| |

| Greetings, Here's your most anticipated business news for next week: - The FED will announce its latest interest rate decision, and four other notable central banks will also post their monetary policy votes.

- Reddit will make its much-anticipated IPO debut.

- Nike will post its latest earnings.

Thanks for reading! Stjepan

p/stjepan-kalinic | |

| 1 | | The Federal Reserve will hold a second meeting in 2024 and issue the latest decision about its monetary policy on Wednesday, March 20, at 2 p.m. ET. The consensus expectation is that rates will remain at 5.5%, with the first rate cut anticipated for June. More: - The Federal Open Market Committee (FOMC) held rates steady during its last three meetings, with the latest hike coming in July 2024.

- The current hiking cycle has been the most aggressive since the 1980s, with 11 rate increases over 15 months. Still, interest rates are less than half of what they were in that era.

- In congressional testimony on March 6, Chairman Powell stated that the policy rate is likely at its peak for this tightening cycle. Still, the market's expectations of six rate cuts in 2024 were optimistic.

- The Fed's primary goal is to achieve a soft landing for the U.S. economy while preserving employment and maintaining price stability.

Zoom Out: - Bank of Japan will announce its policy rate on Tuesday, March 19, with speculations that it might end its negative rate interest policy due to substantial wage hikes by big firms.

- Reserve Bank of Australia will also announce its interest rate on March 19. Despite a slight recent rise in inflation, analysts expect the central bank to maintain the rate at 4.35%.

- Swiss National Bank will announce its latest policy rate on Thursday, March 21. The consensus expectation is to maintain the rate at 1.75%, as inflation easing less than anticipated, diminished the expectation of a rate cut.

- The Bank of England will also announce the latest official bank rate on March 21. The market expects the rate to remain at a 16-year high of 5.25%, with the first cut not happening before Q3.

|     | |

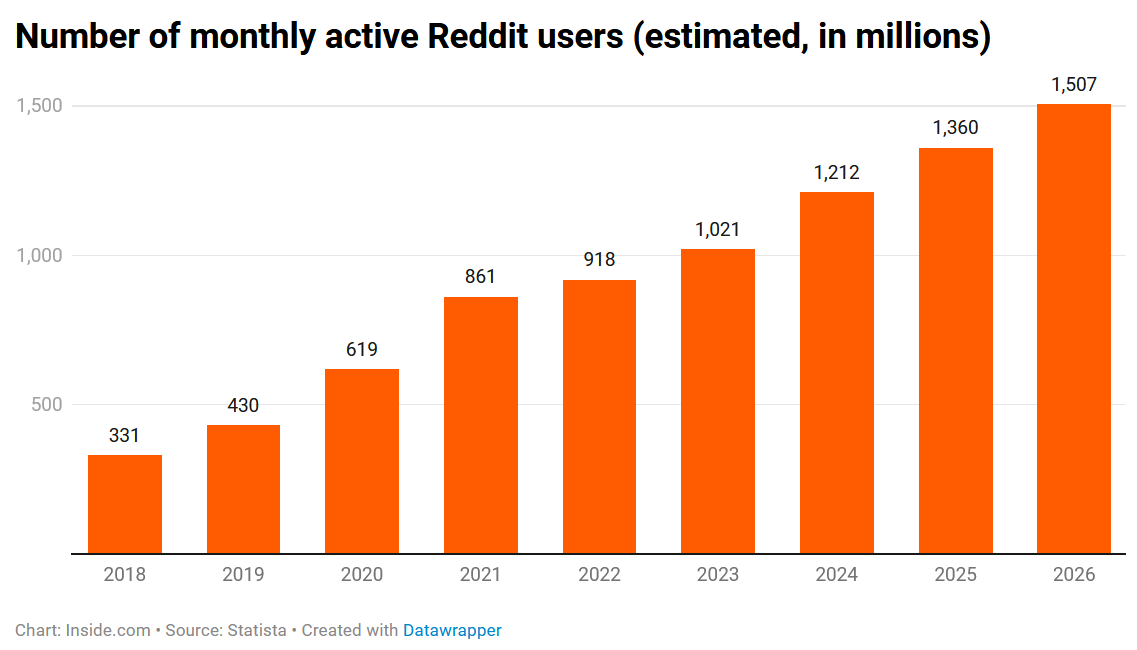

| 2 | | Reddit's highly anticipated IPO is scheduled for Wednesday, March 20, while trading will commence the following day. Details have emerged about the number of shares available, pricing, and potential revenue.

More: - Reddit plans to offer 22 million shares of its Class A common stock to the public, with 15,276,527 shares directly from the company and the rest from existing stockholders.

- The anticipated price range for Reddit's Class A common stock is between $31 and $34 per share, with expectations that the company will raise around $473M to $520M. Still, the anticipated valuation of around $6.4B is down from $10B indicated in 2021.

- A portion of shares (8%) is reserved for users, moderators, friends, family of board members, and employees, prioritized through a tier system based on their contributions to Reddit.

- Reddit's growth strategy involves expanding its user base, enhancing engagement, and improving monetization, particularly through contextual advertising similar to Pinterest's model.

- The company sees potential in leveraging its data for AI model training and licensing. CEO Sam Altman of OpenAI is a major investor and board member, indicating a strategic alignment in AI development.

|     | |

| A message from our sponsor, Chargeflow. |  | | You're Invited To Our Exclusive Virtual Event: Shaping the Future of DTC in E-commerce in 2024! Mark your calendars for March 27, 2024, and reserve your spot at the forefront of eCommerce innovation. 'Shaping the Future of DTC in 2024' is a pivotal virtual roundtable event, gathering the brightest minds in the industry, including CEOs from top DTC brands and leading eCommerce technology solutions. Deep dive into discussions on emerging trends, cutting-edge technologies, and evolving consumer behaviors that are shaping the future of online DTC eCommerce. Enjoy an interactive format with live Q&A sessions, gain actionable insights, and access exclusive resources to propel your business forward. Plus, don't miss the chance to win amazing prizes, including the Apple Vision Pro. Empower your DTC journey—RSVP for free today! RSVP Your Spot Today

| |

|

| 3 | | Nike will report its latest earnings on Thursday, March 21, 2024. Analysts expect a year-over-year decline due to lower revenues, but they see positive catalysts in 2024. More: - Analysts anticipate Nike (NKE) to post quarterly earnings of $0.70 per share, representing an 11.4% decrease compared to the previous year, with revenues expected to be $12.29B, down 0.8% from the year-ago quarter.

- RBC Capital has trimmed Nike's price target by 8% to $110 but maintains an Outperform rating, citing the company's structural competitive advantages and broad lifestyle franchise. They highlighted Nike's strong execution, gross margin tailwinds, and robust marketing capabilities supporting its defensive positioning in the sporting goods market.

- RBC forecasts earnings of $0.72 per share on $12.17B in revenue for the third quarter, with expected profit and EBIT margins broadly in line with Nike's expectations. They anticipate strong sales in China, flat to negative revenue growth in North America and EMEA, a 12% decline in Converse sales, and modest growth in direct-to-consumer (DTC) sales.

- Guggenheim added Nike as the Best Idea for 2024, considering the recent share price pullback as a compelling entry point with a favorable risk/reward ratio. Analysts anticipate impactful product launches driving top-line growth in the second half of 2024 and into 2025, with the 2024 Summer Olympics providing a global platform for Nike and Jordan Brands. Guggenheim maintains a Buy rating on the stock with a $130 price target, reflecting a 31% potential upside from Friday's closing price.

|     | |

| 4 | | Canadian National Statistical Office will post the February CPI Data on Tuesday, March 19, with an expectation to show a rise in headline and core inflation, primarily driven by increased energy inflation. Despite this development, a soft economic backdrop suggests that inflationary pressures in Canada may continue to ease, potentially leading to the Bank of Canada's first rate cut in June. More: - Expectations for Canada's February CPI indicate a year-over-year increase to 3.1% for both headline and core inflation, with higher energy prices, particularly gasoline, contributing to this uptick.

- The rise in Canadian yields, particularly in the five-year bond, suggests market concerns regarding the forthcoming CPI report, with expectations of a 0.6% month-over-month increase in headline inflation, pushing it back above 3%.

- Analysts note that while the headline CPI figure may appear high, there's roughly 0.3 percentage points of seasonality loaded into the data, which might moderate the underlying inflationary pressure.

- The anticipated rise in headline and core CPI poses a communication challenge for the Bank of Canada, as it will be the last CPI release before the April 10 rate decision. It may serve as evidence for the Bank's message of patience regarding rate cuts, but could also complicate discussions around potential cuts expected in June.

|     | |

| A message from our sponsor, Scrut Automation. |  | | Navigating compliance for ISO 27001, SOC 2, HIPAA, or GDPR? Scrut's smartGRC platform is your ally in establishing trust and accelerating growth. Our platform empowers you to: - Seamlessly track multiple frameworks and centralize control evidence.

- Automate evidence collection across 70+ integrations

- Manage infosec risks and reduce compliance efforts in one interface.

- Achieve continuous compliance with minimal manual intervention.

Special offer: Secure a $1000 discount on your first-year subscription for Inside.com users. Elevate your compliance stature with smartGRC and join industry leaders in efficient, reliable compliance management. Schedule A Demo | |

|

| 5 | | FedEx will announce its latest earnings on Thursday, March 21, after the market close. Despite efforts to recover from a slowdown in demand after a pandemic-driven surge, the company faces ongoing pressure, with investors closely monitoring its restructuring efforts and financial performance. More: - FedEx is expected to report third-quarter revenue of $22.02B, with analysts projecting net income of $879.5M and diluted earnings per share (EPS) of $3.50. However, executives recently forecasted a low-single-digit percentage decline in revenues for fiscal 2024, indicating continued strain on the company's top line.

- Key metrics to watch include average daily volume (ADV) and revenue trends, with FedEx experiencing nine consecutive quarters of year-over-year declines in ADV of FedEx Express packages handled in the U.S. The company has been adjusting to a slowdown in revenue following the pandemic boom.

- FedEx's restructuring plan, announced in April 2023, aims to cut about $4B in costs by 2025 and consolidate operating segments under Federal Express Corporation. Investors will seek updates on the progress of this initiative and its potential long-term impacts, including a reduction in the company's global headcount by approximately 25,000 employees.

- The company's management has focused on enhancing operational efficiency while also investing in advanced technology to become a data-driven, digital-first organization. However, the cargo industry's increasing competitiveness poses challenges, with Amazon building its own logistic network and smaller players expanding through innovation and advanced technology.

- In the second quarter, FedEx's earnings fell short of expectations despite adjusted profit increasing by 25% year-over-year. Revenues decreased, primarily due to a drop in revenues from the core Express division, while the Ground segment registered modest revenue growth. Investors will be closely monitoring FedEx's financial performance amid ongoing market challenges and its efforts to navigate a changing industry landscape.

|     | |

| 6 | | Micron Technology will release its second-quarter earnings for fiscal year 2024 on Wednesday, March 20, after the market close. Analysts expect revenue growth driven by dynamic random access memory (DRAM) and further insights into the company's involvement in producing chips for Nvidia's artificial intelligence graphic processing units (GPUs). More: - Analysts anticipate Micron's second-quarter revenue to reach $5.33B, up from the previous quarter and the same period in 2023. The projected loss is $275.81M or 26 cents per share, narrowing from the previous year.

- DRAM revenue growth remains a key focus, with expectations of an increase in this segment following industry trends. Micron captured 19.2% of the DRAM market share in the fourth quarter of 2023 and is projected to benefit from a nearly 20% increase in DRAM contract prices.

- Wedbush analysts forecast DRAM revenue for the second quarter to be $3.9B, supporting the overall revenue growth. Given that nearly three-quarters of Micron's revenue in the first quarter of 2024 came from DRAM, increased revenue in this segment could help narrow the company's losses.

- Micron's involvement in producing high-bandwidth memory (HBM) chips for Nvidia's AI GPUs is expected to be a significant focus. The company's mass production of the 24-gigabyte 8H HBM3E chips for Nvidia, with shipments starting in the second quarter, could lead to substantial revenue growth, as Micron CEO Sanjay Mehrotra indicated.

|     | |

| 7 | | Quick Hits: - Sign up for real-time, easy-to-understand business credit alerts and get the insights you need to help you reach your business goals.*

- Nvidia's annual GPU Technology Conference (GTC) will commence today, and CEO Jensen Huang's keynote address will happen on Monday, March 18. Analysts anticipate updates on new products, partnerships, and Nvidia's sovereign artificial intelligence (AI) initiatives, including details about the highly anticipated B100 chip, which is expected to be Nvidia's most capable AI GPU yet.

- CERAWeek Houston, also known as the "Super Bowl of energy," will kick off on March 18 in Houston, Texas. One of the largest energy conferences in the world will host numerous keynote speakers, including the Secretary of Energy Jennifer Granholm, Exxon Mobil's CEO Darren Woods, Microsoft's co-founder Bill Gates, and Occidental Petroleum's CEO Vicki Hollub.

- The European Council summit will be held on March 21 and 22 in Brussels, Belgium. European leaders will discuss key regional issues, assess the economic situation, exchange views on policy coordination, and discuss the EU enlargement policy.

- Business Owners who took Visa or Mastercard from Jan. 1, 2004, to Jan. 25, 2019, apply to see if you are entitled to a portion of a groundbreaking $5B settlement. *

*This is a sponsored listing. |     | |

| Upcoming Events | | MAR

27 | | Join DTC industry leaders and CEOs at the pivotal virtual roundtable event 'Shaping the Future of DTC in 2024.' | | | | | | | SEP

1 | | Join the $1M prize AI Challenge: Unleash your creativity and push AI Agents beyond today's limits - | | | | | | * This is a sponsored event | | | |

| Freelance Writer | | Stjepan Kalinic is an analyst and writer with a background in institutional investment research. He's passionate about reading, playing music, lifting weights, and practicing martial sports. He values interesting books above everything else, and you can send recommendations through LinkedIn. | | This newsletter was edited by Megan LaBruna | |

| |

| |

|

|  Over 1000+ customers and 700+ 5-star G2 reviews testify to why Scrut Automation is the preferred choice for simplifying Compliance and Risk Management. | |

|

| |