September 19, 2018

“When all the experts and forecasters agree, something else is going to happen.”

- Bob Farrell

| COIN | PRICE | 24H |

| | ||

| BTC | $6,314.29068 | -0.62% |

| | ||

| ETH | $206.766187 | -0.94% |

| | ||

| XRP | $0.317677 | +1.02% |

| | ||

| BCH | $424.599918 | -3.38% |

| | ||

| EOS | $5.027157 | -0.38% |

| | ||

*Information as of 9:30 AM EST

New York Attorney General Publishes “Virtual Markets Integrity Initiative Report”

Digging into crypto exchanges

In April of this year, the New York State Office of the Attorney General (OAG) initiated the Virtual Markets Integrity Initiative a fact-finding inquiry into the policies and practices of cryptocurrency exchanges in the United States.

The OAG sent letters of inquiries to thirteen cryptocurrency exchanges seeking details about their trading operations. Exchanges were not required to respond to the OAG’s inquiry, but the OAG hoped that exchanges would see it as a credible way to provide transparency to their customers.

Now, five months after the letters were sent out, the OAG has published a report detailing the findings of the inquiries.

Here's what you should be concerned about

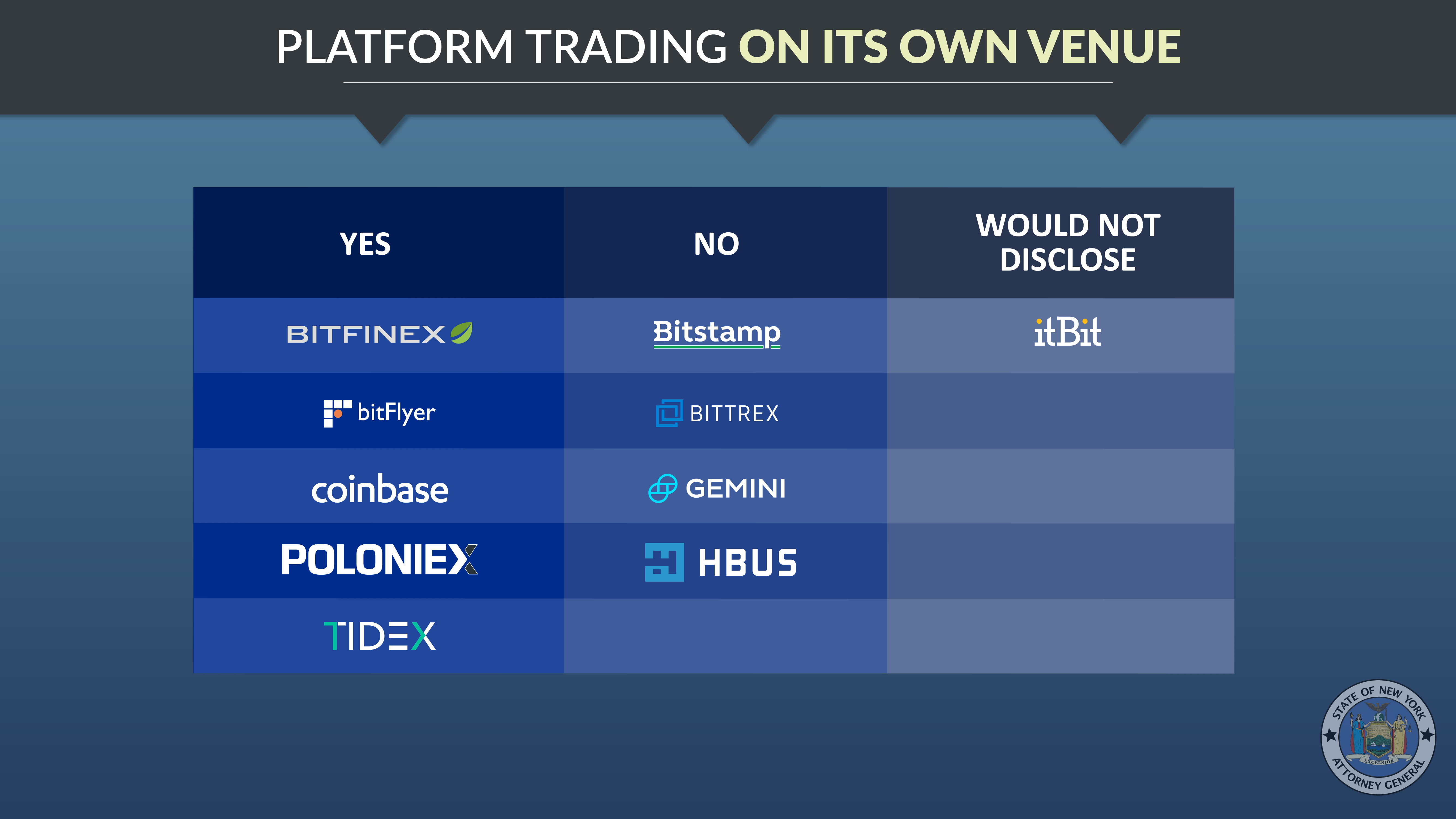

- The various business lines and operational roles of trading platforms create potential conflicts of interest.

Cryptocurrency exchanges and their employees are often involved in trading and investing in digital assets on their own platform. And since internal investors have access to more trading information than their investors, an unfair trading advantage is created.

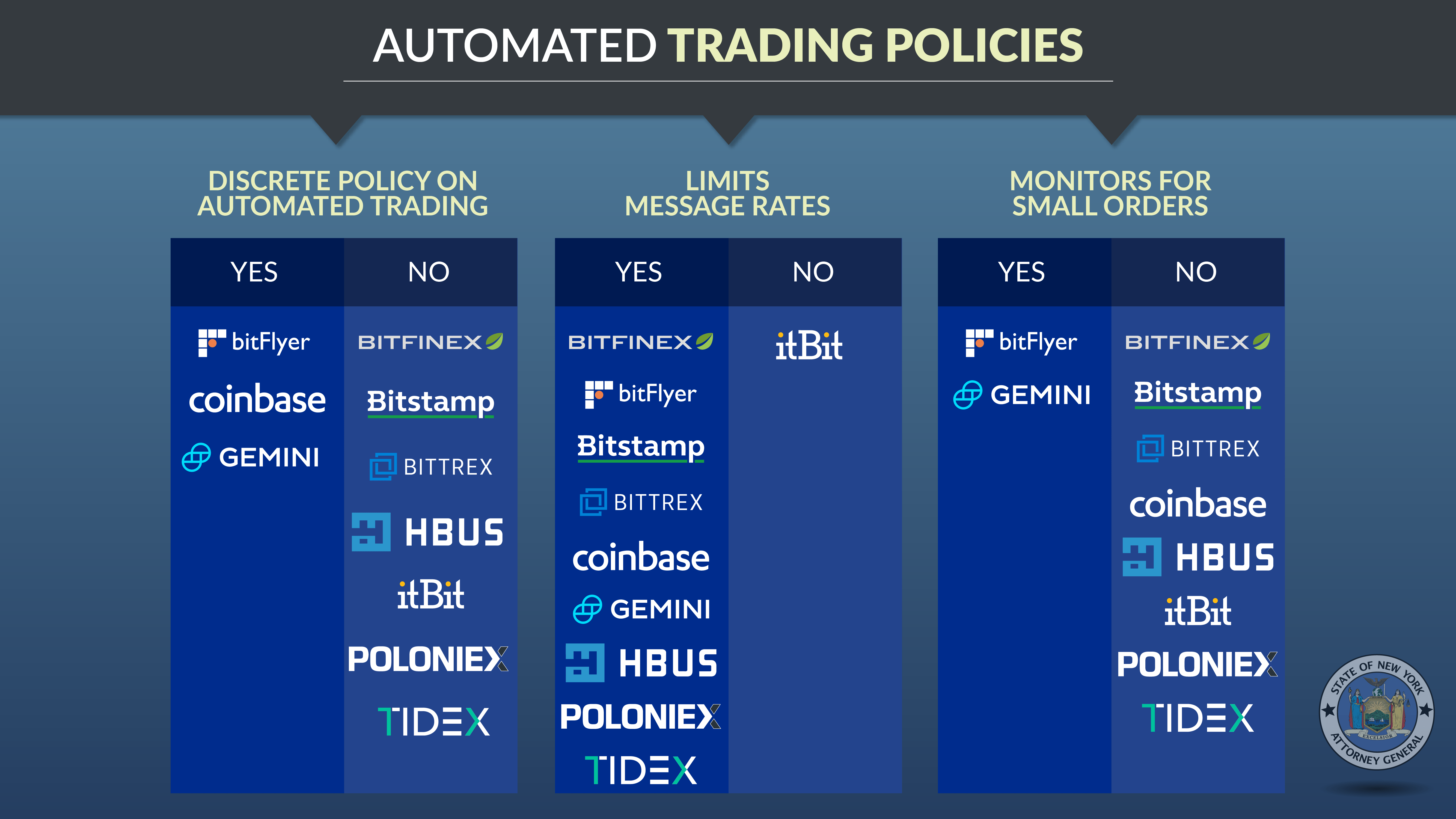

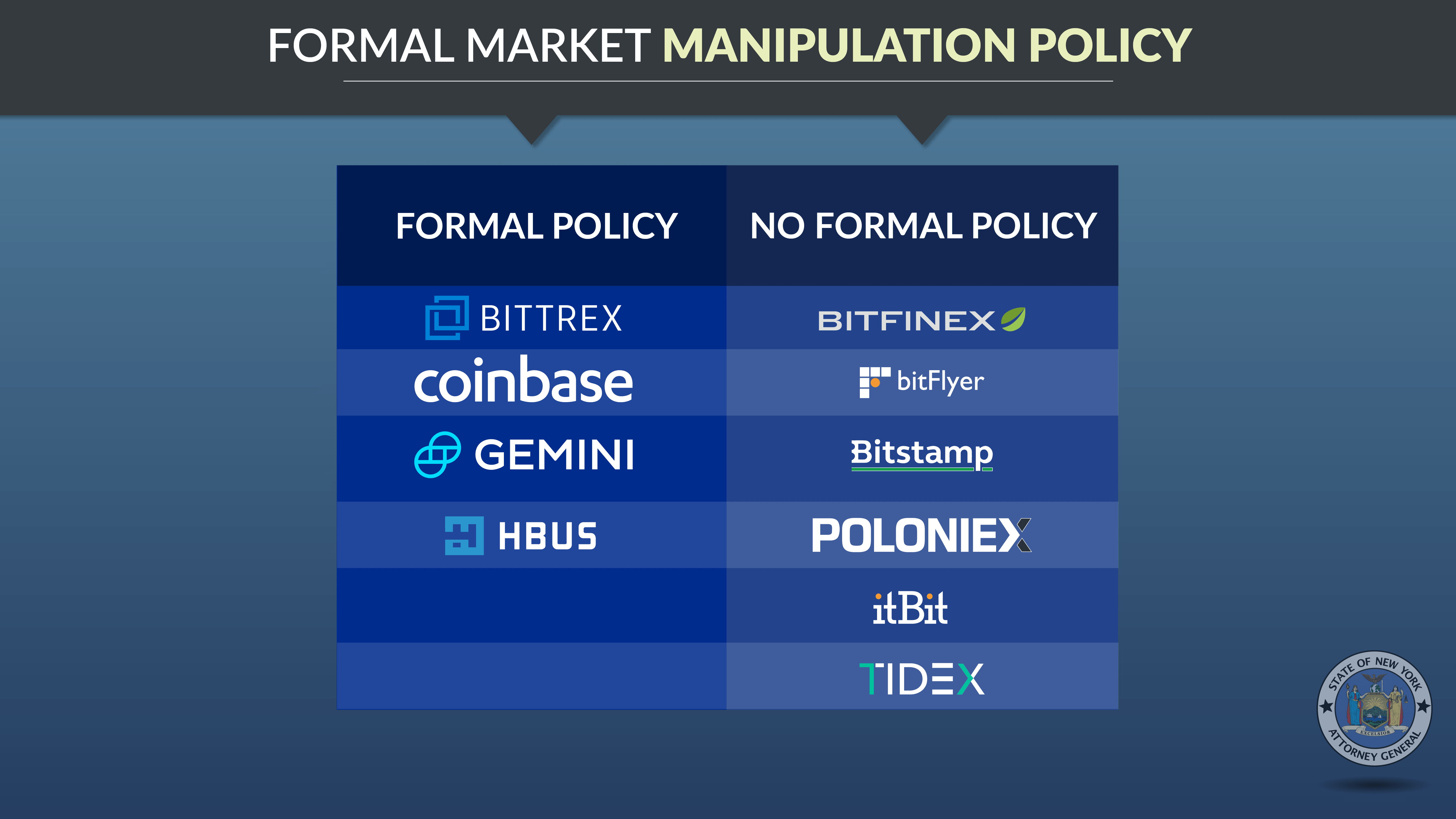

- Trading platforms have yet to implement serious efforts to impede abusive trading activity.

Traditional trading venues monitor suspicious trading activity to prevent the artificial manipulation of prices. However, the OAG found that the crypto exchanges operating in the United States lack robust real-time and historical market surveillance capabilities.

- Protections for customer funds are often limited or illusory.

US crypto exchanges have found to have rarely conducted internal audits on their virtual assets. For this reason, it is always recommended that you keep your crypto off of exchanges and in wallets that you own the private keys to.

Here are some other interesting findings from the survey

You can read the full report here

Fidelity Investments is Looking to Launch Cryptocurrency Products by Year-End

'A few things underway'

Speaking at the Boston Fintech Week conference, Fidelity Investments CEO Abigail Johnson told the crowd the financial firm has "a few things that are partially done" pertaining to cryptocurrency products.

Though no details were given about the pending crypto products, Johnson did explain that the company's cryptocurrency and blockchain use case ideas were mostly scrapped, however, the ideas that survived were not the things Fidelity expected.

As for Fidelity's general direction in cryptocurrencies, Johnson believes her team should think about building the needs of the market before building the technology.

Fidelity is no stranger to crypto

As of now, Fidelity has yet to offer a crypto product to its customers but the financial services firm has outwardly expressed interest in the space by running a blockchain and digital currency incubator to further explore the technologies.

In June, it was rumored that Fidelity was working on a crypto exchange and was also looking to hire a manager for a new crypto fund. So far, neither statement has been officially confirmed by the company.

A digital takeover is unlikely

However, though Fidelity seems to support the emerging technologies, Johnson doesn't believe financial services will see a complete digital takeover any time soon.

Coinbase Hires LinkedIn Executive as New VP of Data

Coinbase continues its aggressive year

The cryptocurrency market may be in a recession, but America’s most prominent cryptocurrency exchange is aggressively expanding its operations.

During 2018, Coinbase has opened new offices, expanded its product line, acquired companies, and poached top talent for its executive team.

It’s obvious Coinbase expects and is preparing for the crypto market to return to the same level of hype we saw in 2017.

Welcome the newest member of the Coinbase team

Previously LinkedIn Head of Analytics and Data Science, Michael Li has now joined Coinbase as their new Vice President of Data.

In addition to his role at LinkedIn, Li has experience integrating data into financial services, e-commerce and social networks.

Li released a statement to announce his arrival to Coinbase:

"I am thrilled by the opportunity to define and evolve the role data can play in a rapidly emerging space, combining an innovative mindset to solve new challenges with learnings from my past experience. Data will be essential to empowering Coinbase's mission, and core to company's strategy to deliver the most trusted and easiest-to-use cryptocurrency products and services. I feel privileged to take on this challenging and rewarding new role to start the next chapter of my career."

Executive team assembling

Adequate talent is critical and Coinbase seems to be leveling up its leadership.

Within the past year alone, Coinbase has hired VP’s of Finance, Communications, Engineering, and Data Science, as well as Chief Financial and Compliance Officers.

Long-Term Investors Stand Strong Despite Bear Market, Research Shows

Long-term believers continue long-term hodling

According to research conducted by Diar, over 55% of all circulating Bitcoins belong to wallet addresses that hold balances of upward 200 Bitcoins.

Perhaps unsurprising due to the hodl mentality, 1/3 of those Bitcoins have never made an outgoing transaction.

Diar concludes this research supports two possibilities:

- Wallet owners have lost their private keys

- Long-term believers show no interest in selling

Adding to the stash

While 1/3 of Bitcoin in whale-sized wallets (200+ Bitcoin) haven't made an outgoing transaction, even during the 2017 price peak at $20,000 BTC, 27% of these wallets actually continue to add to their stash.

This suggests that these wallets are both active and owned by investors who remain bullish on Bitcoin despite bear market sentiment.

- Tim McCourt, managing director of the CME Group, says that bitcoin futures are not to be blamed for the price slump in the crypto market this year.

- A group of U.K. lawmakers called for more oversight and regulation of the cryptocurrency industry in a new report published Wednesday.

- Singapore's de facto central bank issued two warnings about fake news websites that published articles claiming its chairman had invested $1 billion in Bitcoin using state money.

Factom (FCT)

A practical blockchain solution for those seeking a collaborative platform to preserve, ensure and validate digital assets.

| 0 REFERRALS |  |

|---|

https://www.unbankd.co/?ref=192f87b56d

You currently have 0 referrals. All you need is 1 more to receive a FREE Fundamental Analysis Checklist for analyzing crypto projects.

| | | |

|---|

303 5th Ave SE, Minneapolis, MN 55414

The above is not intended to be investment advice.

Copyright © 2018 Unbankd, All rights reserved.

If you don't absolutely love us, drop us.