| Greetings, Here are the top business stories for the next week: - Consumer Price Index will show the inflation data for February.

- Oracle to report the latest earnings with capex in focus.

- Jabil, an alternative AI stock, to report its latest earnings.

Thanks for reading! Stjepan

p/stjepan-kalinic | |

| 1 | | The U.S. Bureau of Labor Statistics will release the Consumer Price Index data on Tuesday, March 12. Investors anticipate a 0.4% rise in the CPI for February, with the annual rate estimated at 3.1%. More: - In January, the CPI increased by 3.1%, exceeding the Federal Reserve's 2.0% target, signaling persistent inflationary pressures.

- Core CPI, excluding volatile food and energy prices, is expected to rise by 0.3% monthly and 3.7% annually in February.

- High inflation rates have led to tentative expectations for rate cuts, with investors closely monitoring Federal Reserve Chair Jerome Powell's stance on monetary policy.

- Goldman Sachs believes most major central banks will execute the first rate cut in June.

Why it matters? The upcoming CPI report is important in determining the Federal Reserve's stance on monetary policy. Despite potential concerns about inflation, the Fed aims to strike a balance by avoiding premature rate cuts that could adversely affect the progress made in curbing inflation rates. Investors will scrutinize the CPI data to gauge the timing and extent of potential monetary policy adjustments, which could impact financial markets and cause heightened short-term volatility. |     | |

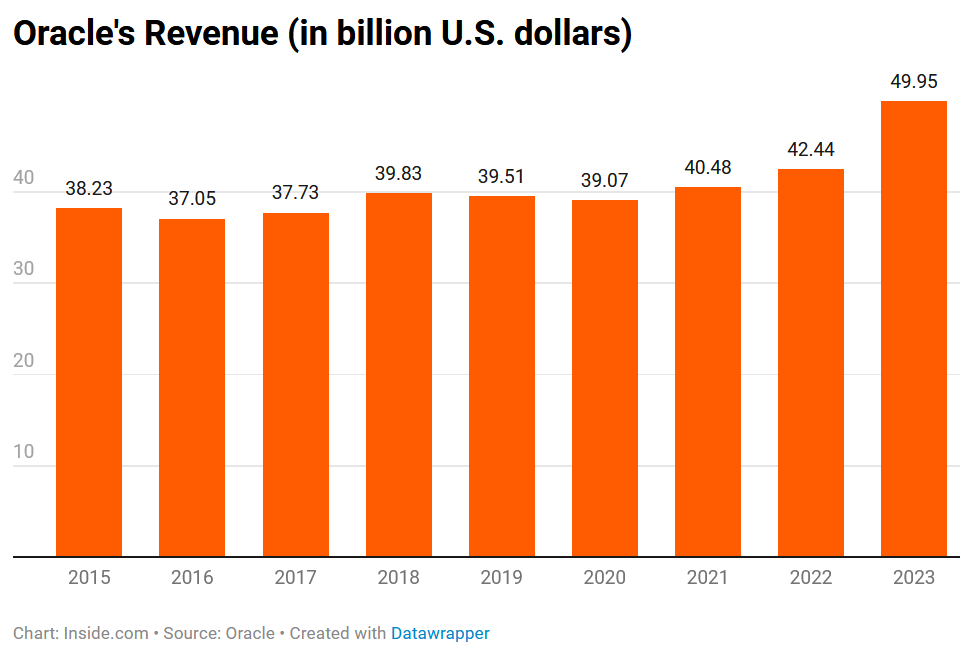

| 2 | | Oracle will release its fiscal third-quarter 2024 earnings on Monday, March 11, with analysts anticipating growth in both revenue and earnings. Key focus areas include Oracle's cloud segment, where concerns about slowing growth persist, and insights into its data center expansion project to meet the rising demand for artificial intelligence (AI).

More: - Analysts expect Oracle's Q3 revenue to reach $13.28B, reflecting an increase from the previous quarter and the same period a year ago.

- Net income is projected to rise to $2.74B, compared to $1.9B in the fiscal third quarter of 2023, with diluted earnings per share estimated at $1.37.

- Cloud growth is a crucial metric, and analysts anticipate revenue for Oracle's cloud segment to be $5.06B, a 23% YoY increase, following a slowdown in the previous quarter.

- Oracle's data center expansion, which involves expanding existing centers and building new ones, aims to meet the growing demand for Cloud Infrastructure and Generative AI services. Investors will be keen to understand how this expansion affects operating margins.

- The company's capital expenditures (CapEx) will be closely watched, especially concerning its AI push. Analysts note the need for a significant CapEx ramp to support cloud and AI growth in the coming quarters.

|     | |

| 3 | | Jabil is set to announce its quarterly earnings before the market opens on Friday, March 15. In its previous quarterly report, Jabil surpassed expectations with earnings of $2.60 per share and revenue of $8.39B, although revenue was down 13.0% YoY. More: - Analysts anticipate Jabil will post earnings of $1.86 per share for the current quarter, a slight decrease from last year.

- The consensus estimate for the current fiscal year suggests a 5.3% YoY increase in earnings to $9.09 per share, while for the next fiscal year, the estimate indicates a further 17.8% growth to $10.71 per share.

- Jabil's stock performance shows a 1-year low of $74.16 and a high of $155.97, with a market cap of $19.71B and a P/E ratio of 26.37. The stock has a relatively high 1.41 Beta, which is notably more volatile than the market on average.

- Research analysts have offered varying opinions on Jabil's stock, with price targets ranging from $141.00 to $161.00 and the consensus rating being "Buy."

- Investment bank JPMorgan has highlighted Jabil as one of the alternative AI stocks in the computer hardware and networking space, alongside Flex and Lumentum.

|     | |

| 4 | | The U.K. GDP month-over-month data is set to be released on Wednesday, March 13, with the forecasted growth of 0.2% following a negative 0.1% in January. Despite economic challenges, the British pound has outperformed over 90% of global currencies in 2024, reflecting growing confidence in the resilience of the U.K. economy and expectations of prolonged higher interest rates. More: - The British pound has surpassed more than 90% of global currencies in 2024, signaling confidence in the U.K. economy's resilience compared to its peers.

- Analysts attribute the sterling's strength to expectations of prolonged higher interest rates, driven by signs of economic recovery and better-than-expected performance.

- Market sentiment suggests the Bank of England is likely to maintain interest rates at current levels for longer than other major central banks, such as the U.S. Federal Reserve and the European Central Bank.

- The U.K. GDP growth forecast for 2024 is estimated at 0.7%, with further growth expected in 2025, indicating cautious optimism about the country's economic trajectory.

- Despite challenges including rising inflation and consumer pressure, encouraging signs in key indicators like job market performance and service prices provide hope for sustained progress and economic stability.

|     | |

| 5 | | Adobe is set to report its first-quarter 2024 earnings on March 14. Despite recent setbacks from the termination of a $20B deal to acquire Figma, Adobe is well-positioned in the creative software field, having demonstrated consistent growth in subscriber numbers and successful implementation of AI across its product portfolio. More: - Analysts anticipate a 15.3% YoY increase in quarterly earnings to $4.38 per share, with revenues expected to reach $5.13B, marking a 10.2% growth.

- The company's management aims to maintain operating margins above 45%, benefiting from streamlined R&D and marketing expenses and increased investments in AI-focused technological innovation.

- In the previous quarter, Adobe reported record-high revenues of $5.05B, a 12% increase, with the Digital Media and Digital Experience segments expanding by double digits.

- Adobe's shares have more than doubled in the past 18 months, experiencing recent weakness following the cancellation of the Figma Inc. acquisition. However, the company remains a dominant force in the creative software industry.

- Adobe has a track record of consistently meeting or beating earnings estimates for over a decade, and this trend is expected to continue in the upcoming report, reflecting the company's resilience and strength in the digital software market.

|     | |

| 6 | | The Canadian housing starts data will be released on Friday, March 15, with a forecast of 227,000 following the previous month's 224,000. Analysts express concerns over the effectiveness of government stimulus measures in encouraging homebuilding, noting that targets set by policymakers are unrealistic and not aligned with market conditions. More: - Despite a slight slowdown in new home starts, the pace of construction remains brisk, with the seasonally adjusted annual rate falling 10% to 224,000 units in January.

- Builders are responding to market conditions rather than policymakers' targets, leading to a disconnect between government objectives and actual industry performance.

- Expectations for Bank of Canada rate cuts are mixed, with some economists suggesting a potential delay in rate cuts until the fall, citing concerns about the impact of stimulative government budgets and a hot spring housing market.

- Analysts warn against premature rate cuts, fearing such actions could exacerbate inflationary pressures and undermine the central bank's credibility.

|     | |

| 7 | | Quick hits: - Attention busy professionals & feline owners: Meowtel has the largest elite network of insured cat sitters who tailor to your cat's every need.*

- Asana will announce its latest earnings on March 11. Analysts expect the software company to narrow its losses, with a consensus EPS forecast of -$0.1.

- Deutsche Bank Media, Internet & Telecom Conference kicks off on Monday, March 11 in Palm Beach, Florida. Notable participating companies include AT&T, eBay, fuboTV, Fox Corporation, and Warner Music.

- The next triple-witching day will occur on March 15. It is one of four days each year when stock options, stock index futures, and stock index options all expire on the same day. Short-term speculators will be on the lookout for unusually heavy volume and volatility.

- Everyone wants to move fast. But you need a strong DevOps foundation to accelerate your AWS workloads & release pipelines. Jump-start DevOps with DoiT.*

*This is a sponsored listing. |     | |

| Upcoming Events | * This is a sponsored event | | | |

| Freelance Writer | | Stjepan Kalinic is an analyst and writer with a background in institutional investment research. He's passionate about reading, playing music, lifting weights, and practicing martial sports. He values interesting books above everything else, and you can send recommendations through LinkedIn. | | This newsletter was edited by Megan LaBruna | |

| |

| |