October 20, 2018

QUOTE OF THE DAY

"The over-all point is that new technology will not necessarily replace old technology, but it will date it. By definition. Eventually, it will replace it. But it's like people who had black-and-white TVs when color came out. They eventually decided whether or not the new technology was worth the investment."

- Steve Jobs

Never miss a beat!

Want to stay on top of the crypto industry? Join our exclusive Telegram channel by clicking the icon below to start receiving the most important crypto alerts.

| COIN | PRICE | 24H |

| | ||

| BTC | $6,493.484596 | +0.63% |

| | ||

| ETH | $205.941003 | +1.28% |

| | ||

| XRP | $0.459723 | +1.65% |

| | ||

| BCH | $443.32313 | +1.76% |

| | ||

| EOS | $5.400179 | +1.32% |

| | ||

*Information as of 10:00 AM EST

North Korean Hacking Group has Stolen More Than Half a Billion Dollars

Stolen crypto traced back to North Korea

According to research done by cybersecurity firm Group-IB, a North Korea hacking group is behind a majority of the crypto exchanges hacks that happened over the last couple of years. The group is known as "Lazarus" and is sponsored by the North Korean government.

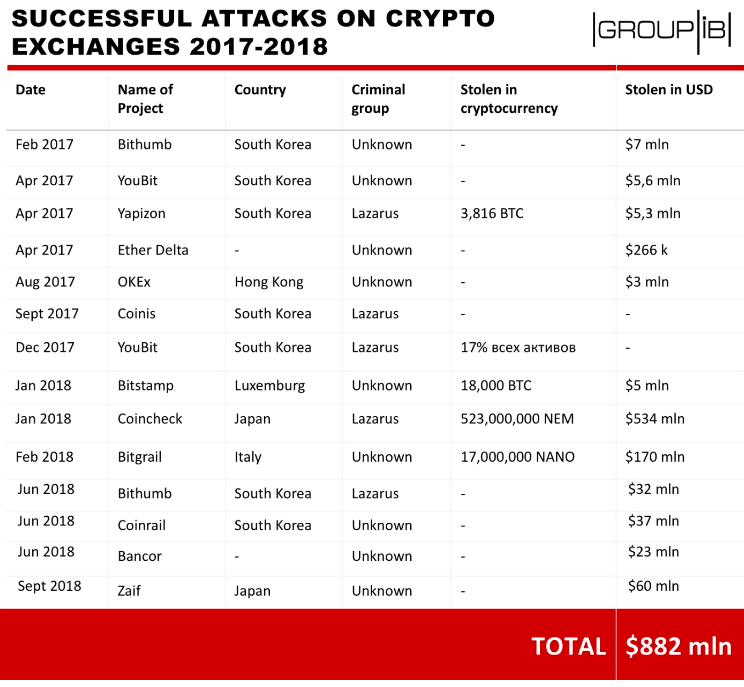

Group-IB's research of exchange hackings found that Lazarus is responsible for five exchange hacks since the beginning of 2017. In total, the group was able to steal a whopping $571 million spread between five different attacks on exchanges.

Below is a table displaying all of the exchange hacks of the last two years, noting the ones done by Lazarus:

Here is how they are doing it

Hackers use many different methods to steal cryptocurrencies from individuals and exchanges. The most popular methods include spear phishing, phishing, social engineering, and malware.

Lazarus's favorite method of attack is spear phishing. This involves sending an email to an exchange with an attachment containing malware. Once someone opens the infected attachment, the malware infects the exchange's network. Then, Lazarus has free will to do whatever they want on the company's network without them knowing... until the funds are gone.

North Korea's interest in crypto

Two financial experts, Lourdes Miranda and Ross Delston, claim that the North Korean government is using cryptocurrencies as a way to evade United States-imposed sanctions.

These two experts know what they are talking about. Miranda is a financial crimes investigator specializing in intelligence collection and Delston is an expert witness specializing in anti-money laundering and combating the financing of terrorism.

It is thought that North Korea is using international exchanges to launder money so that they can exploit international financial institutions. According to sanctions, any financial institution that does business with the United States is not allowed to deal with the North Koreans.

The ICO Class of 2017: An Update From EY

Last year December, Ernst and Young analyzed the top 141 initial coin offerings (ICOs) in the space that accounted for over 87% of the total funding raised in 2017.

One year later, the accounting firm followed up with a new analysis and found that these top ICOs have “[done] little to inspire confidence.”

Fast facts you need to know

- 86% of the ICOs analyzed are now below their listing price

- An investor purchasing a portfolio of these ICOs on January 1st, 2018 would have lost 66% on their investment

- Only 29% of these ICOs have products or prototypes, up just 13% from last year

- The strongest gains in ICOs were concentrated in 10 tokens, most of which were blockchain infrastructure but have yet to reduce Ethereum’s domination in the space

While EY concludes that the ICO Class of 2017 has been a rough one to follow, they do mention that since this investment medium is relatively new, there is not enough data to “form a full perspective on the risk and return.”

A diamond in the rough

Though EY highlighted some pretty negative insights into the ICO market, they also found one figure that sustained growth: developer activity.

Specifically, Ethereum is estimated to now have over 250,000 contributing developers around the world, which is 657% higher than the next competing platform, Neo.

So while investors may have given up HODLing in this bear market as hopes falter, it seems developers have only gotten more excited about BUIDLing.

⏰ Have a minute? We are looking for community testimonials for Unbankd. If you are interested in being showcased on our website, reply to today's newsletter with your testimonial of Unbankd and your name. Thank you all for your support!

2018 Sees “Deal Frenzy” as Merger and Acquisition Activity Surges Over 200%

Headed towards 145

Recently, JMP Securities compiled research for PitchBook that revealed blockchain and crypto-related merger and acquisition deals is projected to hit 145 by the end of 2018.

That is a surge of over 200% from 2017 merger and acquisition activity.

According to Satya Bajpai, head of blockchain at JMP Securities, the recent “crypto winter” has caused the “mispricing of assets.” Put another way, it’s the optimal opportunity for business buyers.

Institutions’ shining moment

While “crypto winter” has sent the market tumbling, institutions may be seeing the decline as a favorable time to join the industry.

Garry Tan, a managing partner at Initialized Capital, commented on the trend earlier this month:

“The crypto winter generally makes it safer for super long-term oriented Yale-model institutions to enter at a price that isn’t dangerous.”

Add on the fact that volatility in the crypto market is hitting yearly lows, the market state could be even more favorable for institutional investors than just the idea of simply buying the dip.

Crypto Mining Hardware Manufacturer Predicts Decrease in Crypto-Related Demand

Bear market hitting miners

Computer chip making behemoth Taiwan Semiconductor Manufacturing Company (TSMC) recently held its Q3 earnings call. On the call, TSMC forecasted weaker crypto mining demand for the fourth quarter.

The company cited the slumping crypto market for why miners are demanding less hardware.

TSMC is the main supplier for Bitmain, who is the largest cryptocurrency mining hardware manufacturer. According to Bitmain's IPO documents, TSMC supplied the company with 60 percent of its total chip supply during 2017 and the first half of this year.

Trump's tariffs also hurting mining industry

Bitmain is far and away the largest mining hardware company. With the company being located in China, it has been impacted by the tariffs imposed on the country by the US government.

Trump's tariffs subject Bitmain's exports to the US to a 27.6% tax. Before the new tariffs were established, there was no tax on the import of Bitmain's products.

But wait, there's more...

- Sia has released the formal code for an imminent hard fork that will block cryptocurrency mining firms like Bitmain from its blockchain network.

- The Government of Gibraltar in collaboration with the University of Gibraltar have created an advisory group focused on the development of blockchain-related educational courses.

- Ethereum's next hard fork, dubbed Constantinople, will be postponed until early 2019, developers confirmed in a meeting Friday.

IOST (IOST)

IOST is a scalable, secure and decentralized blockchain App platform. Its high TPS, scalable and secure infrastructure provide infinite possibilities for developers to create, innovate and build their next big ideas.

| 0 REFERRALS |  |

|---|

https://www.unbankd.co/?ref=192f87b56d

You currently have 0 referrals. All you need is 1 more to receive a FREE Fundamental Analysis Checklist for analyzing crypto projects.

| | | |

|---|

303 5th Ave SE, Minneapolis, MN 55414

The above is not intended to be investment advice.

Copyright © 2018 Unbankd, All rights reserved.

If you don't absolutely love us, drop us.