| Greetings, Here's your most anticipated business news for the next week: - The PCE report, accompanied by the speech of FED Chairman Powell, will help clarify the state of the economy.

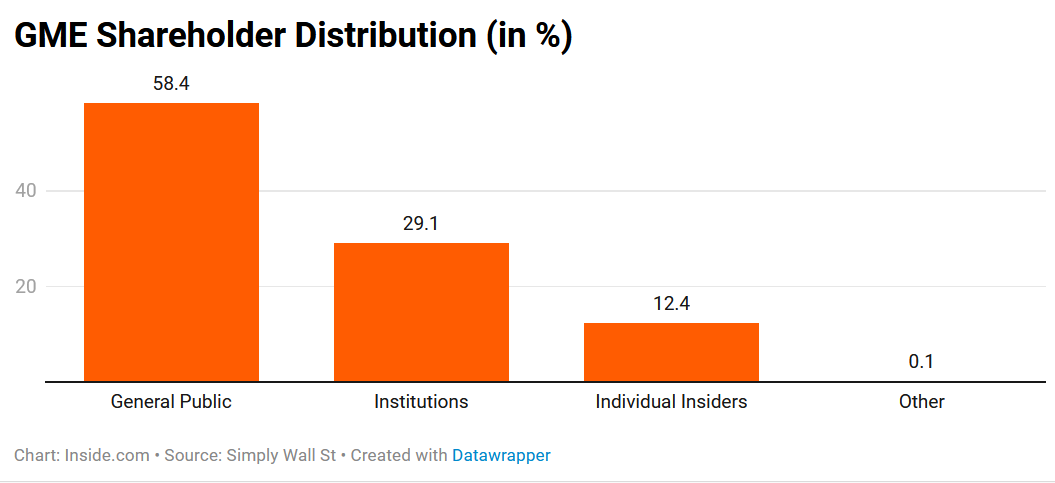

- GME's earnings report will show the state of the company's once-favored retail investors.

- Xiaomi will start selling the SU7, marking a historical expansion into the EV market.

Thanks for reading! Stjepan

p/stjepan-kalinic | |

| 1 | | The U.S. Bureau of Economic Analysis will release the February core PCE price index report on Friday, March 29. The economists expect a 2.8% year-over-year increase and a 0.3% month-over-month rise, signaling a deceleration from the previous month. More: - The core PCE (Personal Consumption Expenditures) price index excludes volatile food and energy prices, providing a clearer picture of underlying inflation trends.

- Both headline and core PCE price indices have been on a downward trajectory since September 2022, reaching their lowest levels in almost two years. Despite some tolerance for slightly higher inflation, the Federal Reserve has maintained its path of rate cuts, citing a "bumpy road" towards its 2% inflation target.

- Economists anticipate the core PCE price index to show a 0.3% month-on-month increase, while the headline PCE price index is expected to rise to 0.4%. The upcoming PCE inflation figures could influence the likelihood of a rate cut, with current odds at 62% for a cut in June, according to the CME FedWatch Tool.

- Later that day, Federal Reserve Chair Powell will speak at a Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference.

|     | |

| 2 | | GameStop is set to announce its earnings on Tuesday, March 26, after the market closes. The analysts are projecting 30 cents in adjusted EPS for the fourth quarter and just over $2B in revenue.

More: - The company's core business of selling video games has struggled for years, leading to declining revenue over previous years and prompting attempts at diversification with varying degrees of success, such as ventures into NFTs and a shift towards a holding company model.

- Analysts are closely watching revenue performance and operating margins in the upcoming report, as they are critical of the company's future profitability.

- Analyst expectations for the upcoming earnings report include a focus on revenue performance and operating margins since they are crucial for the company's path to profitability. The gap between SG&A costs and gross margins has been a concern, with SG&A costs exceeding gross margins since 2020, highlighting the company's financial struggles.

- Recent analyst ratings, including a "sell" rating from StockNews.com and an "underperform" rating from Wedbush, reflect the overall bearish sentiment surrounding GameStop's stock.

|     | |

| 3 | | Xiaomi will start deliveries of its highly anticipated electric vehicle (EV), the SU7, on Thursday, March 28. Manufactured by BAIC Group in Beijing, the company aims for the SU7 to rank among China's top three best-selling luxury electric vehicles. Why it matters: Xiaomi's success in the smartphone market positions it well to enter the competitive electric vehicle sector, leveraging its existing customer base and technological expertise. With the Chinese EV boom and Xiaomi's ambitious plans, the company poses a significant challenge to established players like Tesla and BYD. More: - Xiaomi will sell the SU7 through 59 stores in 29 cities nationwide. The company aims to become one of the world's top five automakers, highlighting its long-term commitment to the EV market.

- Xiaomi's EV venture represents a strategic diversification away from its core smartphone business, aligning with its goal to invest $10B in autos over a decade.

- Despite challenges in the EV market, Xiaomi's substantial revenue and profit growth in its smartphone division provide a solid foundation for its expansion into electric vehicles.

- The launch of the SU7 marks a significant milestone for Xiaomi, which is known for its budget pricing and is looking to reposition itself as an upscale brand.

|     | |

| 4 | | Walgreens Boots Alliance (WBA) is anticipated to release its Q2 earnings on March 28 before the market opens. Analysts expect a year-over-year decline in earnings despite higher revenues. More: - Revenues are expected to rise to $36.48B, marking a 4.7% increase from the same quarter last year. Meanwhile, Zacks Consensus Estimate predicts a decline in quarterly earnings to $0.82 per share.

- Equity researchers at Leerink Partners have revised their Q2 2024 EPS estimate downward to $0.77 per share, citing a decrease from their previous estimate. Their analyst Michael Cherny lowered the price target from $23 to $22.

- Other analysts have issued mixed ratings for WBA, with three analysts rating the stock as "sell," ten as "hold," and one as "buy," resulting in an average price target of $25.75.

- Closely correlated companies like CVS Health and Sally Beauty are expected to show movement in response to WBA's performance.

|     | |

| 5 | | McCormick & Company is scheduled to announce its Q4 results before the market opens on Thursday, March 28. The consensus expectation is a year-over-year decline in earnings accompanied by lower revenues. More: - Analysts expect revenue of around $1.55B, down 0.8% from the year-ago quarter. Meanwhile, earnings-per-share is anticipated to be $0.58, a year-over-year decline of 1.7%

- The company has been struggling with cost inflation pressuring the margin. Additionally, analysts note rising general expenses and increasing brand marketing costs.

- McCormick's track record for earnings surprises has been an average of 8.3% for the last four quarters, with the latest earnings surprise of 7.6%.

- Over the last 30 days, the earnings expectations have remained put, with minimal downward revision. The latest significant rating update came from JP Morgan analyst Ken Goldman, who maintained an Underweight rating but cut down the price target from $59 to $57 on January 26.

|     | |

| 6 | | The Bureau of Economic Analysis will release the final GDP Q/Q annualized estimate on Thursday, March 28. The report will provide an updated assessment of economic growth in the previous quarter, which is expected to confirm a 3.2% annualized growth rate. More: - Goldman Sachs has raised its U.S. economic and job growth projections for this year, attributing the increase to a faster pace of immigration, which has expanded the labor force and potential GDP.

- Goldman Sachs anticipates U.S. GDP to grow by 2.4% year-on-year in the fourth quarter, with a projected growth rate of 2.7% for the entire 2024 year, fueled primarily by increased consumption.

- Despite persistent geopolitical risks and inflation concerns, Deloitte's baseline forecast remains optimistic, anticipating continued strong performance in the U.S. economy driven by factors such as robust job market conditions, consumer spending, and exports.

- Deloitte forecasts real GDP growth of 2.4% for the year 2024, expecting the U.S. economy to continue to outperform in the short term due to strength in various sectors including the job market and consumer spending, while also acknowledging the potential for positive structural changes in labor markets and productivity.

|     | |

| 7 | | Quick Hits: - Pattern released a 30-page insights report for beauty brands selling on Amazon.*

- Markets will close earlier next week, as March 29 marks Good Friday, a public holiday. This trading week also means the end of the first quarter. Thus, investors should take notice and plan any portfolio adjustments by Thursday, EOD.

- The three-day Adobe Digital Experience Conference will begin on Tuesday, March 26, in Las Vegas, Nevada. Adobe CEO Shantanu Narayen is set to speak at the conference, along with other Adobe top executives, discussing the latest technology trends. General Motors CEO Mary Barra and Delta Air Line's Ed Bastian will be among the guest speakers.

- Bank of America Global Auto Summit kicks off Tuesday, March 26, in New York City as an interlude to the New York International Auto Show, which starts on Friday, March 29. Prominent participating companies include General Motors, Ford, Adient, Lear, and others.

- Ready to get your AWS cloud spend under control? Learn how to effectively audit and reduce AWS costs today.*

*This is a sponsored listing. |     | |

| Upcoming Events | | MAR

27 | | Buy-ology: How Today's Consumers Buy Online w/Mike Felix of Act-On | | | | | | * This is a sponsored event | | | |

| Freelance Writer | | Stjepan Kalinic is an analyst and writer with a background in institutional investment research. He's passionate about reading, playing music, lifting weights, and practicing martial sports. He values interesting books above everything else, and you can send recommendations through LinkedIn. | | This newsletter was edited by Megan LaBruna | |

| |

| |