| ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

Monday, December 17, 2018

Mick Mulvaney / Raining Cash / Ethereum Price / XRP

Rewind a year exactly ⏪

December 17, 2018

QUOTE OF THE DAY

"Hardships often prepare ordinary people for an extraordinary destiny."

- C.S. Lewis

We are sad to hear that Cypherpunk legend Timothy May has passed away. Thoughts and prayers go out to his family, friends, and loved ones. May he rest in peace.

Sincerely,

Unbankd Team

| COIN | PRICE | 24H |

| | ||

| BTC | $3,436.751676 | +5.04% |

| | ||

| XRP | $0.302848 | +4.16% |

| | ||

| ETH | $90.352459 | +3.99% |

| | ||

| XLM | $0.103211 | +5.47% |

| | ||

| EOS | $2.146965 | +10.56% |

| | ||

*Information as of 10:00 AM EST

One-Year Ago Today Bitcoin Touched $20,000

Rewind a year

On December 17, 2017, Bitcoin reached unreal heights. For a brief moment on the day, the almost 10-year old cryptocurrency nicked $20,000.

The move would mark over a 1900% increase for Bitcoin since the start of 2017.

Since then, however, Bitcoin’s glory has fallen alongside a grueling pullback that has left the price sitting at mid $3,000’s.

Where to next?

Pricewise? It’s unclear. We know that Bitcoin has gone through multiple boom and busts before but the recovery time period largely differs.

However, there are many events to look forward to in 2019. Here are the top contenders:

- Bakkt’s physically-delivered Bitcoin futures

- Approval of a Bitcoin ETF

- Substantial Lightning Network growth

Remember…

Bitcoin is still in its infancy alongside the entirety of the crypto market. Most technological advances have seen their own version of a bubble - including railroads in the 1840s.

It may not be the masses that bring Bitcoin forward in 2019. Rather, it will be the ones quietly building the foundation during the bear market for the next steps towards mass adoption.

President Trump's New Chief of Staff is a Bitcoin Supporter

President Donald Trump recently appointed Mick Mulvaney as his new Chief of Staff. Before being appointed to his new position, Mulvaney previously served as the Director of the Office of Management & Budget.

Long-time crypto supporter now in power

Mulvaney has a long history of supporting cryptocurrencies during his time as a politician.

When Mulvaney was a member of the U.S. House of Representatives, representing South Carolina's 5th district, he had a hand in creating the 'Blockchain Caucus'. This was a group of Congressmen that created new legislation related to blockchain technologies.

Around the time of creating this group of pro-crypto Congressmen, Mulvaney made a statement saying:

“Blockchain technology has the potential to revolutionize the financial services industry, the U.S. economy and the delivery of government services, and I am proud to be involved with this initiative.”

What this could mean

Donald Trump has never voiced his opinion on blockchain or cryptocurrencies, so it could be anyone's guess on his stance. However, what we do know is there is a new blockchain supporter in the White House.

As Trump's Chief of Staff, Mulvaney will have a meaningful say in how the President's operations are run. Mulvaney will have the opportunity to influence policy decisions, and who knows he may pitch Trump on his beloved blockchain.

No One Took Morgan Creek's $1 Million Bet on Crypto

The bet

About a week ago, Morgan Creek founder Anthony Pompliano offered a bet of $1 million that cryptocurrencies would outperform the S&P 500 (an index of the 500 largest public companies) over the next ten years.

The bet was extended to anyone willing to take the otherside, thinking that stocks would out perform the crypto market.

Put your money where your mouth is

Pompliano recently took to Twitter to share with his followers that no one has accepted the other side of his bet. He told his followers, "Don’t listen to the naysayers. They don’t even believe what they say."

The Morgan Creek founder has always been one of the biggest cryptocurrency proponents and is well respected in the space. He is quick to point out that although most of the crypto market is down as much as 90%, you don't have to go much further than a year back to find a time period that the cryptocurrency market has outpaced the traditional financial market.

As far as we know, the bet remains open, but it seems no one is eager to bet against cryptocurrencies.

Hong Kong Stock Exchange Worries for the Bitmain IPO

Yes or no

According to CoinDesk, the Hong Kong Stock Exchange (HKEX) is having trouble deciding whether or not to approve mining giant Bitmain for its upcoming IPO.

To be approved, Bitmain will have to make it through a series of approvals from not only HKEX but also the Securities and Futures Commission (SFC) to see if it can move forward with the listing.

And it only has 6 months to do so. So far, Bitmain is about halfway through the process with no approvals yet.

The reason why

Volatility in the market has made financial authorities iffy on whether or not to proceed with the listing.

An anonymous CoinDesk source commented on the matter:

“The exchange is very hesitant to actually approve these bitcoin mining companies because the industry is so volatile. There’s a real risk that they could just not exist anymore in a year or two.”

To be fair, it’s totally possible. Mining profits have gone down the drain and Bitmain is expected to report major losses for its third quarter - mostly stemming from crypto holdings and equipment sales.

But wait, there's more...

- 🏛 Switzerland is looking to accomodate blockchain into its exisiting financial framework.

- 🧐 TD Ameritrade is exploring the potential of XRP for its platform.

- ☹️ Experts believe Hong Kong's new regulation could hurt innovation in the crypto industry.

If you ❤️ Unbankd, share us with your friends to help them get crypto smart too!

So far you have 0 referrals but we still have more rewards for you.

Or copy & paste your unique link to share:

https://unbankd.co/?ref=192f87b56d

| | | |

|---|

303 5th Ave SE, Minneapolis, MN 55414

The above is not intended to be investment advice.

Copyright © 2018 Unbankd, All rights reserved.

If you don't absolutely love us, drop us.

Sunday, December 16, 2018

Weekly Bulletin (Dec 16, 2018)

CoinSheet #233 Men's natures are alike; it is their habits that carry them far apart. — Confucius Weekly Bulletin We've had a rather slow week in important news. Which makes sense. The big dates everyone is waiting for are still: January 24, 2019 - Bakkt target launch date

Weekly BulletinWe've had a rather slow week in important news. Which makes sense. The big dates everyone is waiting for are still:

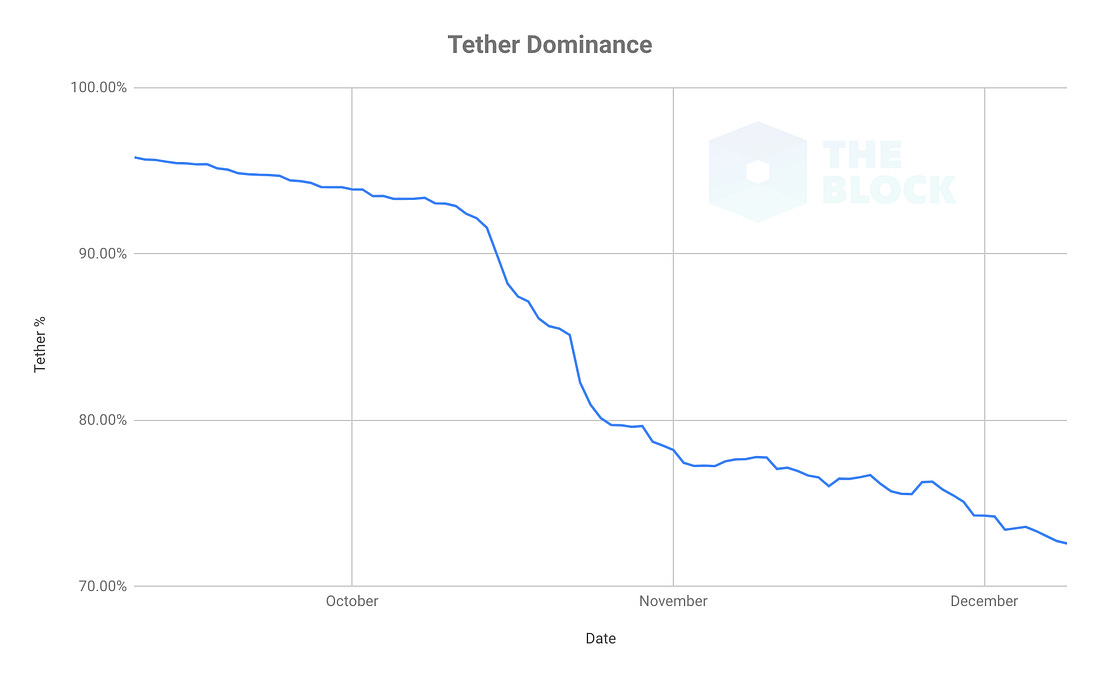

This weekAs much as I want to write about how disgusted I am with the Government of Venezuela for taking pensioners' bolivars from their accounts and replacing them with their shitty Petro coin, I am going to try to keep the Weekly Bulletin information based, and save my rants for the miscellaneous letters. Today we've got a market analysis from CryptoCore (and a dose of hopium from Dmitriy). Tether dominance drops?

At least that's according to this article. Does anyone see anything wrong with this?

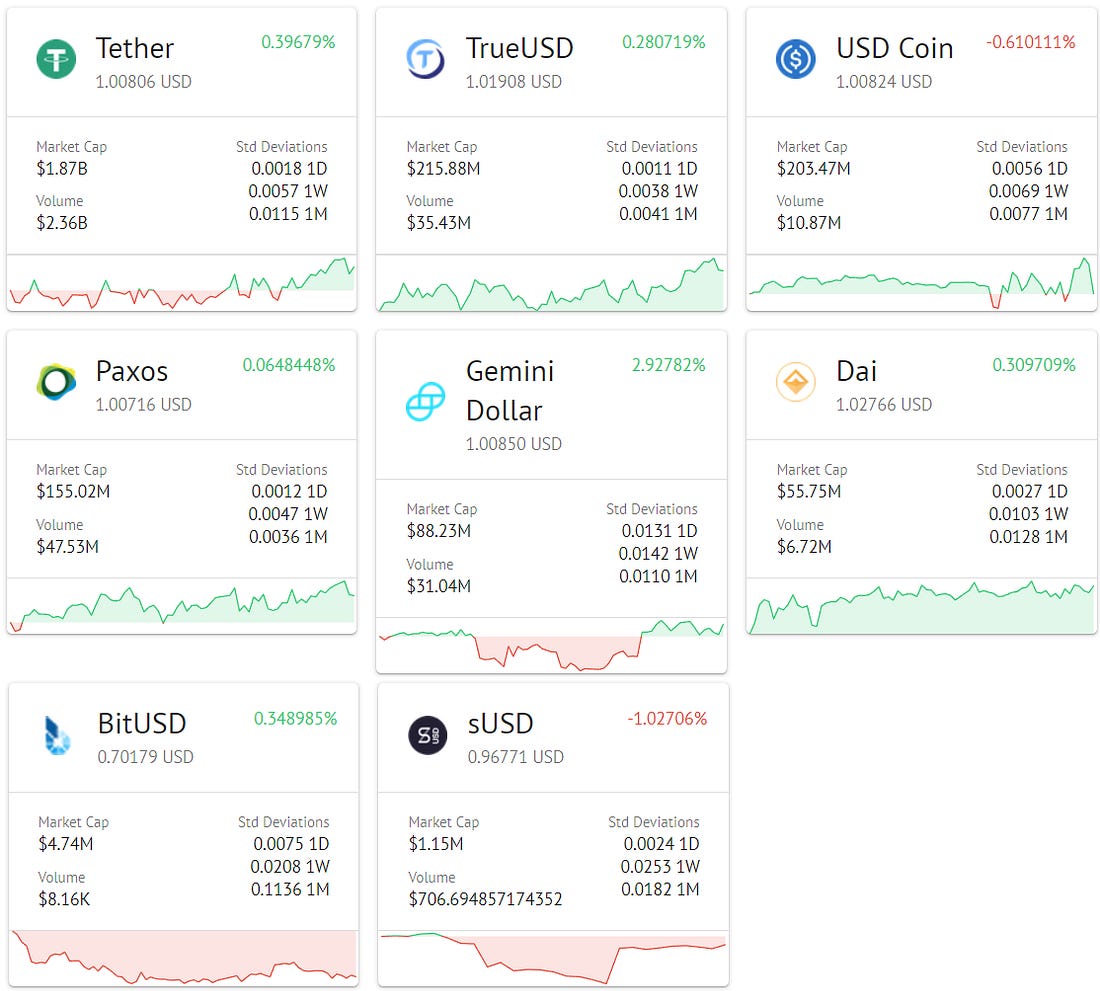

I'm sure you all do, because you're smart. The author correctly wrote that the decline in dominance could explained by the rise of new stablecoins and Tether destroying almost a third of its supply. But the question remains, why is this important? Because it's not. Measuring stablecoins by their market-cap is stupid. Let's take a look at the daily volume of the top 10 stablecoins.

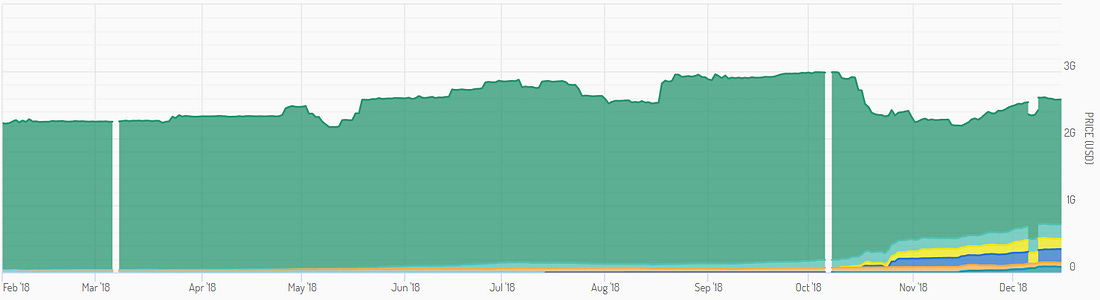

Tether accounts for ~95% of the "stablecoin" trading volume (in the last 24 hours). Below is a chart of stablecoin market-caps. All that green color is Tether, and those colors below the green are other stablecoins. Wow, it still almost looks like Tether is losing dominance.

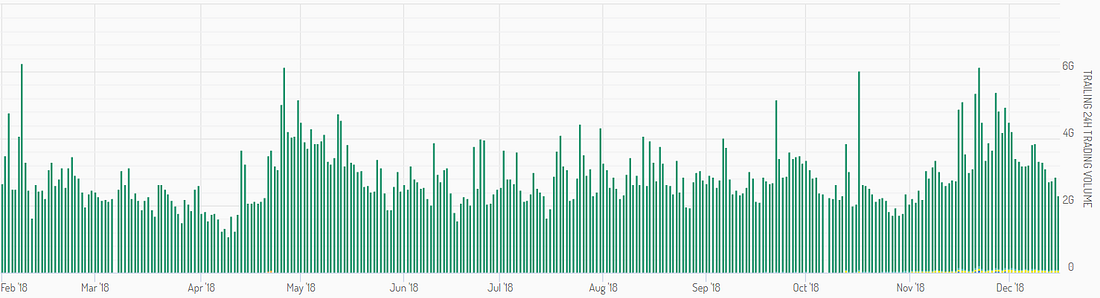

Now let's look at the same chart, but this time with trading volume instead of market-cap.

You get it? And besides, a stable coin isn't actually stable. It's most likely something that's going to be pegged to the dollar. If you're going to have a stable coin pegged to the dollar, your coin is going to depreciate just like the dollar. And now you also have to worry about counter-party risk… Okay, stablecoins are stupid. End of rant.  Dmitriy@DmitriyszUntil someone figures out the deal with oracles, no stablecoin is going to work. Dmitriy@DmitriyszUntil someone figures out the deal with oracles, no stablecoin is going to work.May 26 2018 5 LikesSource for all of these charts: https://stablecoinindex.com/volumeRandom thoughts about Boaz Manor/BCT

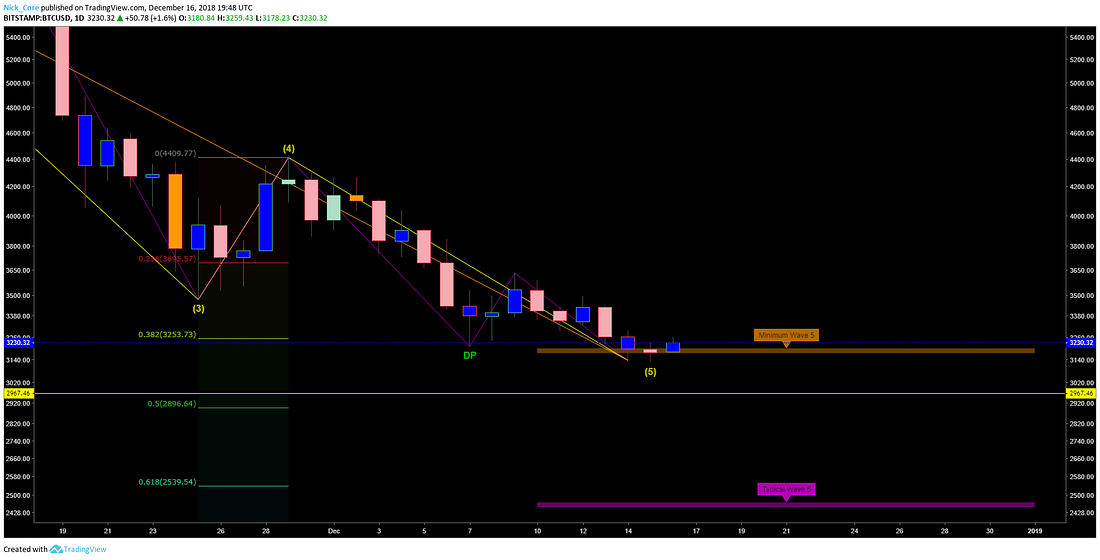

You can read the story here. The reason I bring this up is because Kunyi and I were both in Puerto Rico for a conference in 2018 and we've taken a look at their product. I vividly remember us chuckling and trying to control ourselves from flat out laughter at how shitty their product was (it's rude to laugh as a sales persons / representative face, he's only trying to do his job). It was so bad though. We tried to change up a few indicators, see what was under the hood, and it looked like there were some make-shift API connections to Microsoft Excel or Tableau. Oh, and it wasn't live, all the data was static/historical. We walked away shaking our heads joking about how much of a scam it was. Market SentimentNick's POVAs the weekly candle closes with a ridiculously bearish trend I can't help but wonder when we'll have a week of relief. Taking a look a the Guppy Multiple Moving Averages, the weekly shows us oversold conditions. Typically when I see a trend this strong, with a bearish bias, I either stay out of the markets or retain a portfolio hedge.

Moving on to the daily to see where our potential bottom is on the current wave; I can see the 5th wave has met the minimum criteria needed for a reversal. However, nothing is absolute with technical analysis let alone Elliott waves.

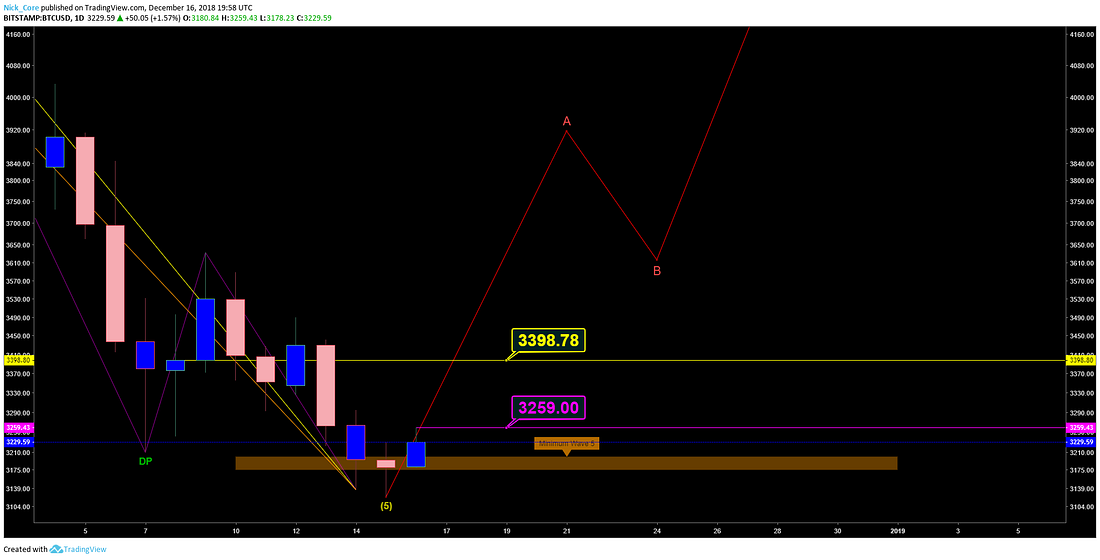

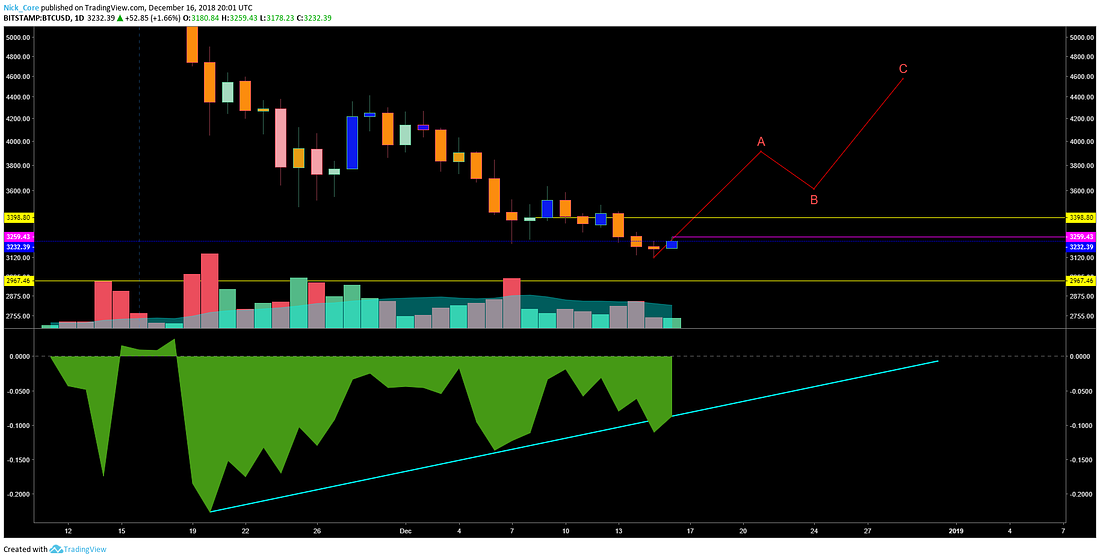

The 5th wave is extremely truncated considering the strength of the sell off lately. More reasonably I think the support range between 2800 to high 2900's (depending on the exchange) is a better ending that matches the strength of prior waves. That being said, we are in a price level scenario that is extremely complex, a rally upwards above 3259 would cause a breakout upwards, and ultimately a test of 3398.

At that point if volume can maintain a trend upwards on the daily Chaikin Money Flow to the median line then I would expect this ABC correction to take place and confirm on the 3398 break. Daily support definitely needs to be found at this level and I need to see a daily close above this level in order for me to confirm the ABC correction upwards.

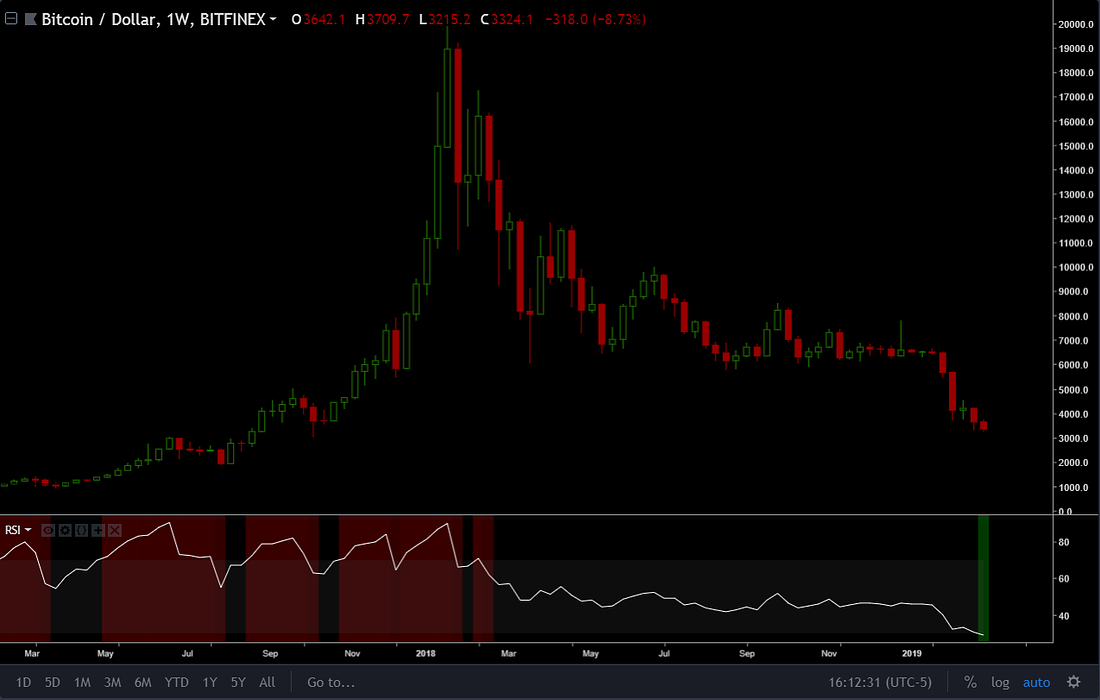

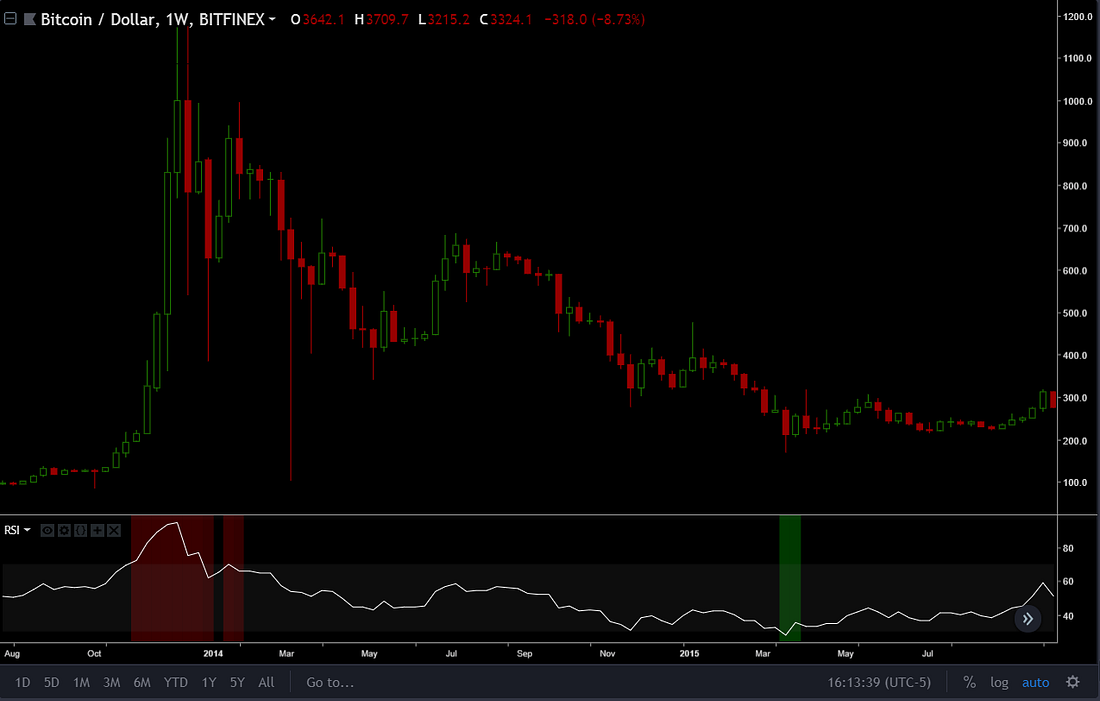

Volume is key in predicting resistance rejections. I believe it's really the core in any form of predictive analysis. So as this approaches I will be watching for severe spike ups from the sellers to determine if the trend can be broken or if my more "reasonable" 5th wave will transpire. There is multiple bull divergences on the daily time frames and higher that have been forming for several weeks. At some point this market will need to allow those to breath. Will it be the bottom? There is nothing on the technicals CONFIRMING a bottom. I would be wary of anyone who says with absolute certainty we have bottomed at any point without providing a technical confirmation. When the market is bullish and out of the bear, you'll know. Bitcoin screams when it needs to establish its dominance, technicals will only offer an exact entry metric. You'll feel the bull without even having to do TA. So I ask... do you feel it? Not at all. Trade safe and let things confirm. You can find Nick on Twitter and on Youtube.Also, if you're a subscriber, feel free to ask Nick questions in the CoinSheet Telegram group.Dmitriy's POVFolks, look at that weekly RSI.

The last time the weekly RSI was that low, the 2014 bear market ended.

Your weekly dose of hopium.

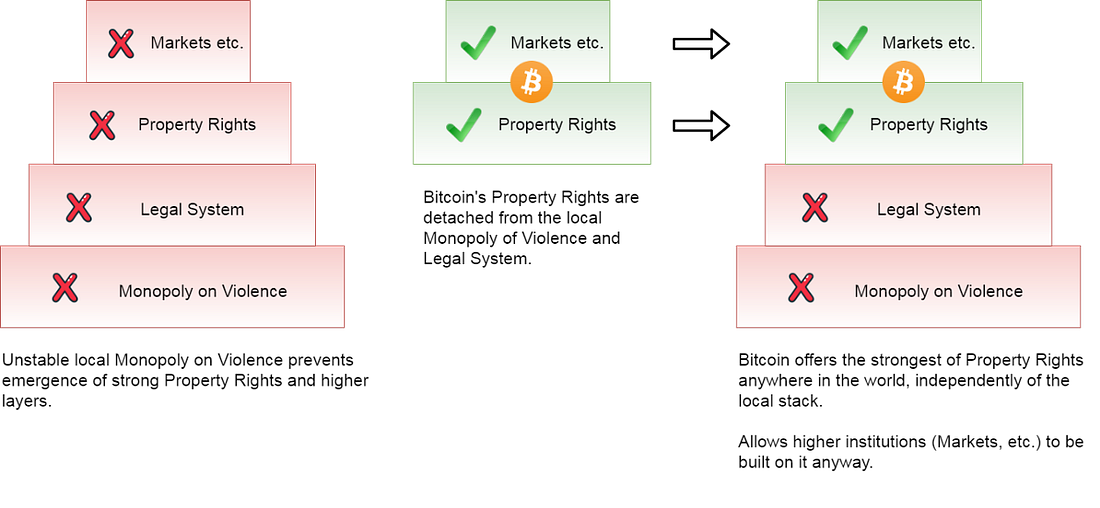

Recommended ReadingsBitcoin and the Promise of Independent Property RightsPart 3 of the Skeptics series.

You can read the article here.

If you think something important happened last week and we missed it, let us know! Continue the discussion in our Telegram group. That's all for now. Have a great week folks! You're on the free list for CoinSheet. For the full experience, become a paying subscriber. © 2018 CoinSheet LLC Unsubscribe A Substack newsletter |