QUOTE OF THE DAY QUOTE OF THE DAY  |

| "Doubt is not a pleasant condition, but certainty is an absurd one." - Voltaire |

Happy 4th of July! Take some time today to enjoy family, friends, and fireworks! And hopefully we will see some fireworks in the market!

Cheers,

Blockchain Brew Team

| COIN | PRICE | 24H |

|

| BTC | $6,752.17 | +2.55% |

|

| ETH | $479.524 | +2.1% |

|

| XRP | $0.500974 | +1.68% |

|

| BCH | $804.663 | +4.09% |

|

| EOS | $9.36462 | +5.12% |

|

*Information as of 9:30 AM EST

Syscoin Fiasco: What Happened?

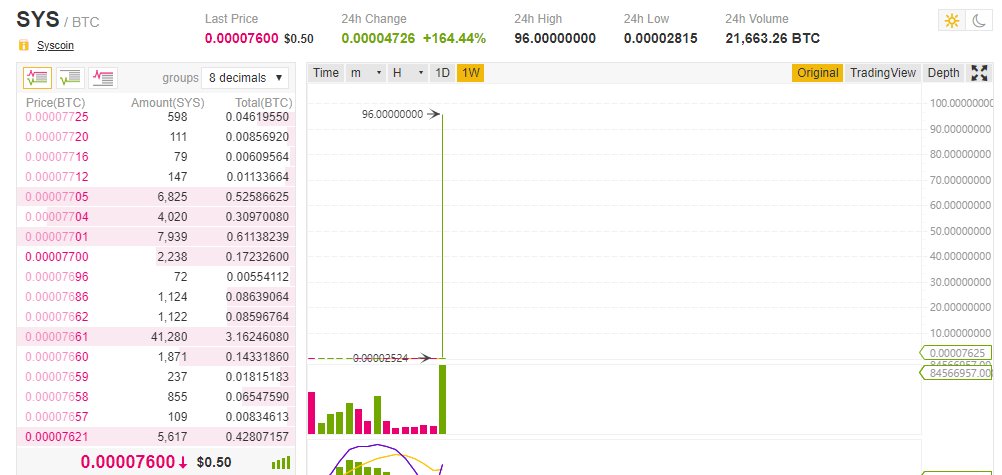

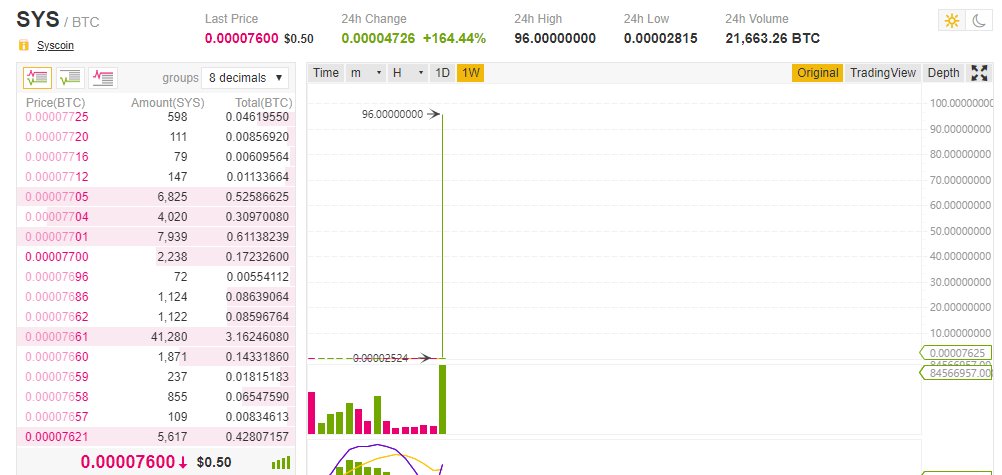

IRREGULAR TRADING

- On Tuesday evening, Syscoin developers announced "odd trading behavior coupled with atypical blockchain activity" on its network, which is a fork of Bitcoin

- The developers asked the exchanges that facilitate the trade of the coin to halt all trades while they figure out the issue

- The issue seems to have stemmed from irregular trading activity on Binance, the daily high for SYS shot up from 0.00004 BTC to 96 BTC

Syscoin co-founder Sebastien DiMichele acknowledged the trading oddity:

"My understanding is that yes, Syscoin was sold for 96 BTC per unit at one point today. We saw massive bot activity, our community let us know that they were having trouble with deposits at Binance."

BINANCE RESPONDS

- Binance took quick actions when the irregular trades were discovered and halted all trades and withdrawals

- The exchange was able to rollback the trades in question and will be discounting trading fees for all users for the next 10 days as a sorry for the temporary down time

- It also announced the establishment of a Secure Asset Fund for Users, 10% of all trading fees will be set aside to reimburse customers in the case that Binance loses any of their funds

- Trading has resumed on Binance and the exchange stated that it will release a more in depth explanation of what occurred soon

ICO Craze is Very Much Still Alive According to Research

100 PER MONTH

- It seemed after the ICO mania and bull market of 2017 and bear market thus far in 2018 that ICO activity would’ve decreased this year relative to last, but in fact actually the opposite is the case

- According to new research from the Big Four auditor, PricewaterCoopers (PwC) there has been 537 ICO’s through June of this year that have raised a total of $13.7 billion

PwC summarized its report by saying:

“[Researchers] highlighted continued growth and popularity of ICOs globally in 2018, with over 537 ICOs conducted in the first five months of this year, raising a combined total of $13.7 billion USD – more than all ICOs which took place before 2018 combined. Going forward this quarterly report on global ICO activity will continue to track the changes and developments in the industry as it undergoes continuous expansion and substantive change.”

- It seems that most of the funds used to invest in these offerings were from Bitcoin and Ether already purchased by investors as the market has suffered throughout this year

- The ICO market works in cycles as investors send BTC and ETH to ICOs who then end up selling the coins to pay for their projects, the coins are bought back by investors to invest in more ICOs

ICOs IMPROVING

- In the market, there is a strong stigma that most ICOs are scams, but this notion is changing

- It is estimated that roughly 50% of ICOs launched last year have already failed, but sign indicate that this number will be significantly less in 2018

A PwC analyst researching the ICO space said:

“After all the hype of 2017, this year has seen the ICO sector becoming more mature and established, with an improved focus on best business and legal practice, investor relations and fundraising. Hybrid models of combined Venture Capital and ICO financing are increasingly bringing together the best of what both have to offer, so that the soundness of a business is validated while it realises its market potential by receiving crowd support.”

India’s Supreme Court Rules Against Reversing Cryptocurrency Ban

BAN

- At the beginning of April, India's central bank restricted banks from providing any banking services to cryptocurrency exchanges

- After the ban was implemented, the country’s cryptocurrency enthusiasts and businesses were outraged and called the ban “arbitrary, unfair, and unconstitutional”

- Petitions were filed and a Right to Information request containing numerous questions about the motives for the ban was sent to the Reserve Bank of India

- As a result of this Right to Information request, the RBI admitted that it did not perform any research into digital currencies before making the decision to ban them

RUMORS OF REVERSAL

- A few weeks ago there was reports coming out of India, that a government panel in charge of cryptocurrencies disagreed with the country’s central bank decision to ban cryptocurrencies

- It seemed that India’s central bank was backing away from claims of jurisdiction over cryptocurrencies

SUPREME COURT REFUSES

- The Supreme Court of India recently congregated to review the Reserve Bank of India’s cryptocurrency ban and ruled against granting temporary stay agains the bank’s restrictions

- This means that banking providers who wish to do business will be “completely choked” by the RBI

- The country’s exchanges remain optimistic as a government committee has been established to propose cryptocurrency regulations for the country

Chandra Garg, the head of that committee, shared:

“We are fairly close to developing a template [for crypto regulations] that we think is in the best interests of the country. We have prepared a draft which we intend to discuss with the committee members in the first week of July.”

- The Supreme Court is planning on revisiting the cryptocurrency case on July 20

Five Major Banks Perform Live Transactions on Using Blockchain Technology

WE.TRADE

- we.trade is a European blockchain trading platform that is built on the IBM Blockchain Platform using Hyperledger Fabric

- The platform announced Tuesday that the first live transactions between 20 companies and 5 major banks have occurred on its platform

- we.trade provides “more efficient and cost effective” platform for banks and companies to trade on

- we.trade currently operates in 11 European countries, but has plans to expand more and is looking for more partners to join the network

BANKS ADOPTING BLOCKCHAIN

- Blockchain was originally invented as opposition against banks and meant to be decentralized, but banks have leveraged the technologies into their processes to increase efficiencies

- Some critics say that blockchain technology will have no benefit for banks and is only meant for decentralized use cases

- However, more and more banks are either beginning to use banking cryptocurrencies or developing their own blockchain platforms

- Xiaomi Denies Authorization of ICO Token That Pegs to Its IPO

- Shapeshift CEO Defeats Peter Schiff in Bitcoin Debate

- Japanese Man Sentenced to Jail for Cryptojacking

Today in Crypto is powered by coinmarketcal.com

| Ethos (ETHOS) |

| Store all of your tokens, coins and digital assets safely and securely on your mobile device. Track assets you have stored somewhere else – such as on a hardware wallet or an exchange. Ethos Universal Wallet gives you a complete view of your entire portfolio in one place, with rich analytics to show how you’re doing. |

| WEBSITE | | REDDIT |

| The above is not intended to be investment advice. |

| 1317 8th Street SE, Minneapolis, MN 55414. |

| If you don't absolutely love us, drop us, click here. |

| Copyright © 2018 Blockchain Brew, All rights reserved. |