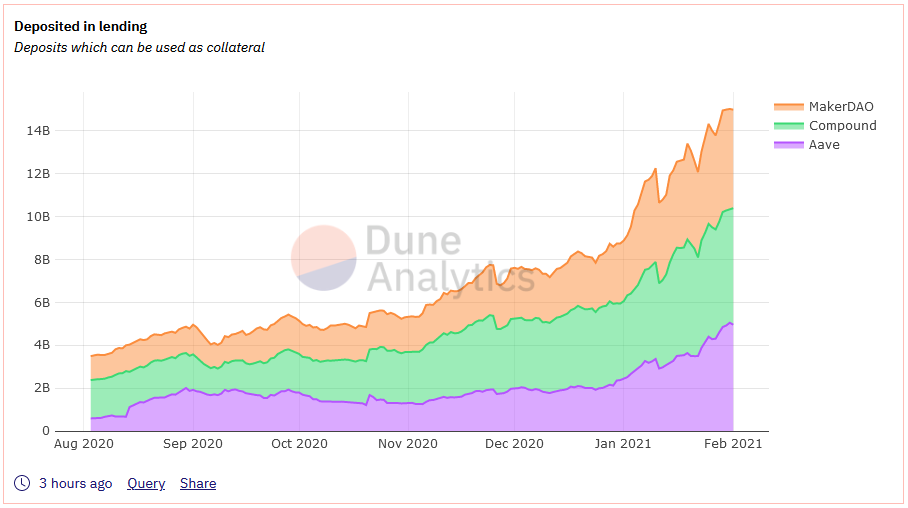

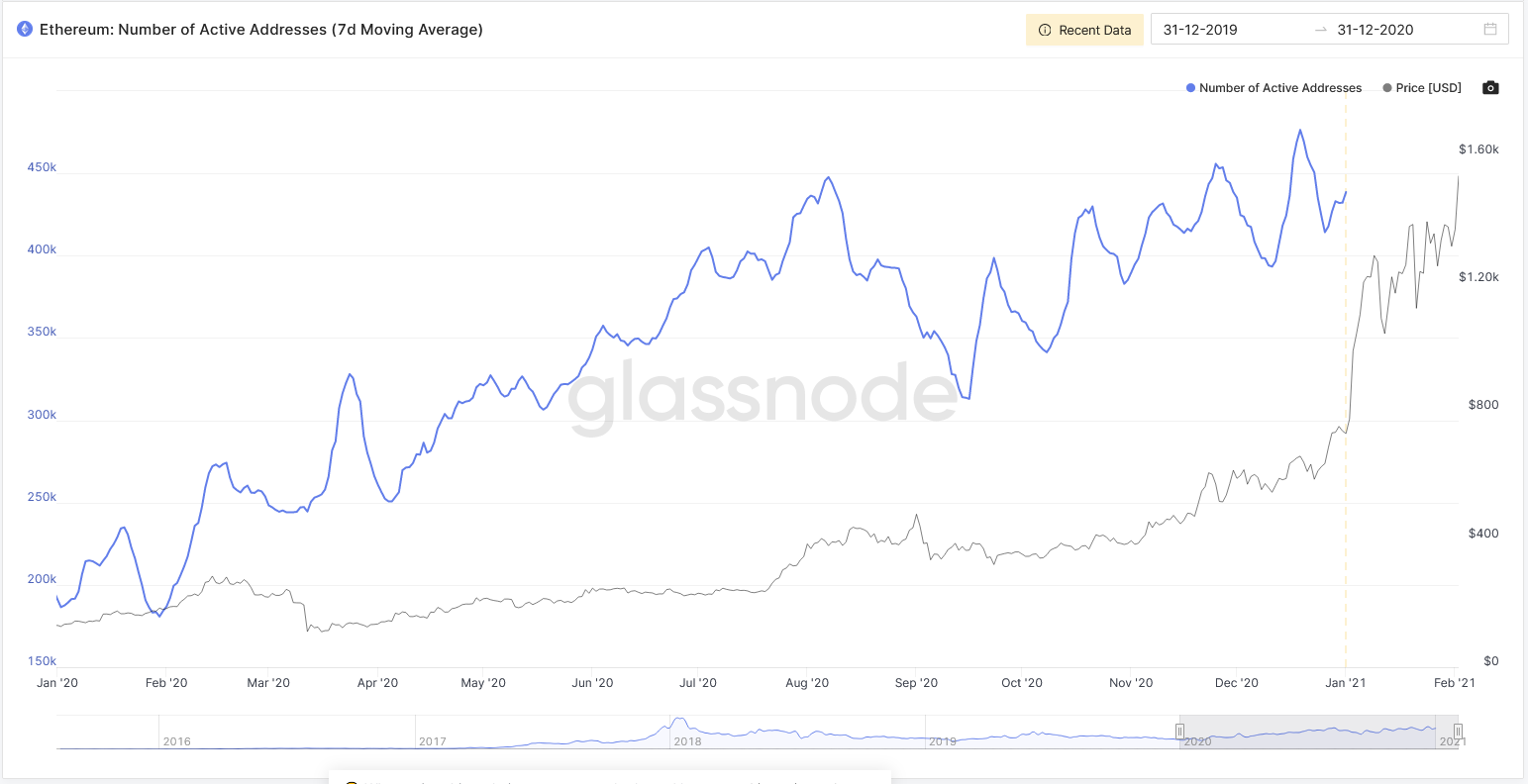

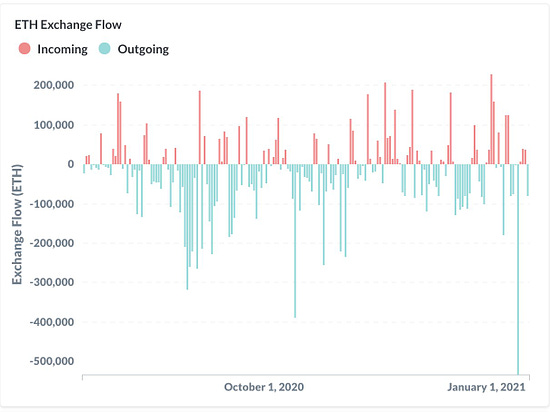

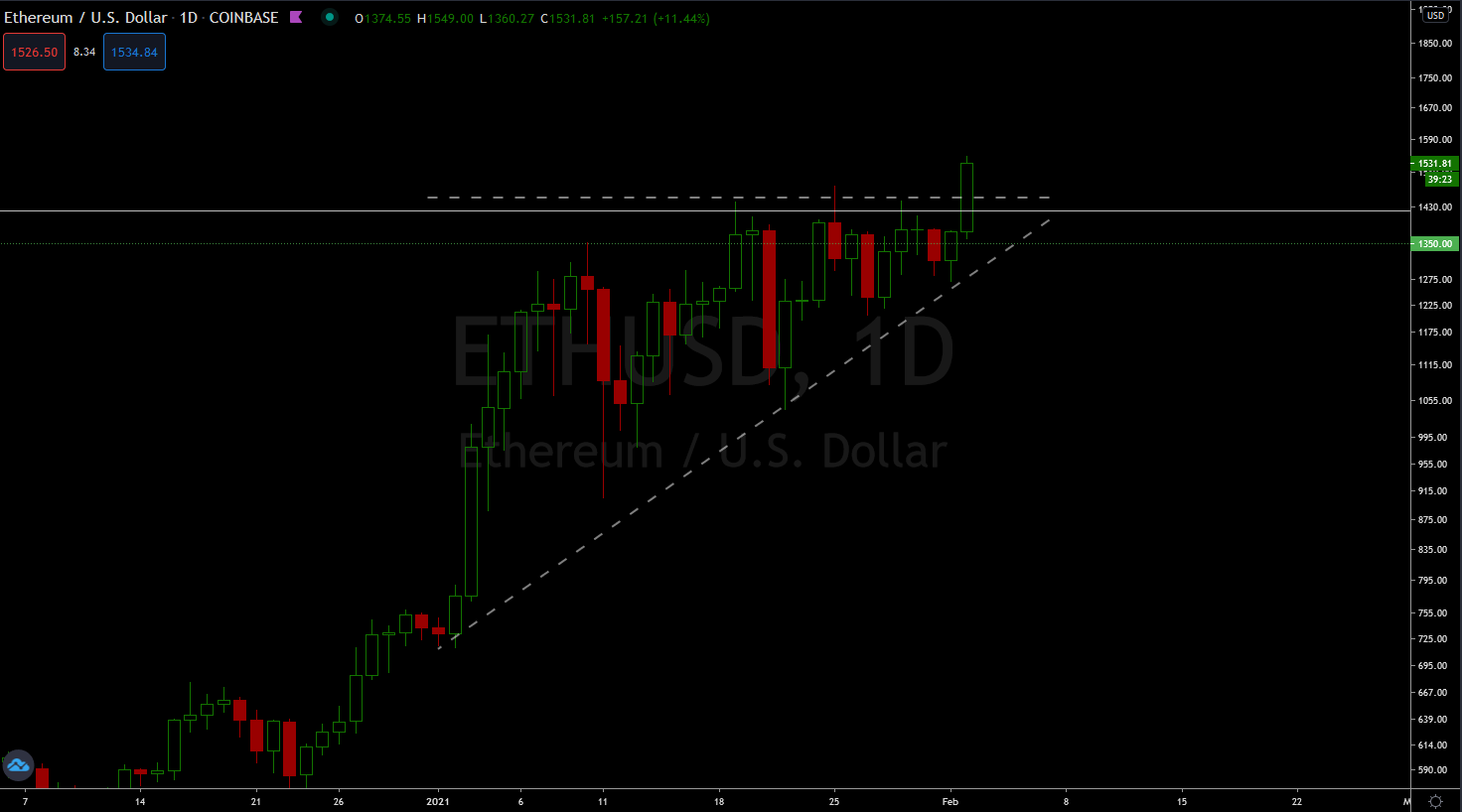

If you’re intersested in this, you can read this letter by the Federal Reserve Bank of San Francisco. The endAnyways, that’s all for now. Leave a comment on anything you’d like us to expand on (DeFi, the bear case, etc… whatever you want). See you later space Cowboy |