Dear subscribers, Welcome to your Thursday edition of Inside Cryptocurrency, which is filled with the latest and best news in the crypto space - enjoy! In order to keep this newsletter going, we are asking subscribers to sign up for the premium version of the newsletter. The cost is $10 per month, or $100 for the entire year, which comes down to the price of a coffee every week. Here's what you'll get: - Full access to all content five days a week

- An ad-free experience

- Q&As with crypto experts

- The latest studies and reports on crypto, with in-depth analysis.

To sign up for the full edition, click here. Best, | |  Rebecca Rebecca |  | | |

In a reverse from yesterday, market prices across the board are back in the green again today. Among the top five, Etherum has seen the biggest jump, increasing nearly eight percent in a 24-hour period. - Bitcoin: $6,989 (⬆️ 3.81%) // $128.1 billion market cap.

- Ethereum: $168 (⬆️ 7.98%) // $18.6 billion market cap.

- XRP: $0.188 (⬆️ 2.76%) // $8.3 billion market cap.

- Tether: $1.00 (⬆️ 0.32%) // $6.3 billion market cap.

- Top 100 Winner: Komodo: $0.550 (⬆️ 20.70%) // $65 million market cap.

- Top 100 Loser: Insolar: $0.948 (⬇️ 4.92%) // $37 million market cap.

Prices are as of 2:30 p.m. ET.

| |

China's digital yuan to be given to state employees in May. China is moving full steam ahead with the creation of what is officially known as its digital currency/electronic payment (DCEP). From May, Suzhou municipal government employees will see half of their transportation allowance replaced by the digital yuan. According to a report from the China State Market, four state-owned banks will issue the payments: the Agricultural Bank of China, the Bank of China, the China Construction Bank, and the Industrial and Commerical Bank of China. Earlier this week, it was announced that the Agricultural Bank of China had piloted a digital wallet app, which supports the People's Bank of China's (PBoC's) digital current project. Last December, the PBoC was reportedly planning to launch a DCEP pilot program in several Chinese cities, two of which were Suzhou and Shenzhen. DECRYPT

| |

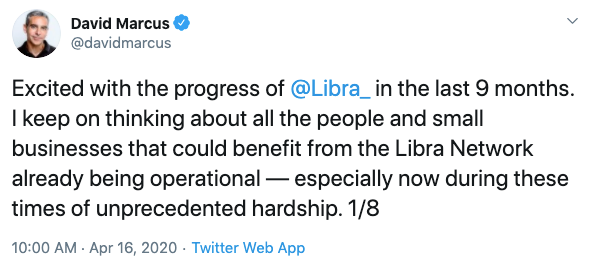

David Marcus posts update on Libra, including stronger protections for customers. It's been a bit quiet on the Libra front lately, but today that changed. Posting on Twitter today, the co-creator of the Calibra wallet noted that he was excited about the progress that's been made in the last nine months. With a new whitepaper on the stablecoin project, Marcus highlighted several changes during a series of tweets.

Most notably, he said the project will focus on providing individual stablecoins for specific fiat currencies, including GBP, EUR, and USD, in addition to its Libra Coin. Another change is the building of stronger protections into the Libra Reserve to protect consumers, Marcus noted. Since being announced last June, Facebook's Libra project has come under global pressure from regulators, with many calling for it to be stopped. @DAVIDMARCUS/TWITTER

| |

Throwback Thursday: Is Bitcoin a collective delusion? Our weekly Throwback Thursday feature takes a look back at the most newsworthy items in the crypto space over the last decade. On April 11, 2013, Eric Posner, a law professor at the University of Chicago Law School, published an article titled "Fool's Gold." In it, he argued that Bitcoin is a fantasy, adding that it resembles a Ponzi scheme. Comparing the two, Posner said that Ponzi schemes collapse when people realize that early investors are being paid from what later investors put in. He went on to say that Bitcoin won't survive after people realize that it can't be used as a currency because of its deflationary features. While a Ponzi scheme is a fraud, Bitcoin, however, appears like a collective delusion, he argued.

| |

BitGo acquires portfolio management platform Lumina. Mike Belshe, CEO of BitGo, said that the acquisition of Lumina is helping the company create a larger role within the crypto industry... | |

Coinbase Custody announces support for Compound Governance. The news comes as Compound, an open finance money market protocol, has gone live with its own token-based model, the COMP token. In a move to further enable the decentralized finance (DeFi) ecosystem, Coinbase Custody today announced that it is launching support for the COMP token, in addition to other Compound-tied tokens such as cETH, cZRX, cUSDC, cBAT, cDAI. According to the announcement from Coinbase, this offering will provide a seamless and secure way for its clients to govern Compound. COINBASE

| |

Report: Greyscale and its Bitcoin Trust (GBTC) hold nearly two percent of Bitcoin supply. In its quarterly report, Greyscale noted that its GBTC now holds 1.7 percent of the circulating supply of Bitcoin, adding that the percentage of the total market capitalization amounts to... | |

Japan-based SBI Holdings to use blockchain for forex trading. SBI Holdings is to use R3's blockchain technology Corda to perform forex trading... | |

Crypto Finance raises $14.5m in a Series B funding round. The Switzerland-based crypto asset management, trading and custody firm saw its funding round led by Swiss investor Rainer-Marc Frey and Asia-based Lingfeng Capital. Jan Brzezek, CEO and co-founder of Crypto Finance, said that the money will help it expand into Asia, in addition to boosting coverage of its target market in Germany and the U.K. Looking ahead, the company is awaiting a Securities House license in its home country, which would enable it to trade derivatives. However, Brzezek is clear that the firm doesn't want to become another Chicago CME Group, which operates as a regulated derivatives market. THE BLOCK

| |

|  | This newsletter was written and curated by Rebecca Campbell. She has been writing and reporting on various industries for the past 10 years, more specifically tech in the last three. |  | | Editor | Beth Duckett is a former news and investigative reporter for The Arizona Republic who has written for USA Today and other publications. A graduate of the Walter Cronkite School of Journalism, she won a First Amendment Award and a Pulitzer Prize nomination for her original reporting on problems within Arizona's pension systems. | |