| Greetings, Here's your daily business briefing. - Airbus reports a strong year and announces a special dividend.

- Retail sales cool off in January.

- Dropbox sinks almost 23% on recurring revenue woes.

Thanks for reading! Stjepan

p/stjepan-kalinic | |

| 1 | Airbus reported strong 2023 results, reaching $6.25B (€5.8B) in operating profits (up 4% YoY) and $70.48B in revenues (€65.4B). Despite facing persistent supply chain challenges, the company expects to deliver approximately 800 commercial aircraft this year, reaffirming its plans to build 75 A320 jets per month by 2026. More: - Airbus plans to deliver about 800 commercial aircraft in 2024, representing an increase of 65 planes compared to 2023.

- The firm announced a special dividend of $1.08 (€1) for shareholders after its net cash exceeded $10.7B (€10B) in 2023. They affirmed a regular dividend of $1.94 (€1.8).

- The management expects adjusted EBIT in the range of $7B (€6.5B) to $7.54 (€7B) for 2024, signaling a robust financial outlook.

- Analysts expressed concerns about cautious financial forecasts for 2024 and the lack of updates on a broader share buyback.

Zoom Out: - Airbus' net orders surged to 2,094 aircraft in 2023, a 155% increase from 2022, while Boeing lagged behind with net new orders of 1,314 units.

- Airbus ended the year with a net cash position of $11.5B (€10.7B), while Boeing posted a consolidated debt of $52.3B.

|     | |

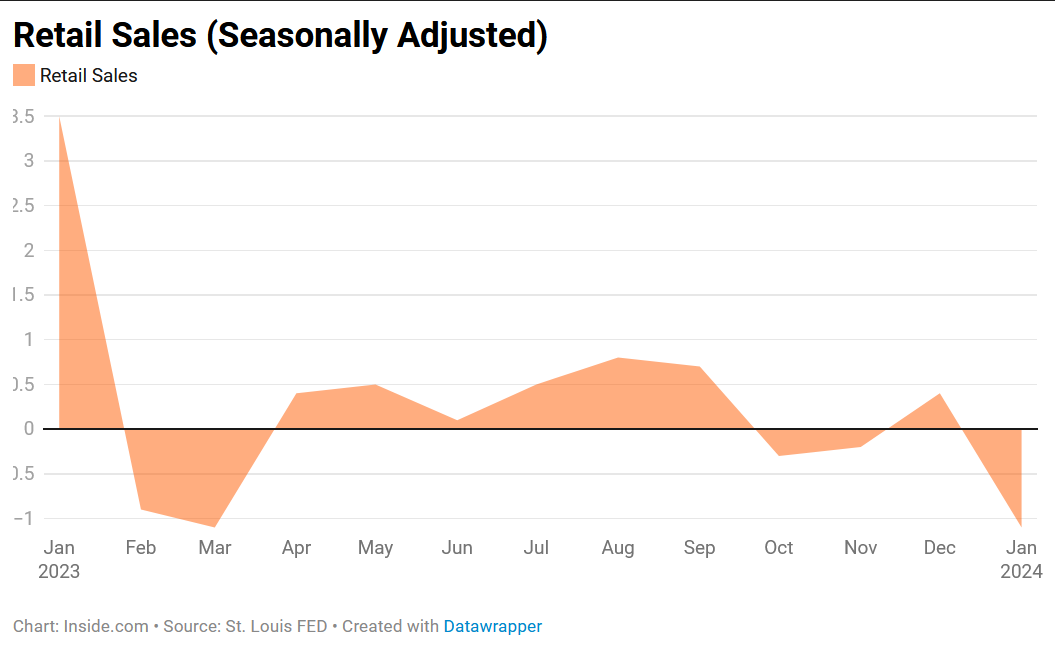

| 2 | Retail Sales Decline in January U.S. retail sales experienced a larger-than-expected decline in January, falling 0.8% from the strong pace in December. The data indicates a spending pullback by consumers entering the year with less vigor than in prior months.

More: - The Commerce Department revised December's sales to a 0.4% gain, and excluding auto sales, January's retail sales were down 0.6%, contrary to economists' expectations of an increase.

- The drop is attributed to technical factors, including less supportive seasonal adjustments and adverse weather conditions, with cold weather potentially weighing on sales across the country.

- Despite the slowdown, the fundamentals for consumers remain solid, as indicated by strong job reports. Analysts debate the extent to which the data reflects a consumer pullback or is influenced by complications in the data.

- Economists suggest that higher interest rates and reduced savings from the pandemic could potentially crimp consumer demand, leading to a weaker outlook for growth in 2024 compared to the previous year.

|     | |

| 3 | Dropbox shares plummeted almost 23% after reporting its fourth consecutive quarter of declining annual recurring revenue growth, prompting multiple downgrades from analysts. The firm posted Q4 adjusted earnings per share of $0.50 on revenue of $635M and weaker-than-expected guidance for 2024. More: - Annual recurring revenue (ARR), a crucial sales metric, was $2.523B at the end of Q4, showing a modest 0.3% year-over-year growth. This represents a significant deceleration compared to previous quarters, where the company achieved ARR growth of 7.8%, 7.2%, and 3.8% for Q1, Q2, and Q3, respectively.

- Dropbox's paying users at the end of Q4 declined sequentially to 18.12 million, compared to 18.17 million at the end of Q3. The company acknowledged a reduced level of paying user growth relative to 2023 and indicated that there might be some quarters with negative paying user additions.

- Dropbox provided 2024 revenue guidance of $2.535B to $2.550B, while the market expected $2.57B.

- Analysts, including Michael Funk of BofA Securities and Kash Rangan of Goldman Sachs, highlighted concerns about the company's risk/reward profile, the need for growth re-acceleration, and a stronger small- and medium-sized business environment.

- The company experienced downgrades from several analysts, including J.P. Morgan (Overweight to Neutral), JMP Securities (Market Outperform to Market Perform), BofA Securities (Buy to Underperform), and Goldman Sachs (Neutral to Sell).

|     | |

| 4 | Vulcan Materials, a leading company in the building materials industry, posted Q4 2023 earnings, recording earnings per share (EPS) of $1.46 and revenue of $1.83B. Following the news and an optimistic outlook for FY 2024, shares surged to an all-time high of $260.81, rising 6.2% in Friday's trading. More: - EPS expectations beat by $0.06, while revenue had a marginal $10M miss. Still, $1.83B in revenue represents a year-over-year (YoY) growth of 5.8%.

- The aggregates segment, the company's largest, witnessed a 30% YoY jump in gross profit to $424M, with shipments increasing by 2% to 55.3 million tons and freight-adjusted selling prices climbing 14% to $19.32 per ton.

- The management expects FY 2024 net earnings in the range of $1.07B to $1.19B, surpassing the $933M reported in the previous year and largely exceeding the $1.08B consensus estimate.

- Chairman and CEO Tom Hill highlighted the positive pricing environment, expecting pricing momentum and operational execution to contribute to a significant expansion in aggregates unit profitability, irrespective of the macro demand environment.

|     | |

| 5 | Alphabet has officially changed how it compensates publishers through its Google AdSense program. The company is switching from paying publishers based on clicks to paying them per impression, making it easier for publishers to compare earnings across Google's products. More: - Google Ads Product Liaison Ginny Marvin confirmed the change, which was announced in November 2023.

- Per Google Ads VP Dan Taylor, the company is splitting AdSense revenue share into separate rates for the buy-side and sell-side. The firm expects these changes to have an impact on situations when third-party platforms purchase AdSense to display ads.

- In those scenarios, the update should increase publishers' revenue share from the typical 68% to 80% of the revenue after the advertiser platform takes its fee.

- The company is switching from the previous cost-per-click (CPC) model to eCPM (effective cost per thousand impressions). Thus, the revenue now depends on impressions, not clicks, and it could impact businesses whose advertising revenue focuses on engagement rather than overall traffic volume.

|     | |

| 6 | | Stellantis shares surged over 6% after reporting record-high net revenue and profit for 2023, reaching $204.12B (€189.5B) and $20.02 billion (€18.6B). The company also unveiled a $3.2B buyback program, demonstrating confidence in its financial position. More: - Adjusted operating income rose to $26.19B (€24.3B), although the operating margin slightly dipped to 12.8% from 13% in 2022 due to costs associated with the United Auto Workers (UAW) strike.

- Despite estimated losses of $3B in revenue and $800M in profit from the UAW strike, Stellantis outperformed other Big Three automakers, Ford and General Motors, with its losses being less significant.

- Stellantis reported a 21% increase in global battery electric vehicle (EV) sales in 2023, and CEO Carlos Tavares confirmed that the EV business is profitable, emphasizing the company's commitment to EV transition plans.

- The $3.2B buyback program, coupled with positive financial results, reflects Stellantis' confidence in its financial position and strategy.

|     | |

| 7 | | Quick Hits: - If your business accepted Visa or MC from Jan. 1, 2004 to Jan. 25, 2019, you may be entitled to a share of the historic $5.6B settlement.*

- JPMorgan expects a resolution with two U.S. regulators that might cost the firm a $350M fine. The bank had recordkeeping failures in its corporate and investment branch.

- Insider trading activity has accelerated, with insider selling far outweighing insider buying as the market reached record highs. Amazon is leading the charge in total transactions as the fresh Florida resident Jeff Bezos saved over $140M of capital gains tax on a $2B stock sale.

- Volkswagen is under pressure to ditch its joint venture with SAIC in Xinjiang, China. New evidence emerged linking the car maker with China's persecution of Uyghur minorities in the region. Meanwhile, the U.S. has impounded thousands of its cars because they contained parts made by a Chinese supplier on a sanctions list for using forced labor.

- The latest 13F filings unveiled recent institutional investors' trades. Although he wasn't a big buyer, Buffett received an exemption from regulatory filing for Q3 and Q4 2023, signaling that Berkshire might have taken a new stake in some company.

- Conquer any Kubernetes challenge with the Kubernetes Cookbook. Get your copy from DoiT, a global team of cloud experts.*

*This is a sponsored listing. |     | |

| Upcoming Events | | MAR

7 | | Portfolio Diversification - Learn from knowledgable experts on the latest trends in alternative investment assets like private equity, crypto, real estate, and the art market. | | | | | | | MAR

27 | | Discover how generative AI can speed up your enterprise, expand your business model, and improve your value proposition. Network with hundreds of AI leaders.* | | | | | | * This is a sponsored event | | | |

| Freelance Writer | | Stjepan Kalinic is an analyst and writer with a background in institutional investment research. He's passionate about reading, playing music, lifting weights, and practicing martial sports. He values interesting books above everything else, and you can send recommendations through LinkedIn. | | This newsletter was edited by Megan LaBruna | |

| |

| |