QUOTE OF THE DAY QUOTE OF THE DAY  |

| "When dealing with people, let us remember we are not dealing with creatures of logic. We are dealing with creatures of emotion, creatures bristling with prejudices and motivated by pride and vanity." - Daniel Carnegie |

Happy Tuesday! We are thankful for all of our daily readers. If you love the Brew, share us! Just click the 'Invite Friends' button above and forward us to your favorite people.

Cheers,

Blockchain Brew Team

| COIN | PRICE | 24H |

|

| BTC | $6,216.21 | +0.44% |

|

| ETH | $450.374 | -2.45% |

|

| XRP | $0.477562 | -0.79% |

|

| BCH | $744.48 | -1.04% |

|

| EOS | $8.08667 | -0.58% |

|

*Information as of 9:30 AM EST

Bitmain Hash Rate Nearing Important 51% Mark

BITMAIN

- Bitmain is a privately owned Chinese company, founded in 2013 by Jihan Wu and Micree Zahn

- The company is one of the worlds largest Bitcoin miners and manufacturers of ASIC Bitcoin mining chips

- It also operates AntPool and BTC.com, which have been historically two of the largest mining pools in the mining industry

- Earlier this month, Jihan Wu indicated that the company is considering an IPO to raise additional capital

NEARING 51%

- Bitmain now accounts for more than 40% of the Bitcoin network’s hash rate, a concerning statistic for those who care about Bitcoin remaining decentralized

- Its two mining pools, AntPool and BTC.com account for 16.5% and 25.5% of Bitcoin mining market share, respectively

- If Bitmain were to achieve 51% of the network, it would enable them to perform a 51% attack, allowing them control over the network

- Already this year, some small altcoins have fallen victim to a 51% attack, including: Litecoin Cash, Bitcoin Gold, Verge, and Monacoin

- If Bitmain were to achieve 51% of the network, it would enable them to perform a 51% attack, allowing them control over the network

- However, because of the way it was designed, there is less financial incentive to perform a 51% attack on Bitcoin

- Nonetheless, Bitmain’s CEO Jihan Wu is an avid supporter of BCash and may have a motivation to attack Bitcoin

PREVIOUS 51% CONTROL

- If Bitmain were to achieve 51% control of Bitcoin’s network, it would not be the first occurrence

- In 2014, the mining pool Ghash passed the 51% mark, but with the desire to keep Bitcoin decentralized, advised a portion of its users to move to another pool

- Bitmain hasn’t shown any interest in doing something similar to what Ghash did, instead they are ramping up promotions and still trying to acquire new customers

SOLUTION IN THE WORKS

- Singular control over the network is a major concern for Bitcoin developers and one in particular, Matt Corallo, has taken the initiative to develop a solution

- Corallo has developed what he calls “BetterHash”, a draft proposal designed to make Bitcoin mining more decentralized

- He suggests replacing the current mining protocol, with two new protocols that would allow individual miners to create their own block templates, eliminating the need for mining pools

Circle Attracted 30% More Institutional Investors in May, Despite Bitcoin Fall

CIRCLE TRADE

- Circle, the Goldman Sachs-backed U.S. crypto exchange allegedly saw a 30% increase in institutional investors on its platform in May

- Along with its retail investor offerings, Circle also offers Circle Trade, a product that caters to large traders due to its ability to trade bigger block orders

- Since the same time last year, Circle Trade's volume has spiked over 1500%, despite the recent Bitcoin slide

NEW ERA

- On Monday, Circle CEO Jeremy Allaire explained that traditionally, hedge funds used a telephone broker to make deals

- This is largely not the case anymore, however, up until recently, Circle had utilized employees in the U.S., Hong Kong, and London to authorize and complete trades

- Now, these processes are being automated to streamline trades as high as $1 million for the customer

- In addition, Circle is implementing application programming interfaces (API) so hedge funds can automate orders and settlements

Allaire explained to CNBC Circle's strategy to mature crypto investing:

"Major institutional investors don't go through telephone broker, they go through an electronic interface. We're maturing this into a more traditional product; it's much faster and a more flexible way to trade."

LOOKING FORWARD

- Currently, over $2 billion is traded on Circle's platform each month with a minimum order size of $250,000 as the exchange hopes to grow immensely

- Also, last month, Circle raised $110 million in a fundraising round that was led by crypto mining giant Bitmain

- It is clear Circle is positioning itself as a unique player in the institutional investor space in crypto and will continue to if regulations are favorable

FTC Warning: Consumers Will Lose $3 Billion by the End of 2018 to Crypto Scams

GROWING FRAUD

- Speaking during an event focused on cryptocurrency scams, Federal Trade Commission official Andrew Smith stated that investors lost $532 million to crypto scams in just the first two months of 2018

- Smith then went on to state that this number could very well end higher than $3 billion by the end of 2018

- Crypto fraud is one of the fastest growing crimes right now as investors crave the higher returns that were seen in the 2017 rise of cryptocurrencies

PROACTIVE REGULATION

- To be most effective, regulators will have to be both proactive but welcoming of crypto

- Since this is a new industry, regulators are still unsure of how to treat the new digital assets

- However, regulators are finding ways to investigate and stop seemingly legitimate projects that are actually exit scams or ponzi schemes

Joe Rotunda, an official for the Texas State Securities Board, shared his thoughts on a process to identify fraudulent projects:

"Regulators need to number one, identify companies that are trying to do it right and work with [them]. The companies that are trying to do it right [should] get a telephone call from the regulator, not a cease-and-desist order, right? Not a lawsuit. We can usually work with them ... [and] we need to identify the fraudulent schemes and we need to act quickly and stop them."

INVESTOR RESPONSIBILITY

- Though many regulators are looking to step in and cut down on crypto fraud, it is ultimately the investor's responsibility to do their due diligence and avoid shady projects

Tether Prints $250 Million New Tokens: What it Means

$250 MILLION USDT

- Tether prints new USDT tokens in batches when people deposit US dollars, the printing of new Tether is esentially a new deposit into crypto

- On Monday, Tether printed $250 million in new tokens causing cryptocurrency investors to gain hope that this bear market could turn around

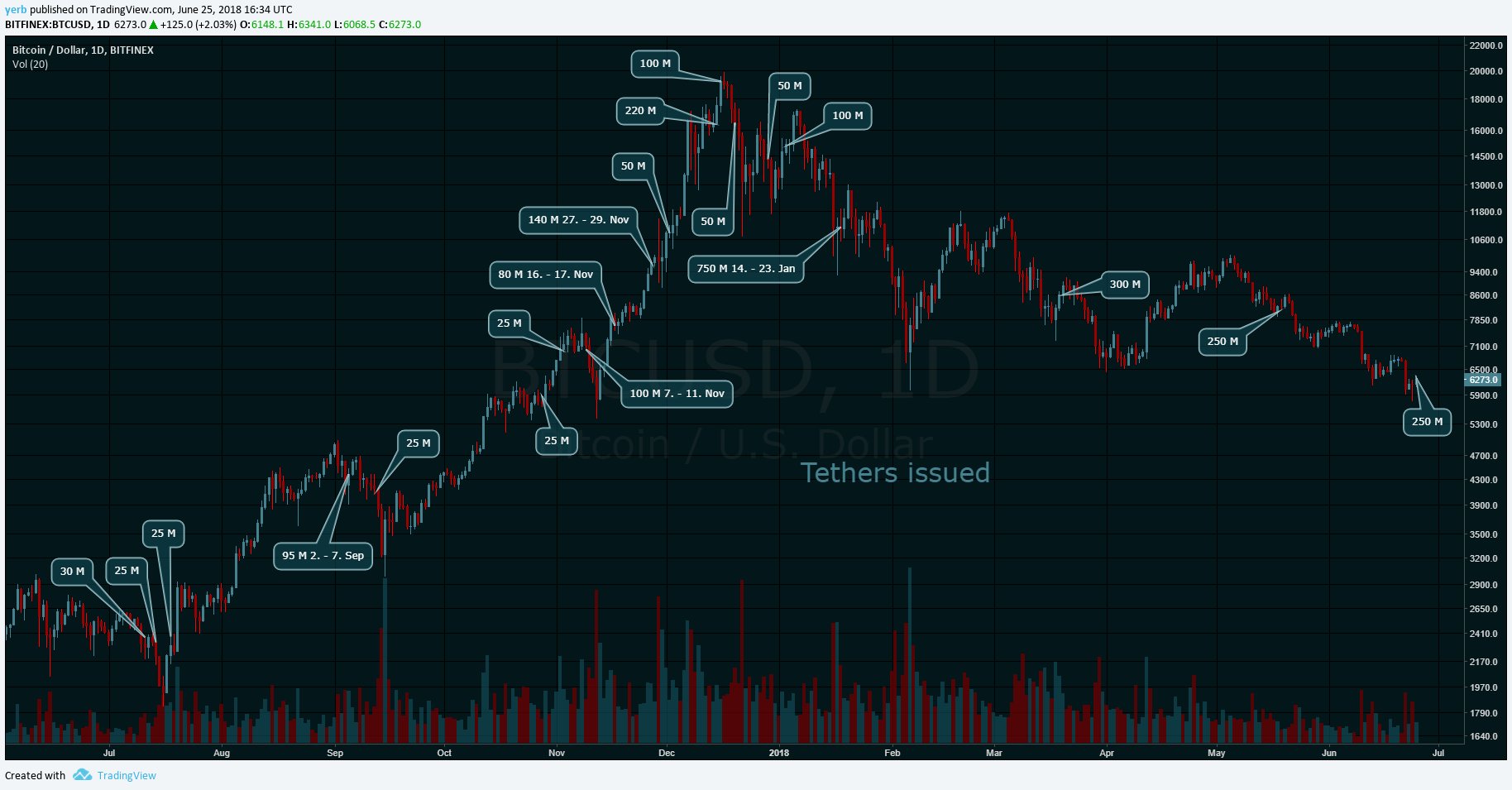

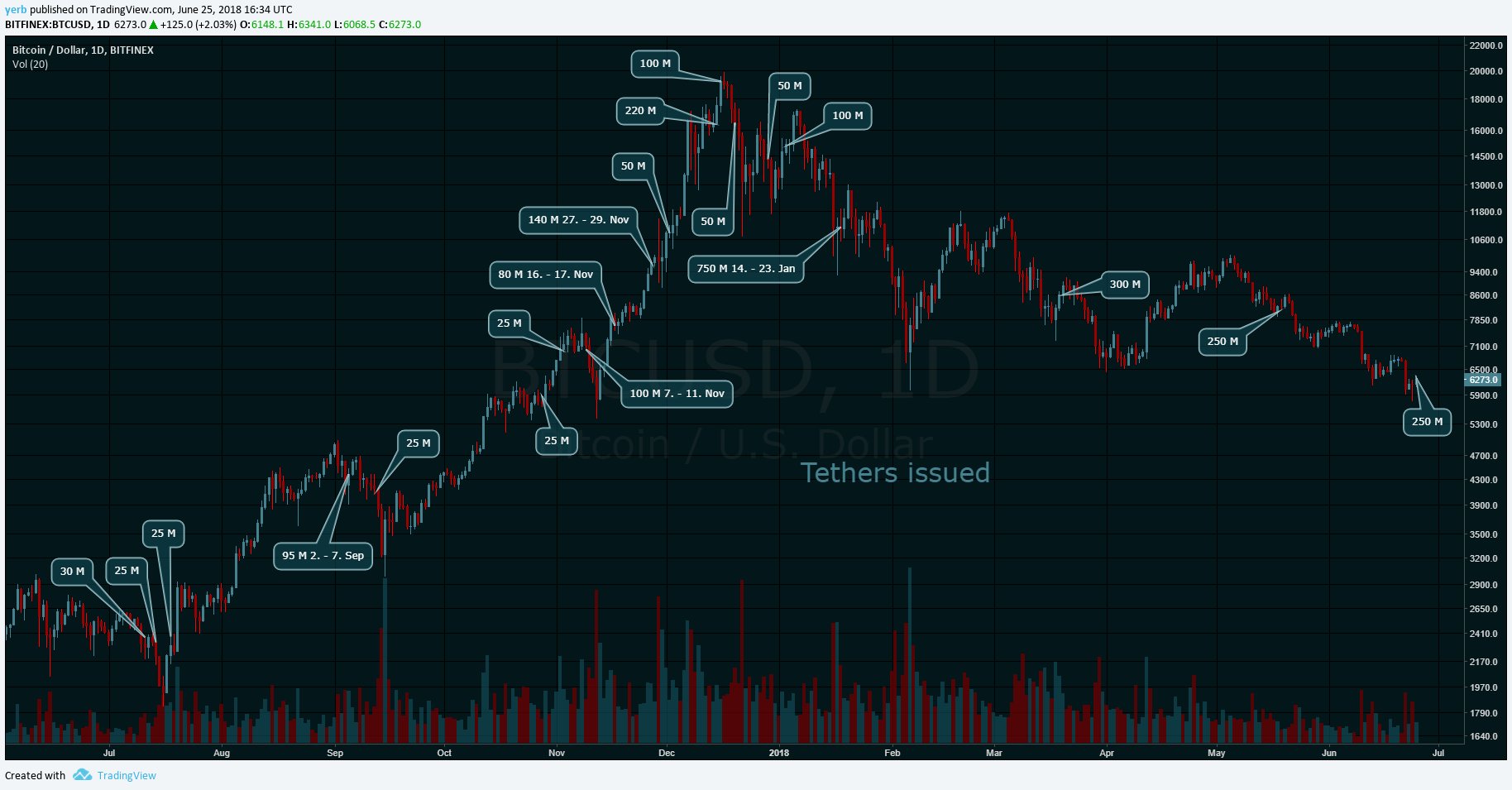

- People have always speculated that the printing of new Tether signals an impending pump in prices, however there seems to be no correlation, as shown in the graph below which marks new Tether issuances on the Bitcoin chart

Credit to Yerb on TradingView for the chart

- A New Business Model Is Shaking Up the Crypto Exchange Rankings

- Ukrainian Authorities Are Not Planning to Regulate Crypto Mining

- Binance Extends System Maintenance, Postpones Trading And Withdrawals Due To A Risk Warning

TRON (TRX)

Super representatives for the Tron mainnet will be elected by the community.

Zcash (ZEC)

"focused entirely on making itself and future network upgrades safer for users, even in the case of governance contention"

aelf (ELF)

Blockchain Connect Conference in Silicon Valley, June 26-27, 2018 at the San Jose Convention Center.

Lisk (LSK)

Lisk Amsterdam Meetup on June 26.

Centrality (CENNZ)

Japan Blockchain Conference from June 26 - 27, 2018 in Tokyo.

Ardor (ARDR)

Jelurida (Ardor) will be attending Trade Expo along with Google, Samsung, Microsoft, Visa and Novartis.

Ardor (ARDR)

NXT and ARDR spot trading begins.

Zcash (ZEC)

Coindelta will support the Network Upgrade for Zcash dated to 26th June 2018.

Today in Crypto is powered by coinmarketcal.com

| Cortex (CTXC) |

| Cortex's main mission is to provide the state-of-the-art machine-learning models on the blockchain in which users can infer using smart contracts on the Cortex blockchain. One of Cortex's goals also includes implementing a machine-learning platform that allows users to post tasks on the platform, submit AI DApps (Artificial Intelligence Decentralized Applications). |

| WEBSITE | | REDDIT |

| The above is not intended to be investment advice. |

| 1317 8th Street SE, Minneapolis, MN 55414. |

| If you don't absolutely love us, drop us, click here. |

| Copyright © 2018 Blockchain Brew, All rights reserved. |