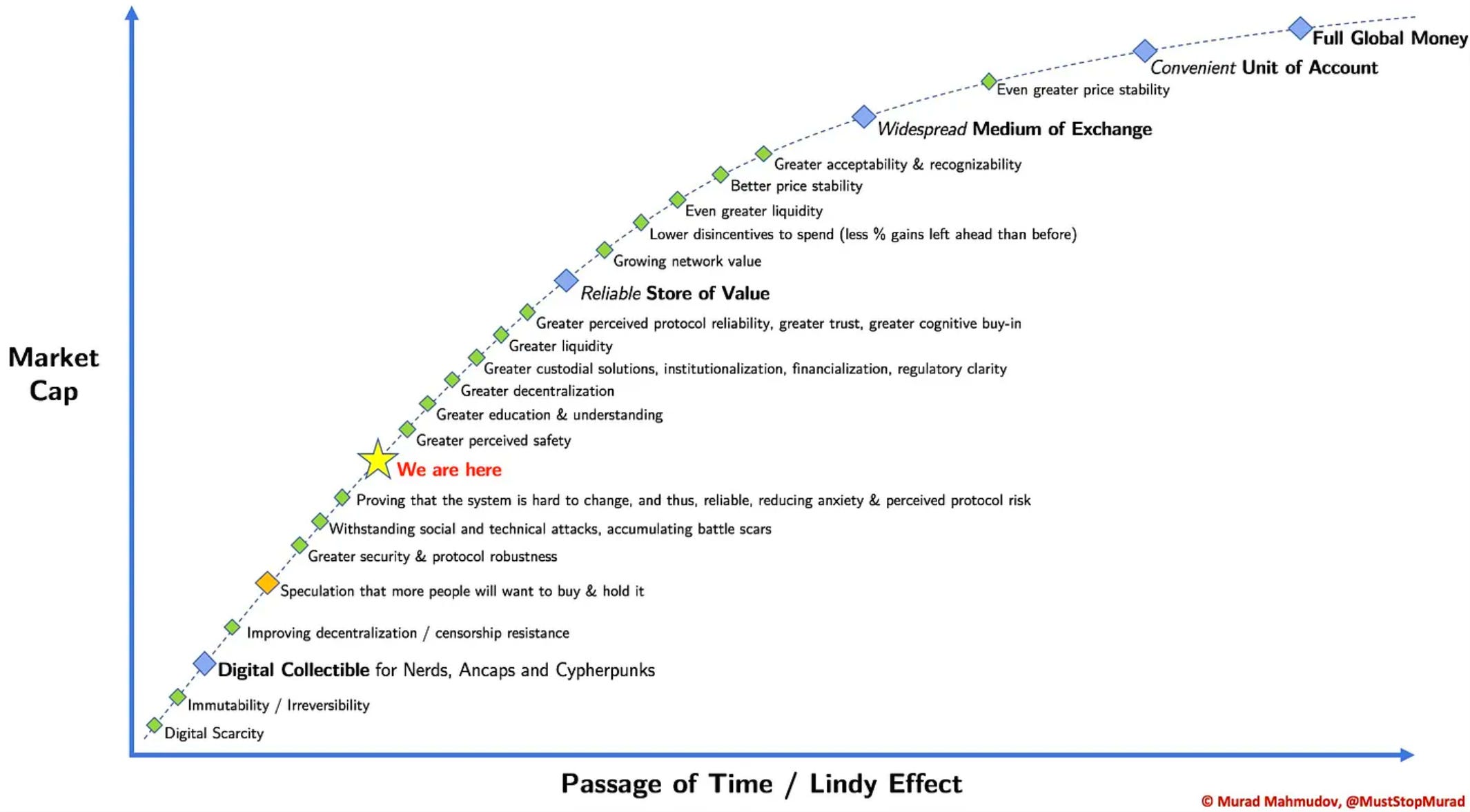

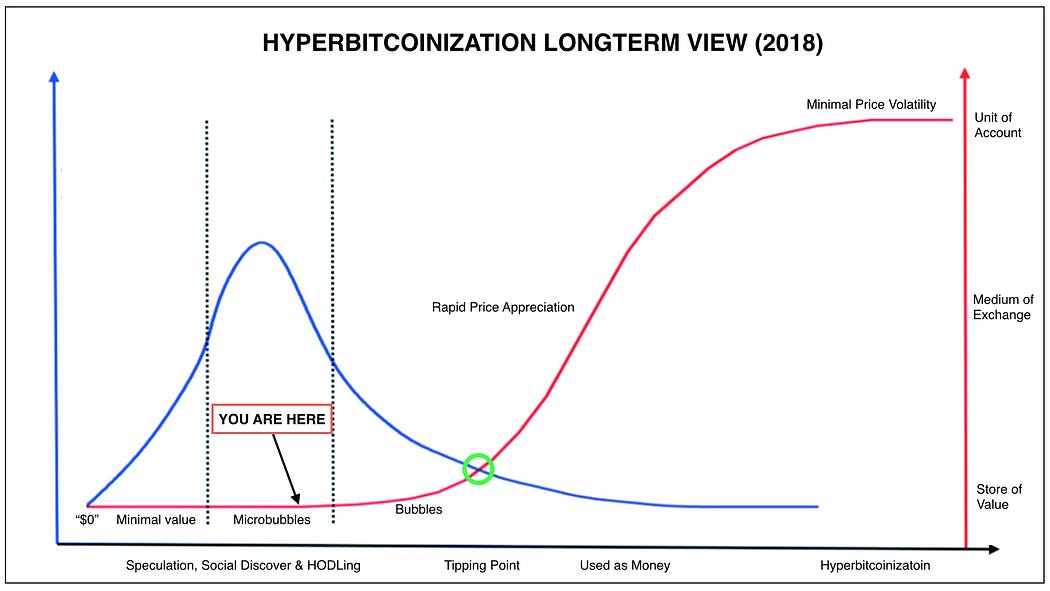

"The circulation of confidence is better than the circulation of money." — James Madison Are we there yet?Short answer, no. But, that doesn’t mean we’ll never get there. We’re about a third of the way through 2023 and Bitcoin is back above 30k, so let us gather around the digital campfire to talk about hyperbitcoinization - the notion that Bitcoin will steamroll its way through society, ultimately cannibalizing fiat currency and ascending to the almighty status of the global reserve currency. A brief introduction to hyperbitcoinizationHyperbitcoinization, a term coined by Bitcoin enthusiasts, refers to a potential future scenario where as Bitcoin's adoption grows, it'll eventually slay the fiat currency dragon and claim the throne in the world of finance. It's like the tale of David and Goliath, but instead of slingshots and stones, we've got wallets and QR codes. But before we tumble down this internet money rabbit hole, let's consider another phenomenon that’s important to understanding hyperbitcoinization - the Lindy Effect. This little concept suggests that the longer a technology or idea survives, the longer it is likely to stick around. It's like a reverse Darwinism for ideas, where past performance (contrary to your broker's disclaimers) might actually predict future success. The Lindy Effect becomes a remarkably useful tool for understanding the relationship between longevity and potential success. In the case of Bitcoin, as it continues to weather the storms of economic turmoil, regulatory scrutiny, and environmental concerns, its very existence grows stronger, more resilient, and more likely to endure. Here’s two charts that have been made in an attempt to illustrate the velocity of this idea.

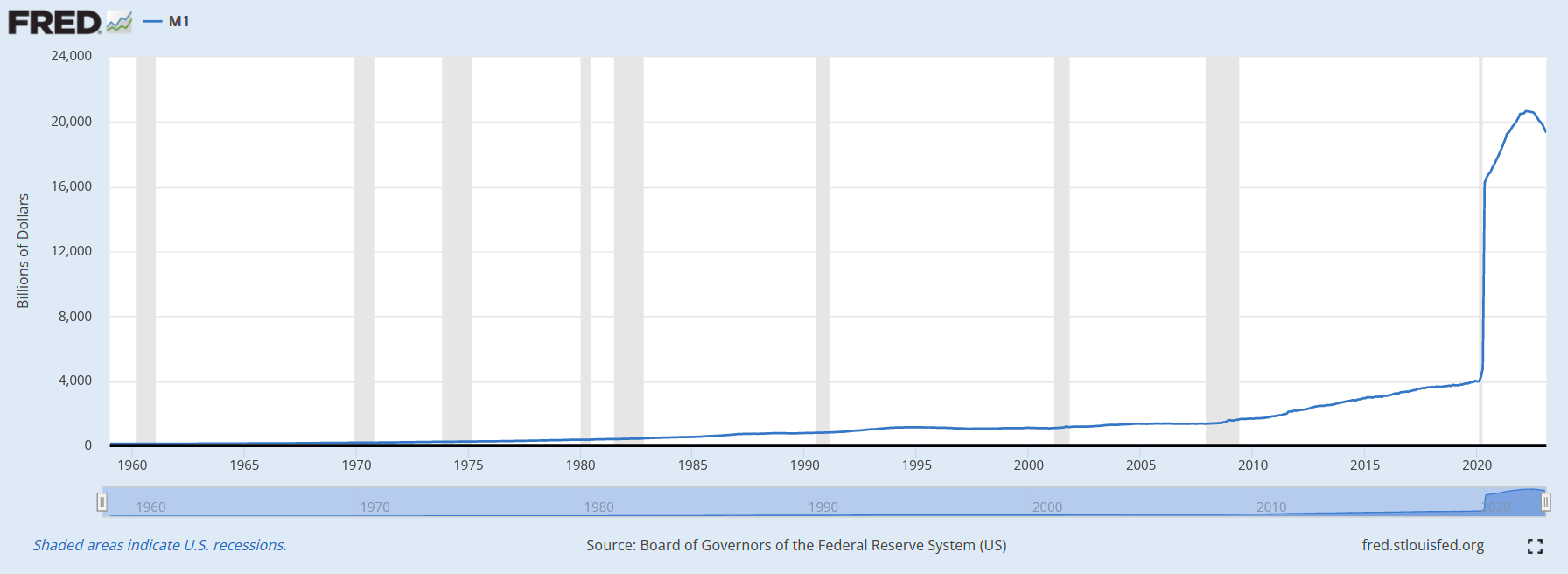

The State Of Hyperbitcoinization in 2023The meme dreamSo, we're in 2023, Bitcoin's back above 30k, and hyperbitcoinization is looking less like a pipe dream and more like a meme-worthy reality. As Bitcoin's usage and acceptance grow, the Lindy Effect naturally reinforces its potential staying power. This symbiotic relationship between the two concepts creates a feedback loop of credibility and adoption, turning Bitcoin from a niche player into a formidable contender for global economic DOMINATION (let me entertain myself). We're already seeing countries like El Salvador and the Central African Republic (CAR) adopt Bitcoin as legal tender because it offers a way to address some of the problems that traditional currencies face (like inflation and believe it or not, volatility), and it's likely that more countries will follow suit in the coming years. The de-dollarization memeIn light of recent banking shenanigans, the de-dollarization meme has been making the rounds on news publications (both niche & mainstream), Twitter, Tiktok, and wherever else the cool kids hang out these days. De-dollarisation refers to the act of dethroning the unshakable US dollar from its dominant position in global markets. Imagine it as a wrestling match where the dollar gets tossed aside, replaced by a cast of alternative currencies vying for control over the world's oil, commodities, and trade deals, along with their presence in foreign exchange reserves and other dollar-hoarding assets. Isn’t it a bit funny how the usual suspects keep cropping up in the headlines? Russia, China, Saudi Arabia, Pakistan, Iran…it's as if they've got nothing better to do than play the role of villains in this twisted, dystopian world we find ourselves in. WHAT IF Saudi Arabia announced it will price oil in Chinese yuan (which is basically pegged to the US dollar)? I took to Google to get an answer. There you have it folks. My fellow internet-dwelling degenerates, it’s been decided that the yuan and some other dogshit currencies are going to be responsible for de-dollarization (and definitely not the fact that US money supply went up ~390% in ~2 years). And if you still don’t understand, let me ask you a question - if the yuan wasn’t pegged to the US dollar and was a free-floating currency…would you hold it? De-dollarization will only happen when foreigners don’t want US dollars. These trending de-dollarization concerns are not new and have been around for several years. Here are some reasons why the de-dollarization concerns in recent headlines are largely a meme.

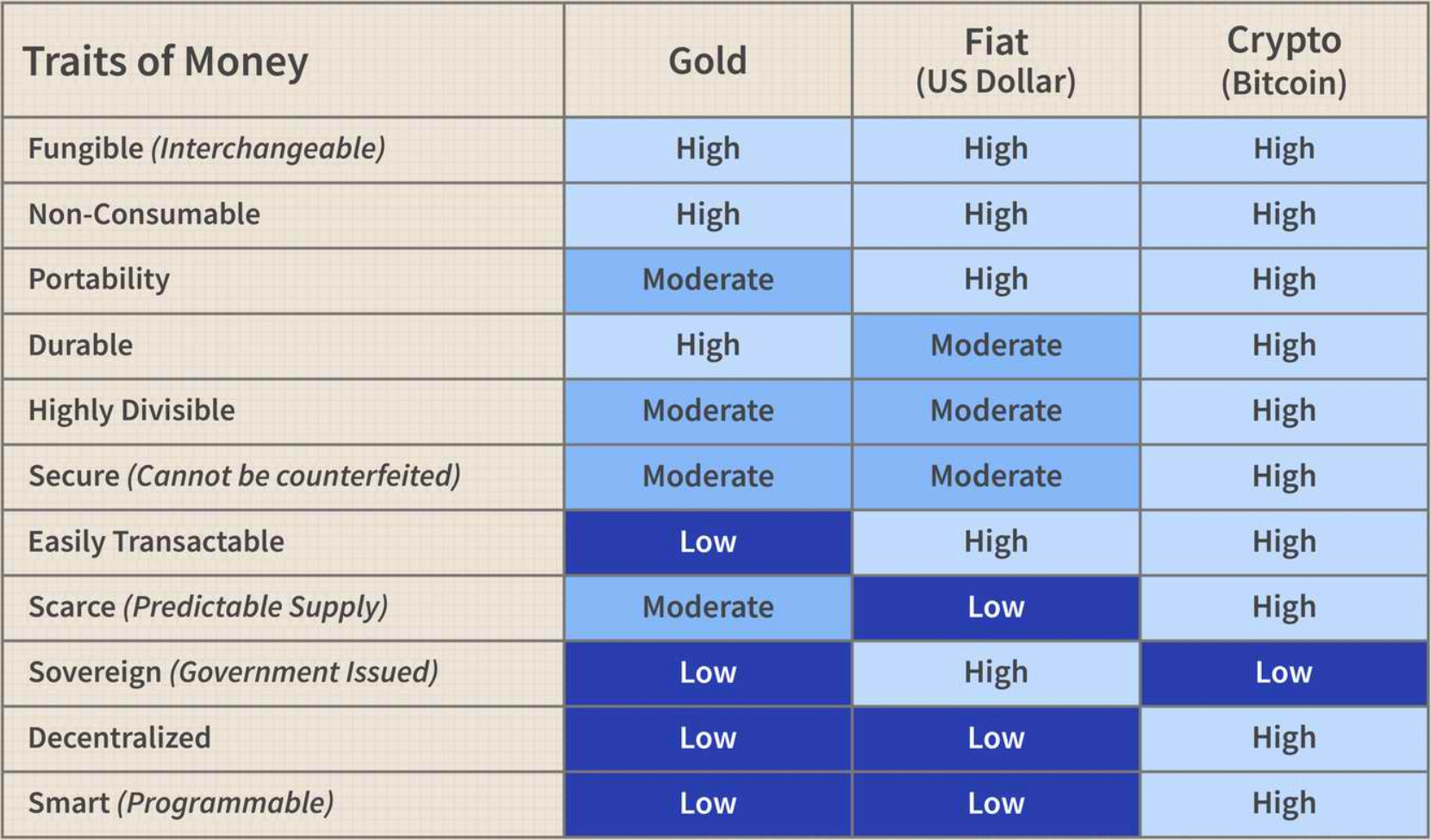

Hyperbitcoinization & de-dollarizationFunny enough, Bitcoin may be the most important and relevant asset when it comes to de-dollarization. You see, countries that cling too tightly to the US dollar risk finding themselves at the mercy of sanctions and other economic toys that Uncle Sam just loves to play with. Bitcoin, however, is the defiant outsider, beyond the grasp of any government or central authority – a currency as untamed as the internet itself. And nations around the globe are starting to pay attention. When de-dollarization does eventually start to happen, Bitcoin will undoubtedly take center stage. As countries and individuals search for alternatives to conventional currencies, Bitcoin stands tall as a decentralized, secure, and reliable option, unburdened by the fickle whims of political and economic pressures that traditional currencies face. Whether or not Bitcoin ultimately becomes a global currency, it's already changing the way we think about money and value, and it's playing an important role in the ongoing evolution of the global economy. Why Bitcoin will eventually be the star of the de-dollarization showBitcoin's destined to be a key player in the de-dollarization game because, quite simply, it's a better money. Here's how this translates to the real world -

It's got geopolitical neutrality, global liquidity, improved auditability, reduced counterparty risk, and protection against inflation, all wrapped up in a digital package. And in a world where de-dollarization starts to take center stage, that's a pretty sweet deal. The inevitable clash with hyperbitcoinizationHyperbitcoinization would represent a significant shift in the global financial system and could have major implications for US foreign policy. If Bitcoin were to ascend as the supreme global currency, it would cripple the US's ability to wield economic sanctions as a weapon of global policy influence. With Bitcoin's decentralized nature, free from the clutches of any government or central bank, it'd be significantly more diffucult for the US to impose sanctions on countries that embrace Bitcoin as their prime currency. In present day, the ghost of Bretton Woods lingers, continuing to shape the global financial system. Any significant alterations to this system could spell major consequences for the US and the global economy. Imagine a world where Bitcoin becomes the new bedrock of the global financial system, dethroning the Bretton Woods system. A seismic shift in the global financial landscape would ensue, with dramatic implications for US foreign policy. If Bitcoin were to establish itself as the new foundation, the US dollar's role would diminish, possibly eroding the US's economic and political power. A shift in the balance of power among nations could follow, with some countries gaining more influence over the global financial system. Could the United States eventually embrace hyperbitcoinization?While unlikely and probably not in our immediate future, let's indulge in a thought experiment: how could hyperbitcoinization and de-dollarization unfold while the US maintains its global financial system. Here are two potential scenarios:

And a two reasons why the US may choose to become more friendly with Bitcoin:

Now, for a healthy dose of reality, here's what will PROBABLY happen before any of the aforementioned memes come to pass:

In closingIt’s 2023 and most of us can agree that Bitcoin has gone from being a niche curiosity to a global phenomenon. But let's be real - the biggest hurdle to Bitcoin's adoption as a global currency is still the fact that most people don't understand it. Bitcoin is complex, and it requires a certain level of technical knowledge to use it safely and effectively. We need to do a better job of educating people about Bitcoin and making it more accessible to the masses. That means more user-friendly wallets, better user interfaces, and more education about how to use it securely. Hyperbitcoinization, de-dollarization, and meme magic aside, as we gaze into the haze of an uncertain future, one thing is clear…the tides of change are upon us. The endSpecial thanks to Jacobthebomb for this topic recommendation. I encourage you to comment below with topics you'd like me to cover in upcoming CoinSheet letters. Thanks for reading. See you later Space Cowboys -Dmitriy |