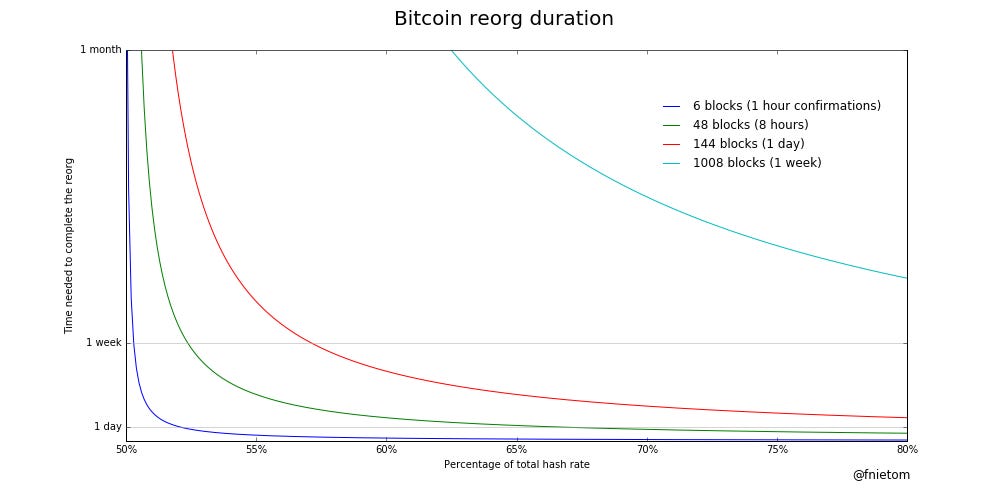

Weekly BulletinHello folks, Unfortunately, as soon as I mentioned Game of Thrones, it started getting wayy less excellent. sigh* Anyways, few bit of news to cover then we'll jump into the markets. Let's go. Binance hack & talk of re-orgBinance was hacked and hackers were able to withdraw 7,000 BTC. Exchanges are bound to get hacked and Binance is well enough off that it will use its SAFU fund to cover this incident in full so user funds will be affected. No big deal. The more interesting thing is some of the conversation in the aftermath. Specifically, this. What CZ is referring too is a forced bitcoin chain rollback, a 51% attack (where a party acquires a majority of the network hash rate) . This is how it would work in theory: The problem with this is that while it sounds good on paper, it's largely unfeasible. Even if CZ was to offer miners all 7,000 BTC that were compromised, it would probably not be a financially interesting roll back for the miners. Here are some relevant excepts from a stack exchange discussion.

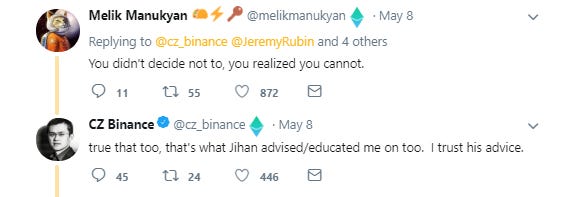

Besides folks, it would damage the whole bitcoin immutability meme and we can't have that can we? Good thing CZ actually came to the same conclusion, good lol from him actually being called out below.

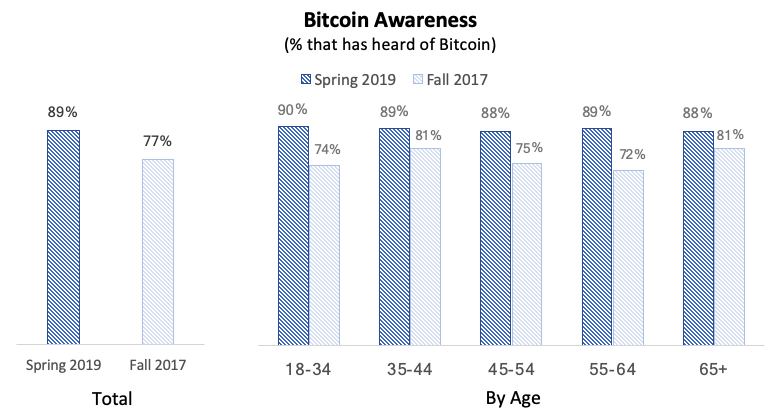

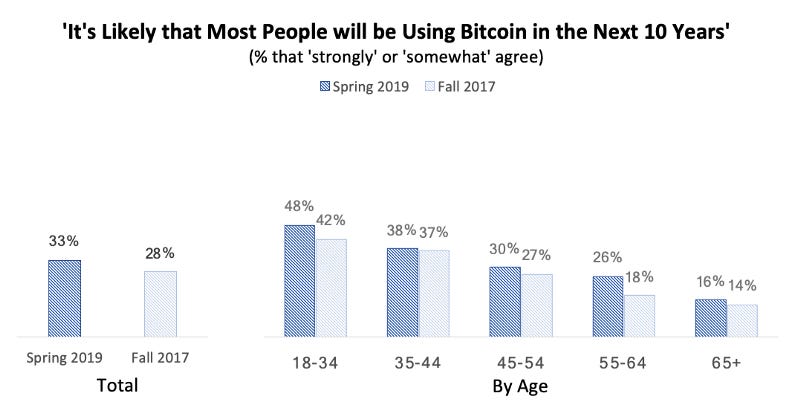

Recommended ReadingBitcoin is a Demographic Mega-TrendBlockchain Capital published a report which highlights that younger demographics are leading in terms of Bitcoin awareness, familiarity, perception, conviction, propensity to purchase, and ownership rates. You can read the report here.

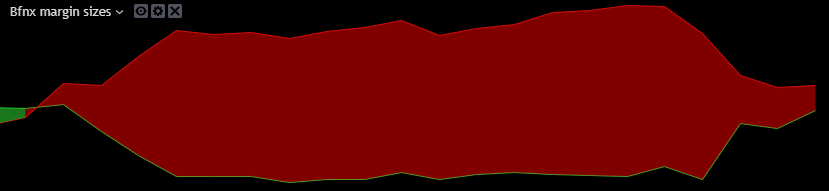

Market SentimentThe short squeezeLast letter I wrote that there were lots of shorts are pilling up, and a that a short squeeze looked unlikely. I said it looked unlikely because I thought there would be more then enough sellers and ample bitcoin supply, but I was wrong. Here's an explanation. In a short squeeze, people borrow shares to bet against a company. They eventually need to buy those shares back to cover their negative position. If the folks that actually hold the shares, or in this case bitcoin, decide that they don't actually want to sell their bitcoin back to the short sellers, the price can run upwards out of control. When you buy, the price rises = added demand. When you sell, the price falls = added supply. When there are too many shorts, the price can rise rapidly because everyone is buying back at market price (closing their position) to avoid their shorts going underwater. This is called a "short squeeze." And boiii did it squeeze.

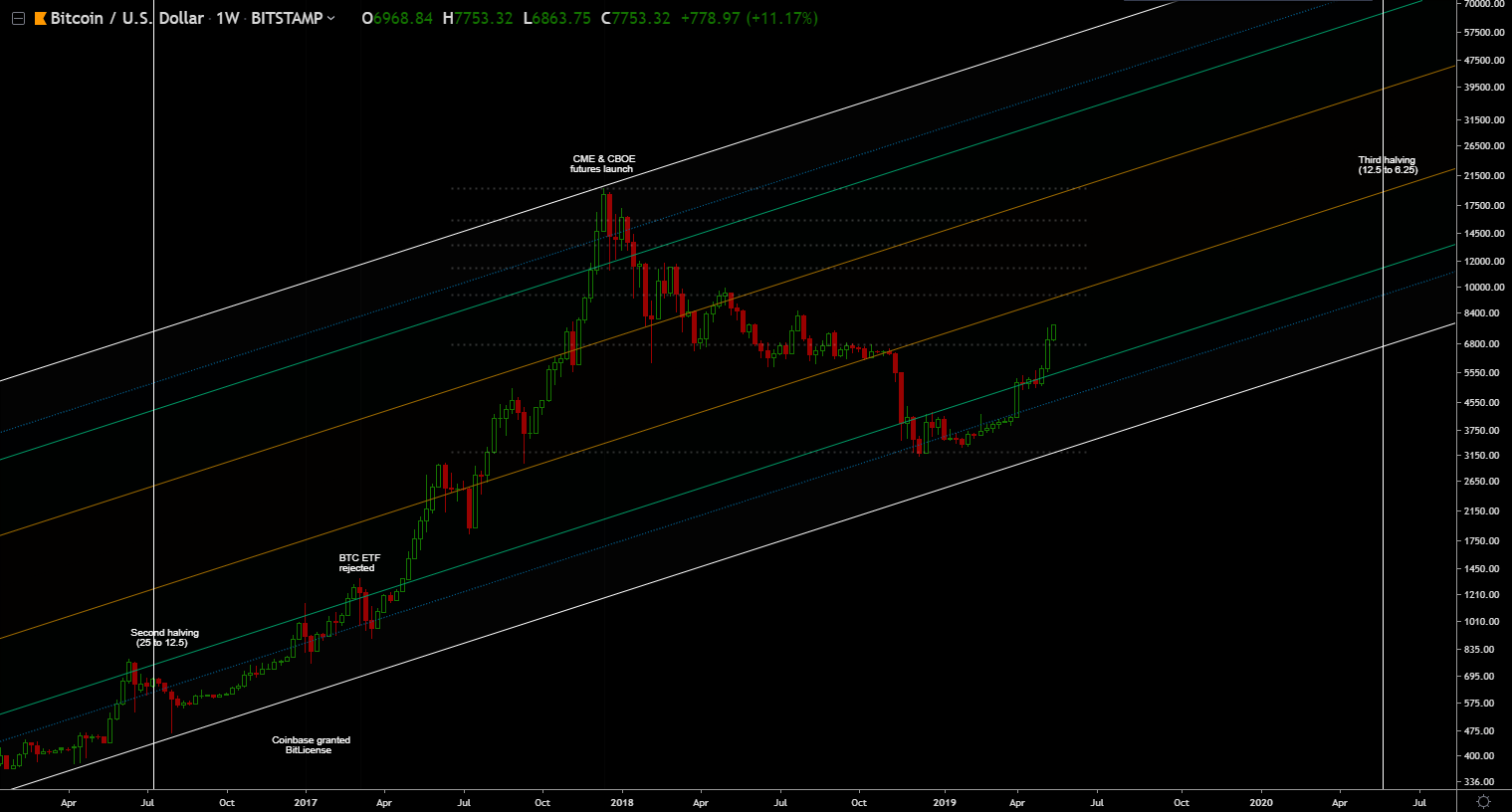

(Visual representation of the shorts going down and longs going up) Bitcoin (Macro Trend Lines)What a blast.

Bitcoin (Moving Averages)

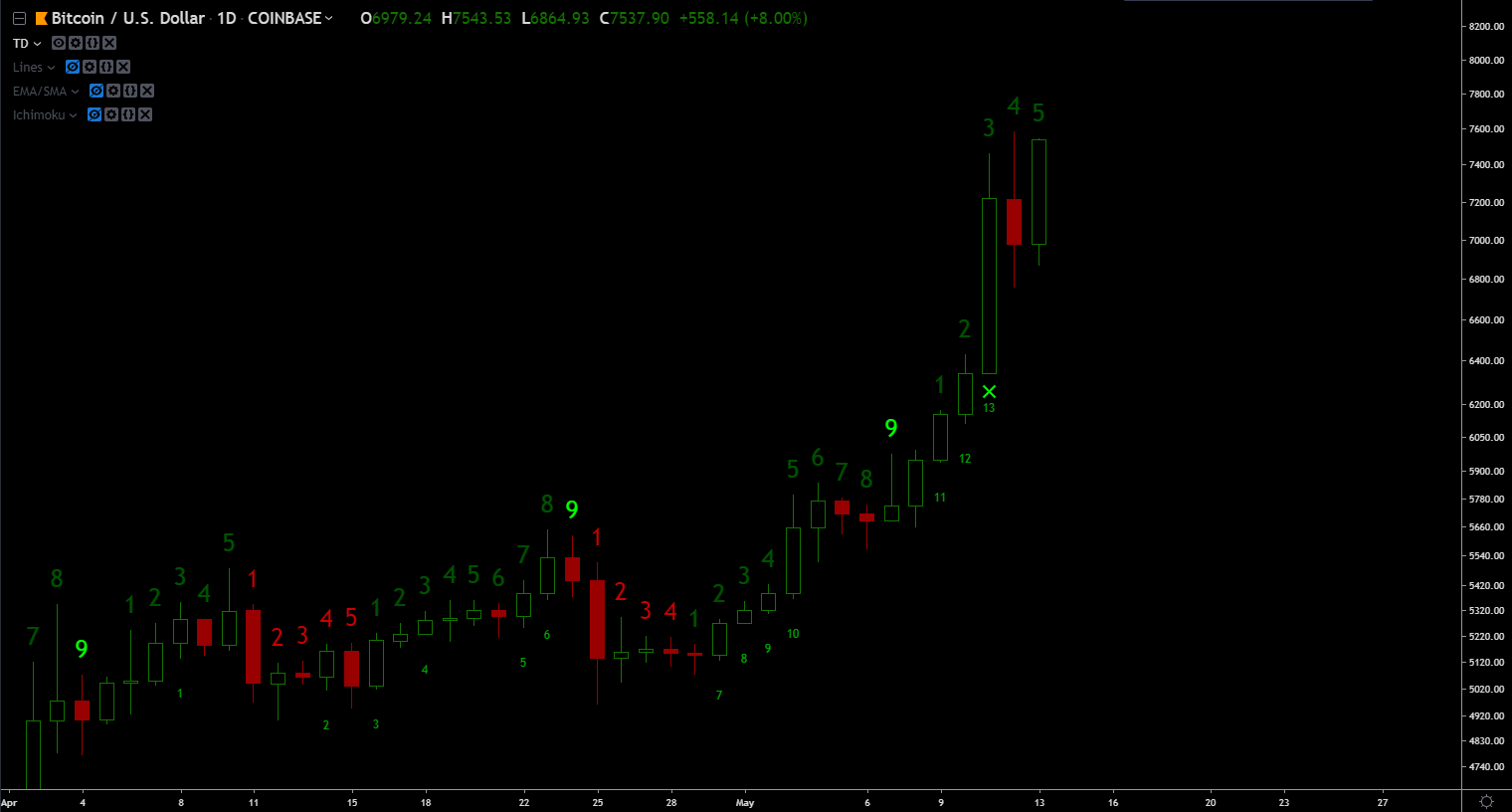

The TDDaily TD

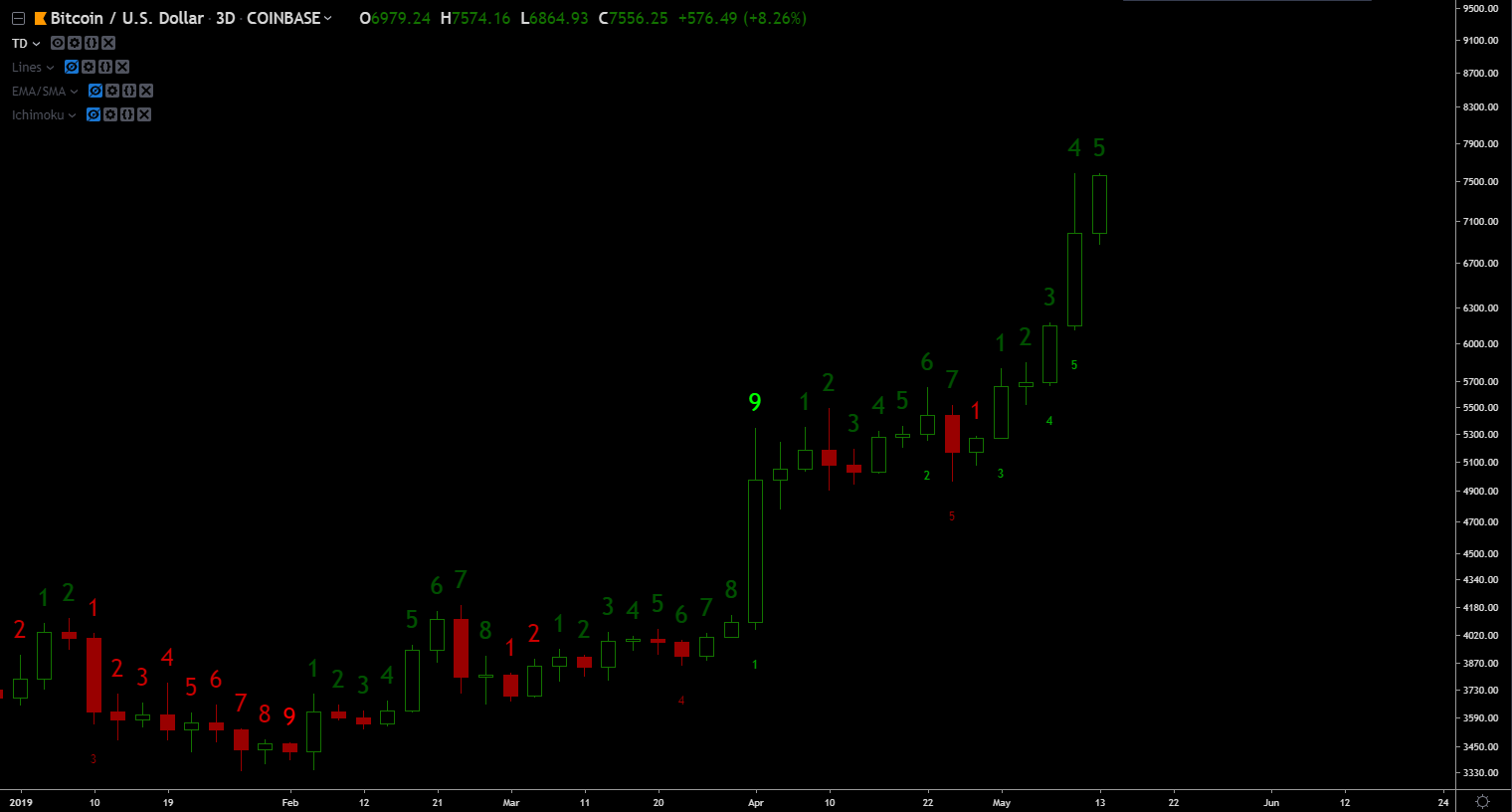

3 Day TD

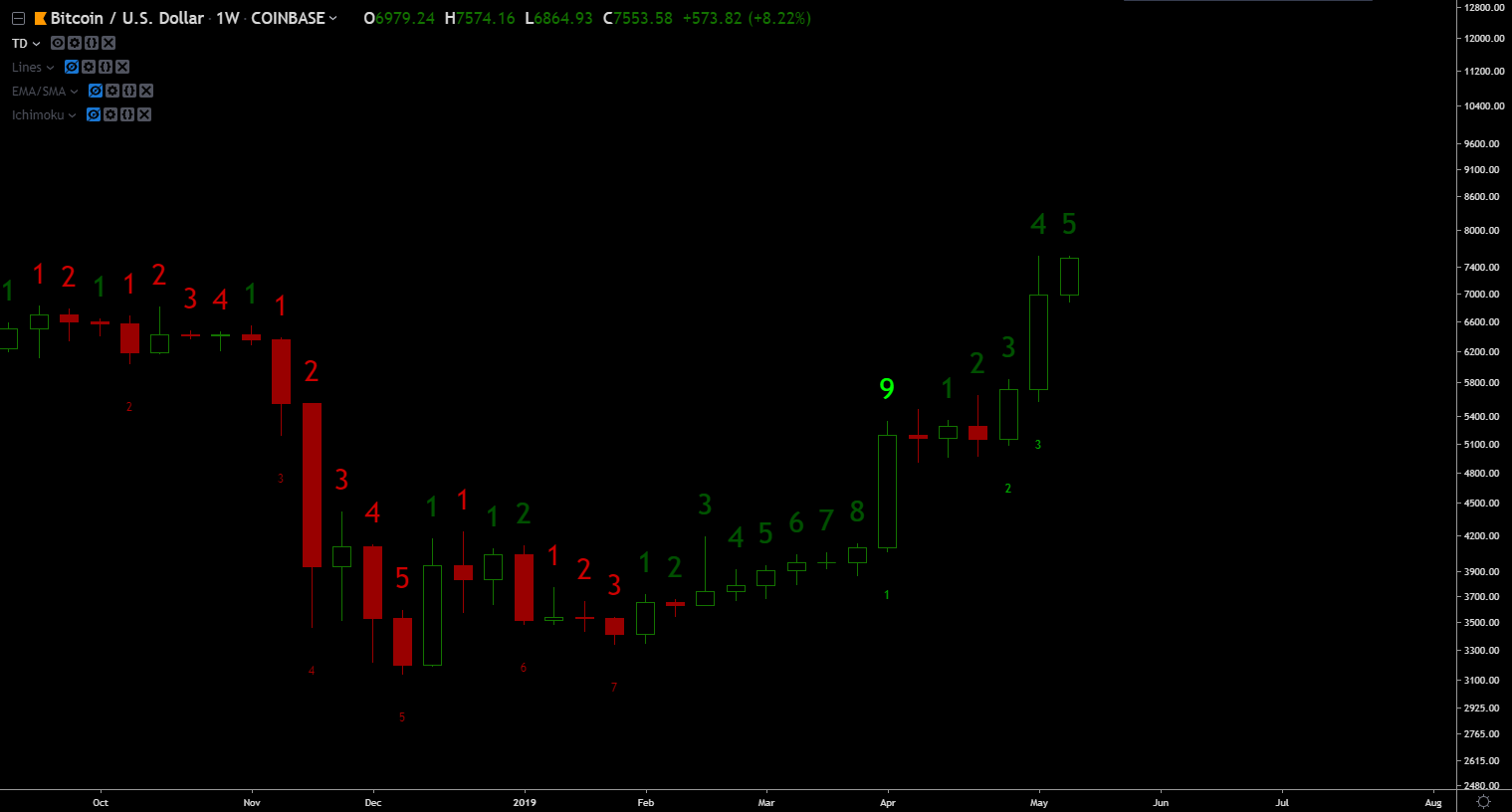

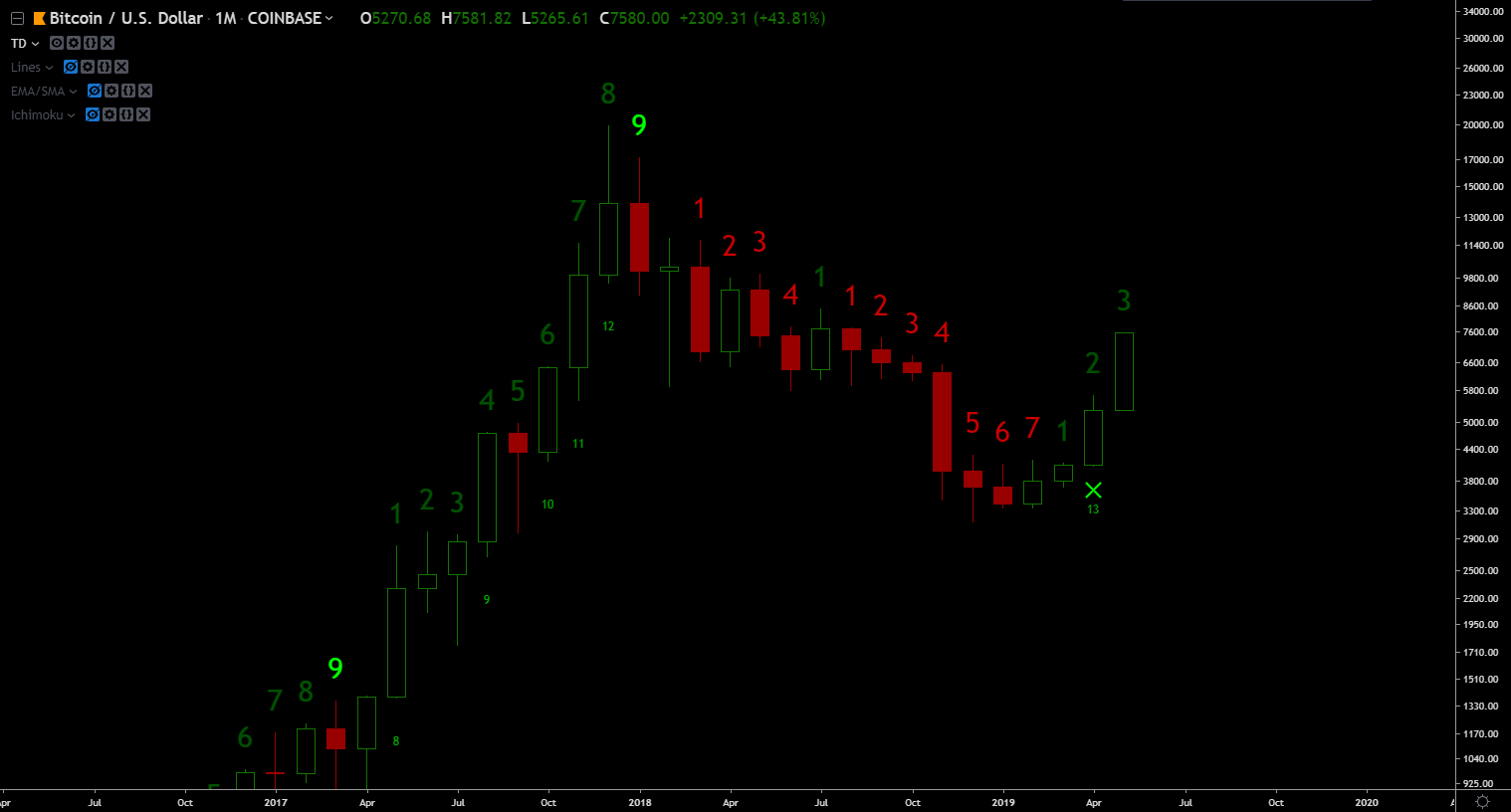

Weekly TD

Monthly TD

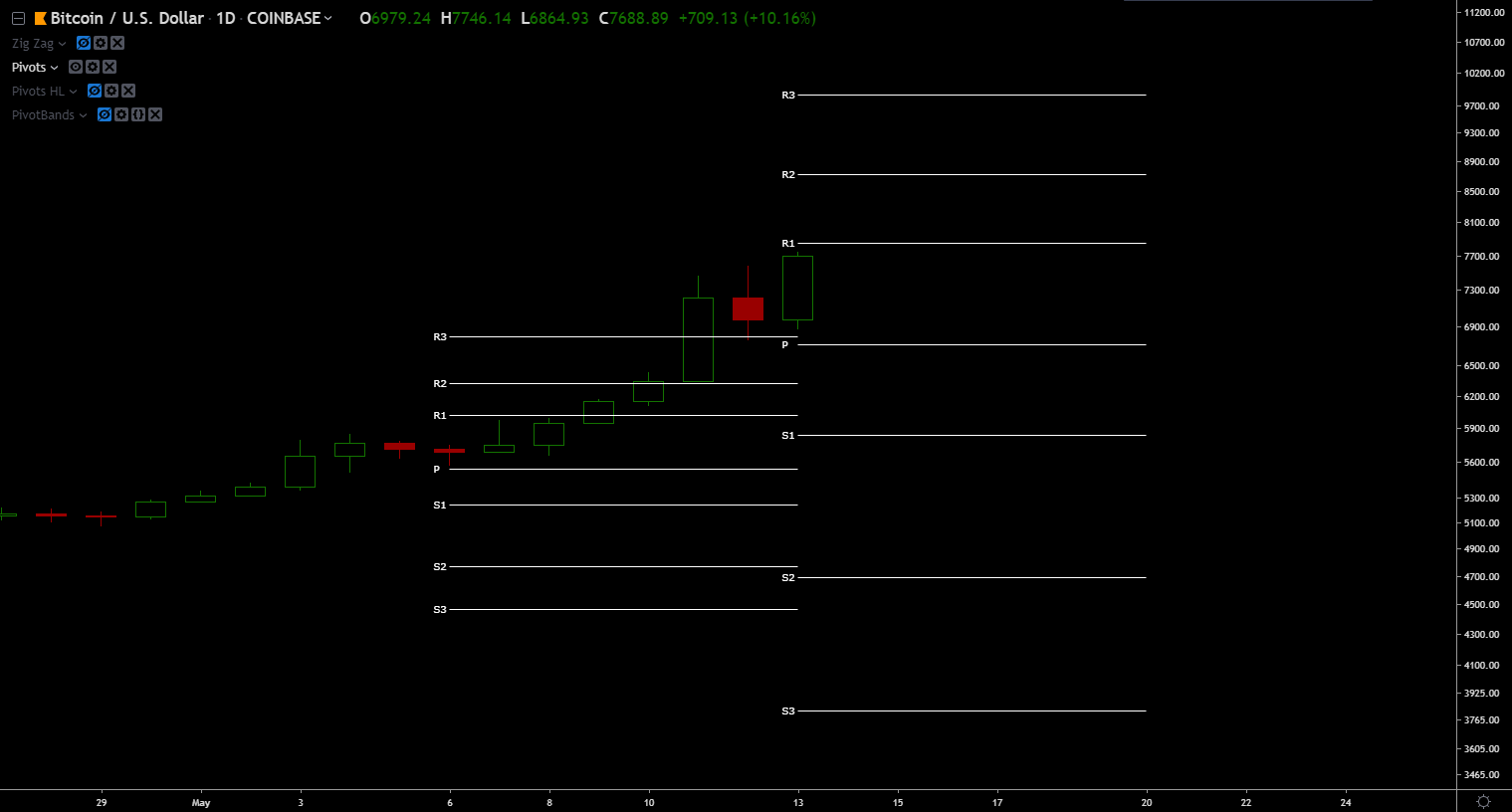

Bitcoin (Support/Resistance Levels)Weekly Pivot Points

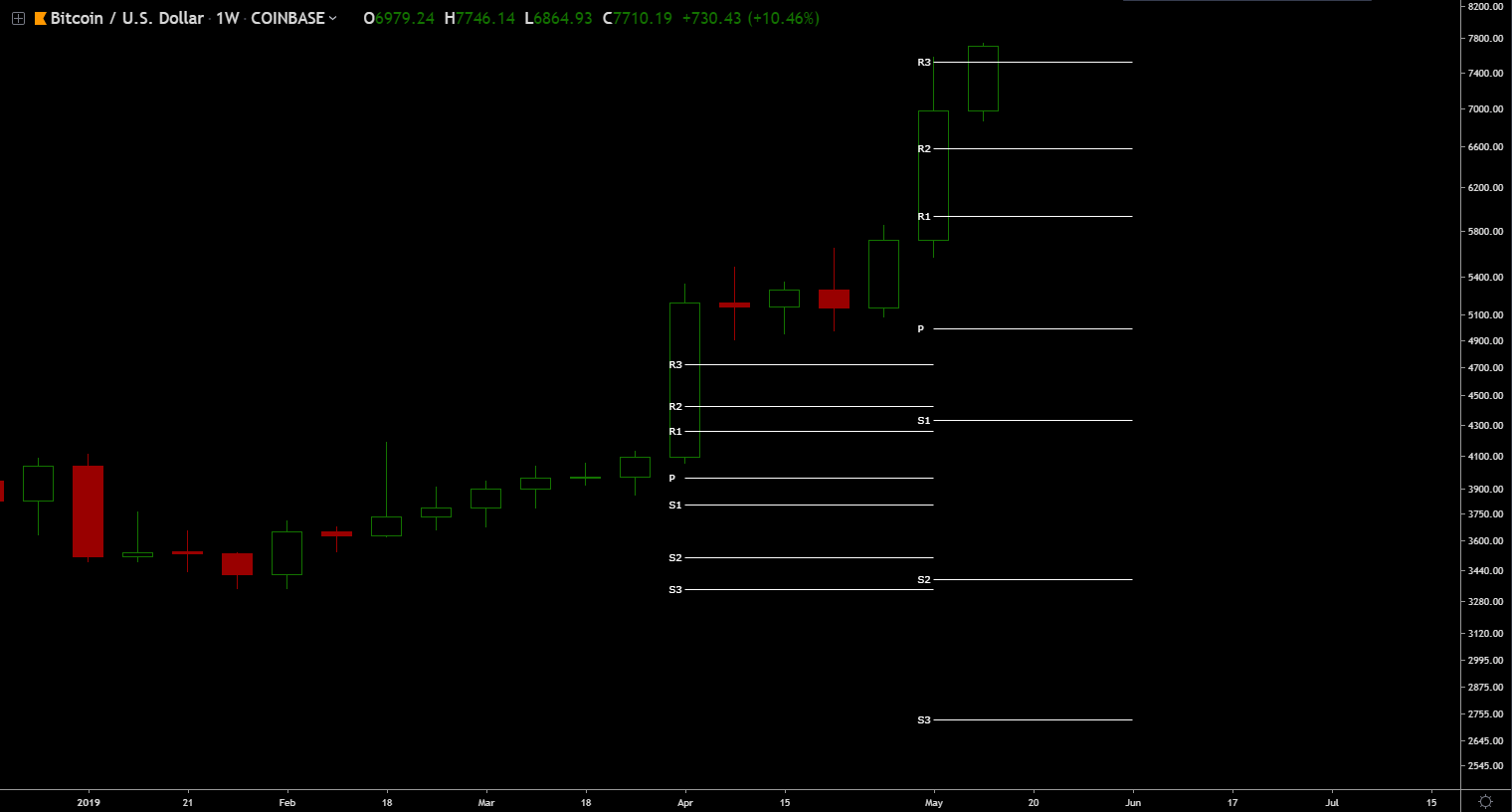

Monthly Pivot Points

VolumeDaily Volume

4h Volume

2h Volume

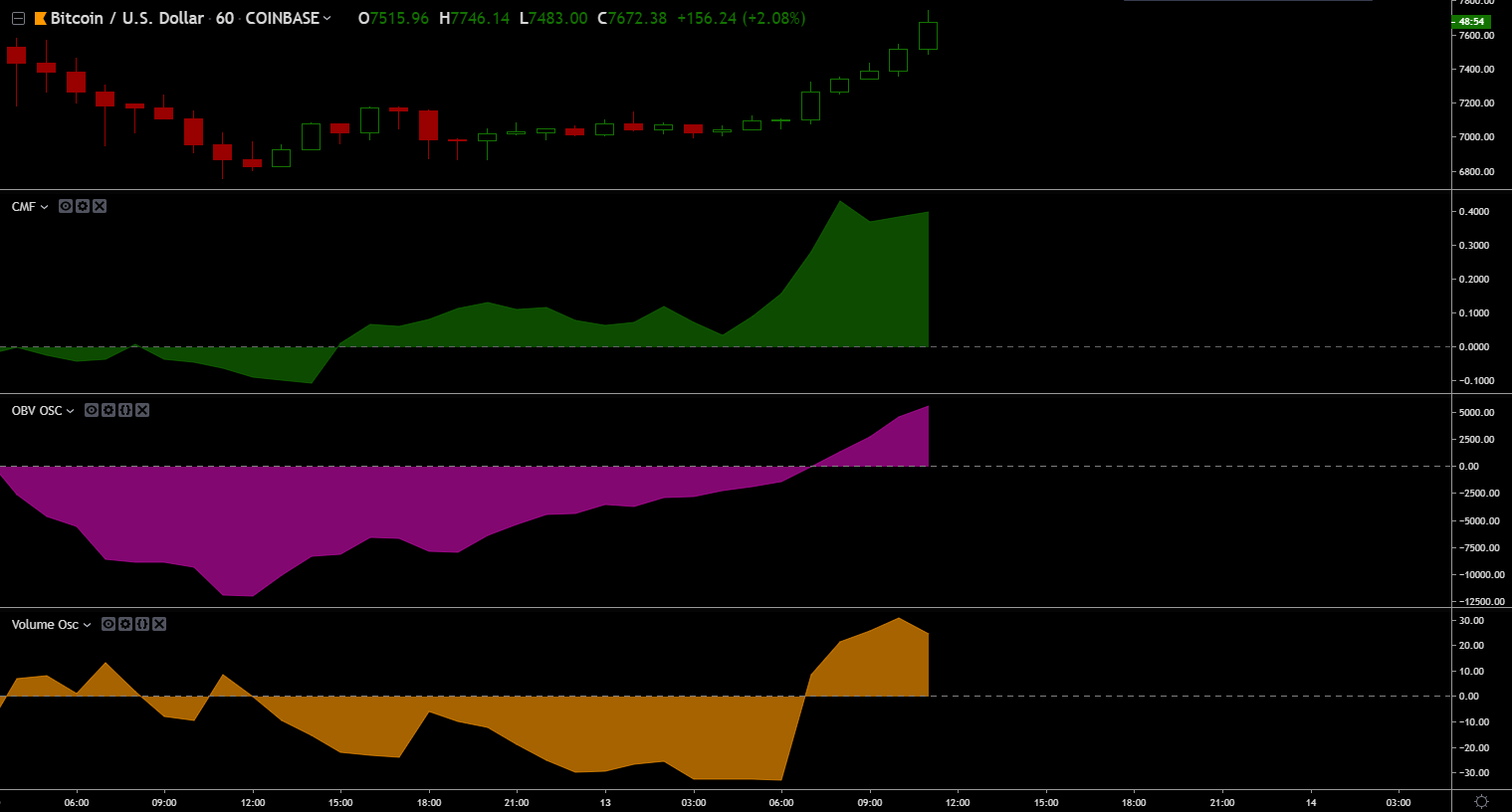

1h Volume

Bitcoin (Macro Overview)We're about ~375 days away from the next halving event. As of May 13, 2019 my confidence level are:

The endWhat do you folks think? Continue the discussion in our Telegram group. That's all for now. See you later space Cowboy -Dmitriy You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |