Weekly BulletinHello folks, You've probably noticed that today is Monday (which means it is not Sunday). Since weekly candles close on Sunday night, I think it makes it more fitting if I try to send out these letters on Monday (especially since most of you are only here for the market sentiment). Let's jump into it. BUT first, some meme news. Craig Wright (not Satoshi), Hodlonaut, and BSV delistingLast week Craig Wright (and friends) offered a $5000 bounty to reveal the identity of Hodlonaut (an anonymous person on Twitter). Mostly because this person said Craig Wright is not Satoshi and is not responsible for creating bitcoin. The crypto twitter community got pissed because Craig Wright's actions were really shitty and it culminated into this tweet from CZ.

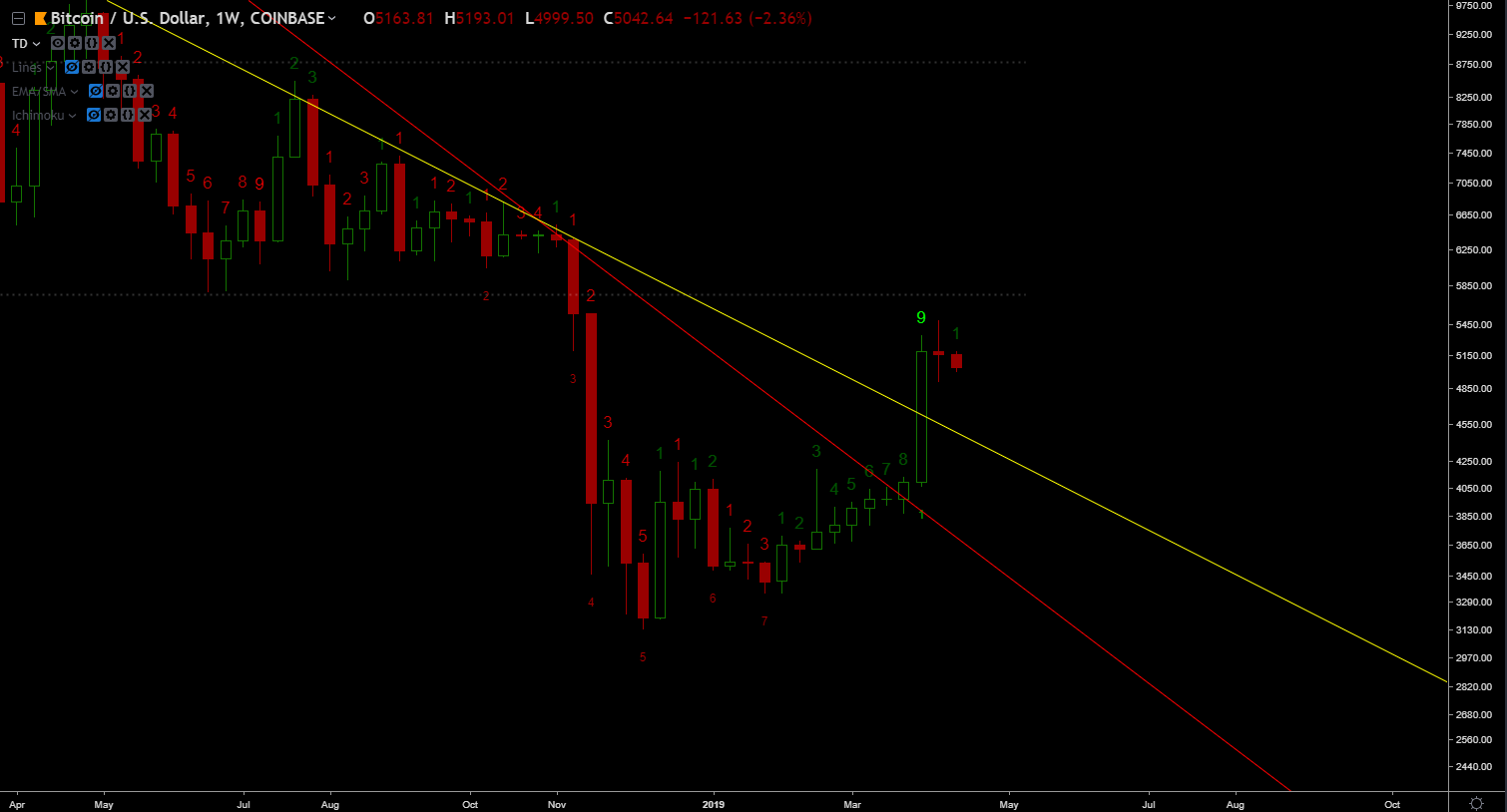

Okay, okay, we're getting somewhere. But he wouldn't just delist a coin from his exchange would he? Well, Craig Wright and friends wouldn't stop suing people, so…. They actually delisted BSV (Bitcoin Satoshi's Vision) from Binance. While is all well and good, and almost tastes like justice, it should remind us all that we're still in the wild west era of cryptocurrency and that the biggest exchange can list or delist any coin they want, whenever they want, for any reason. You should expect more delistings. Harvard investing in shitcoinsHarvard's $37.1 billion endowment fund has reportedly invested $12.65 million in Blockstack. Market SentimentBitcoinBitcoin had a quite bearish weekly close. That weekly doji candle signals that a pullback is possible. If that is the case, our previous trend lines (yellow and red) will act as the strongest support.

Bitcoin (Moving Averages)We didn't yet break, or even effectively test the 50 Weekly SMA. The 50 SMA / 200 SMA crossover is going to be the real test.

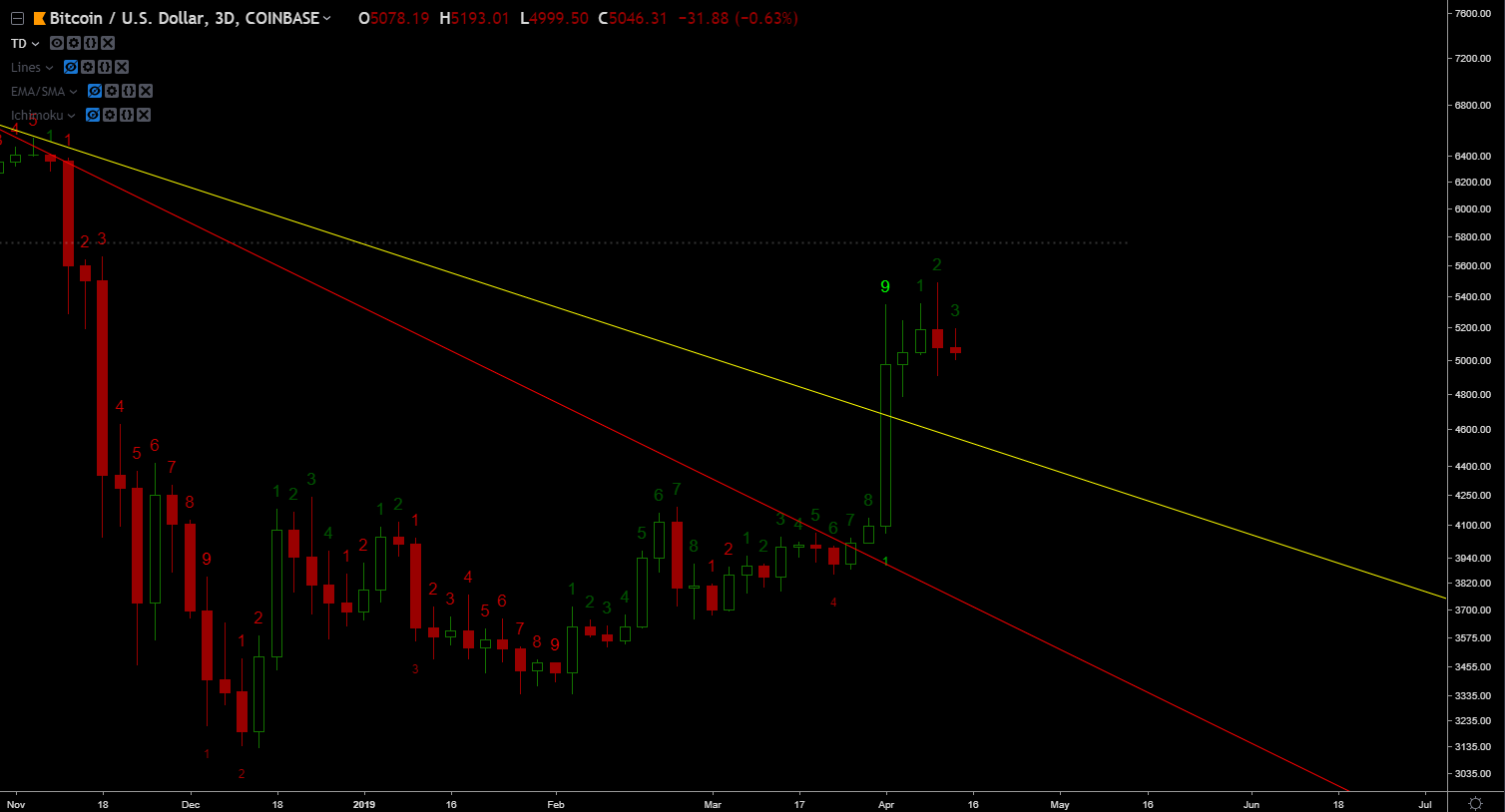

The TDAs I mentioned in the last letter, the weekly and 3-day TD painted a 9, which suggests a pull back (while the monthly TD count was suggesting to us that the bear trend was exhausting). 3 Day

Weekly

Monthly

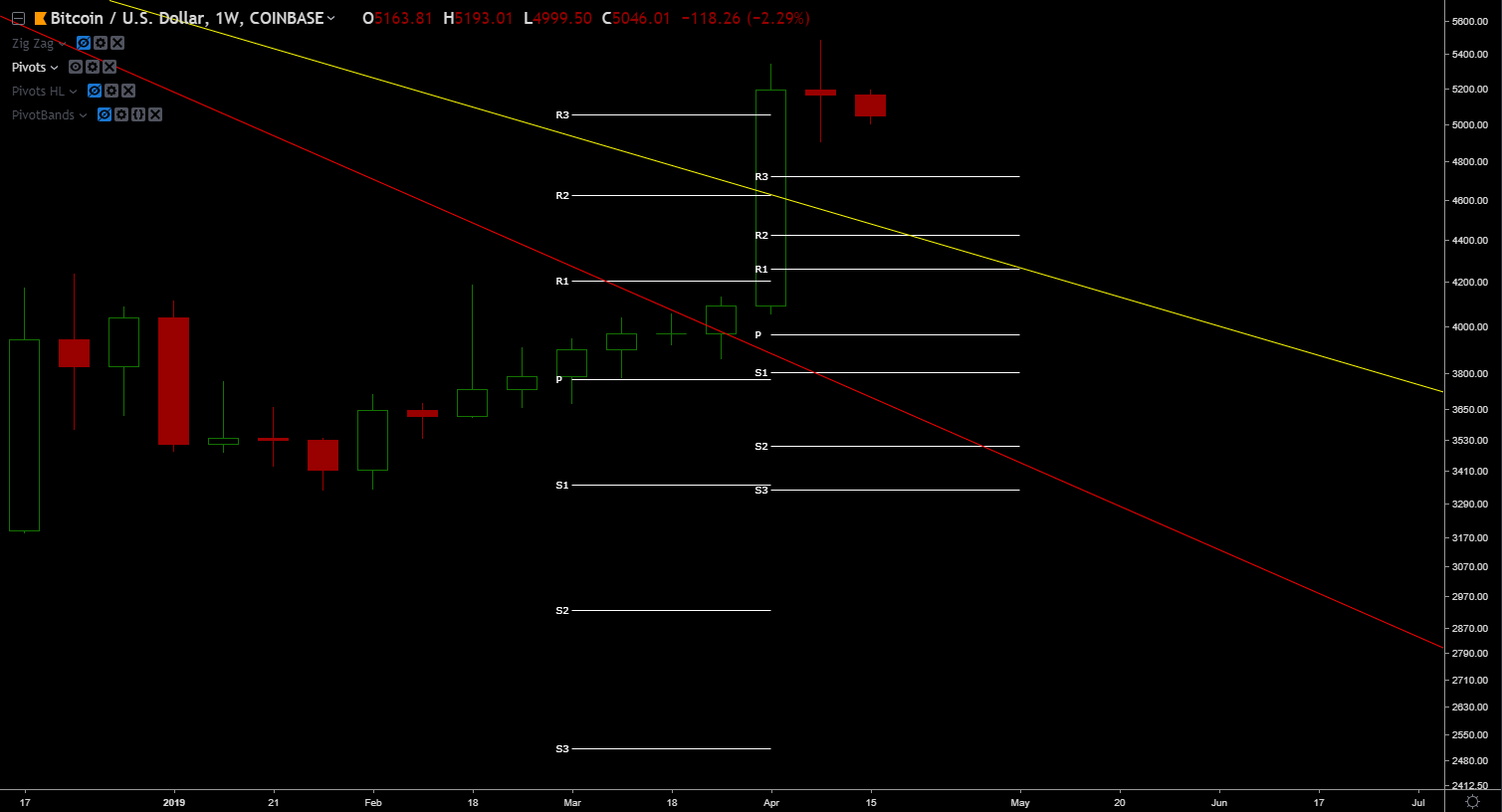

Bitcoin (Support/Resistance Levels)Monthly pivots points are showing that price is over-extended.

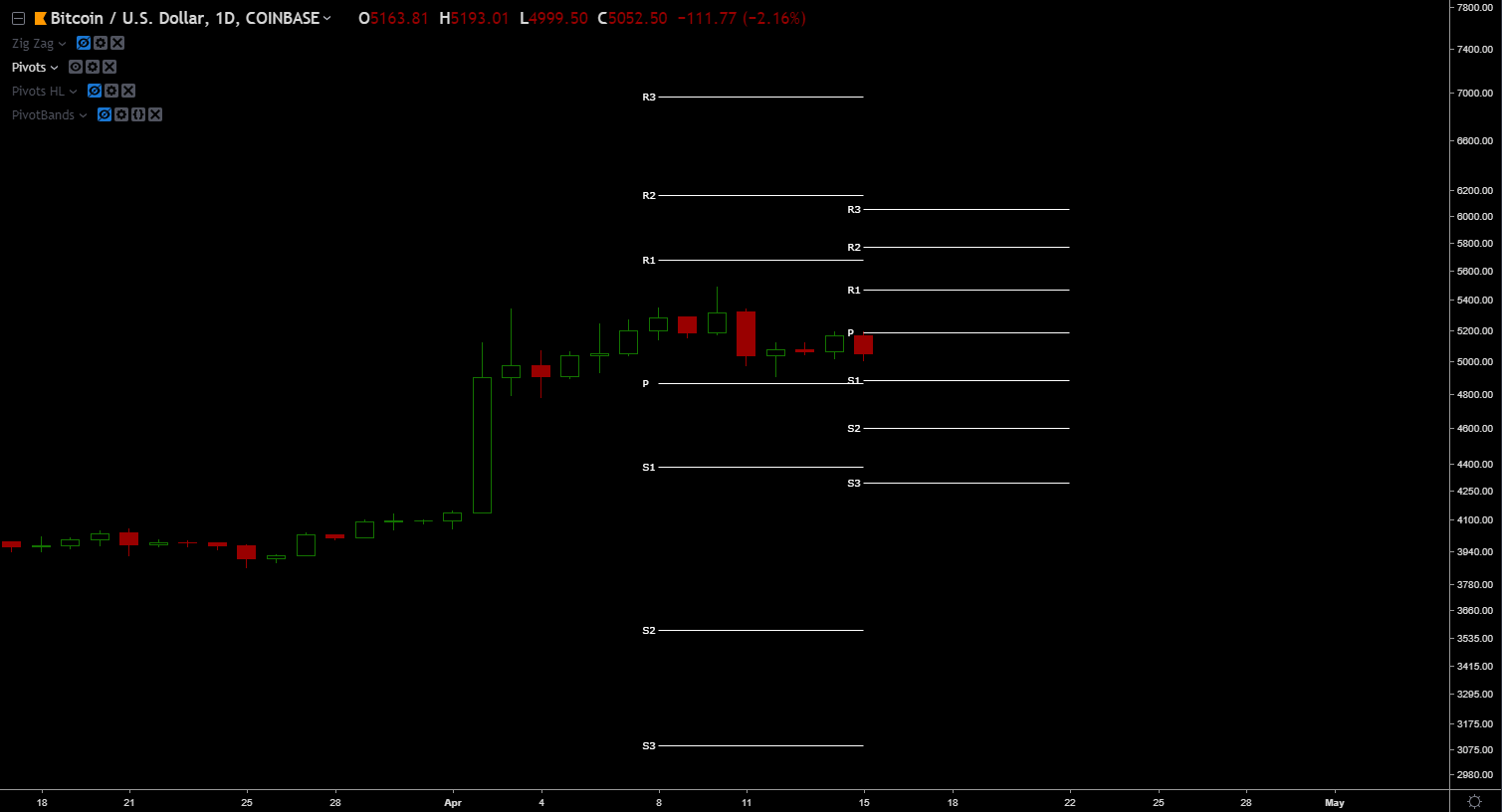

Weekly pivot points are showing that price is neutral.

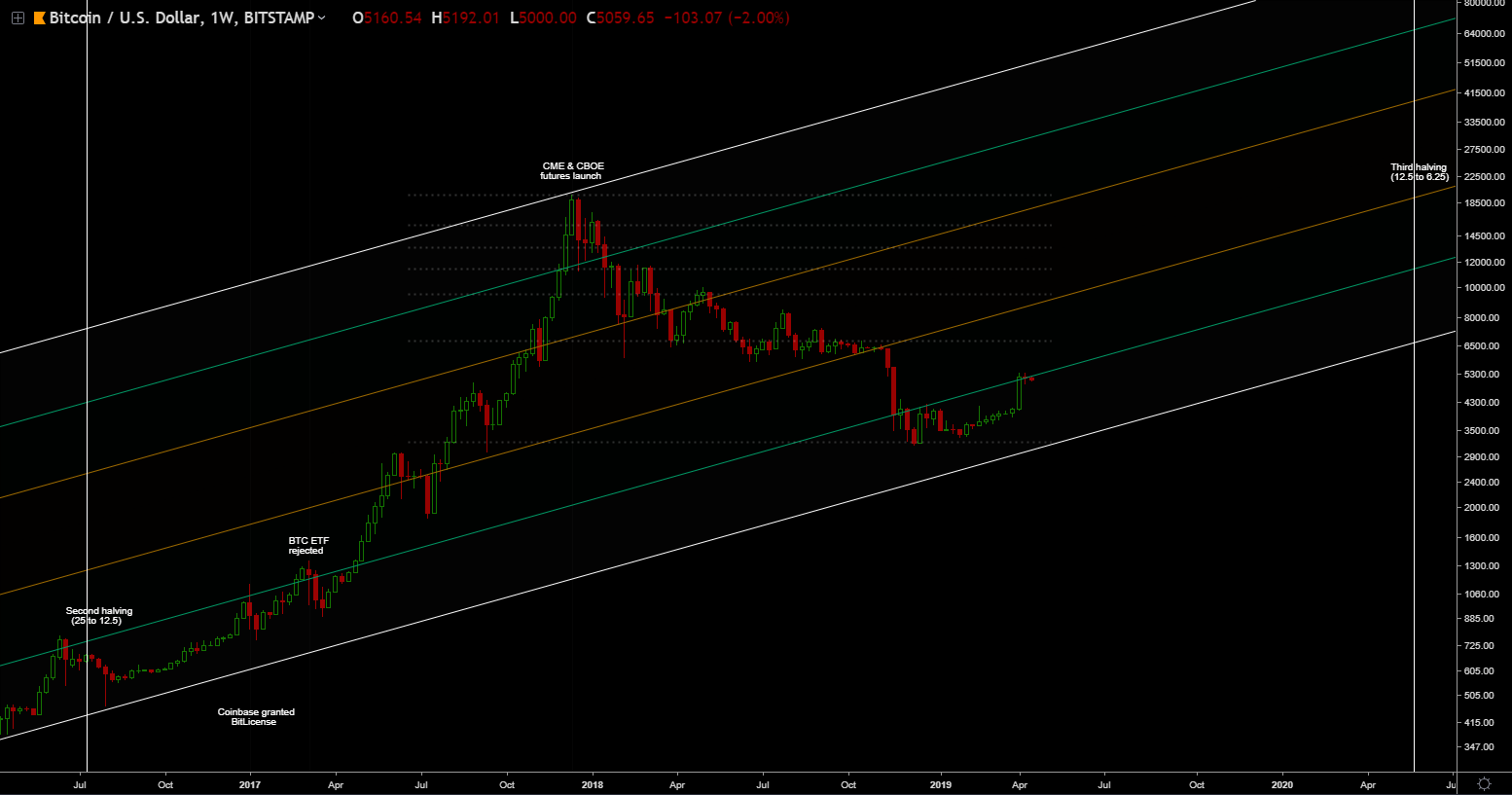

Bitcoin (Macro Overview)We're about ~405 days away from the next halving event. As of April 15, 2019 my confidence level are: A bottom between 1,700 and 2,600 = about 55%.

The endWhat do you folks think? Continue the discussion in our Telegram group. That's all for now. See you later space Cowboy -Dmitriy You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |