| |

| Greetings, Here's your daily business briefing: - The Federal Reserve maintained its interest rate, looking to cut later this year.

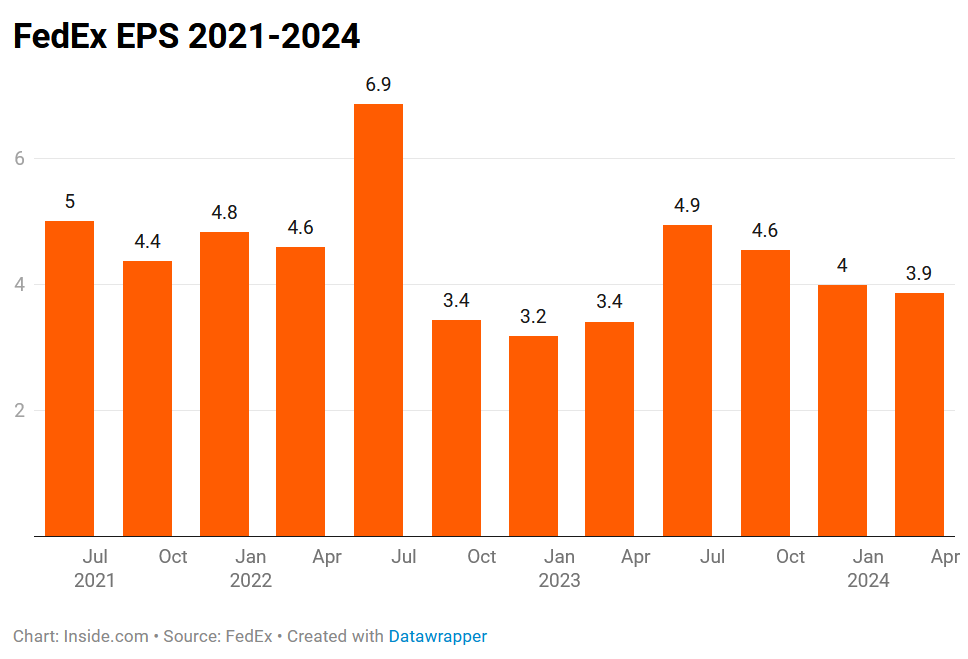

- FedEx delivered surprising earnings, prompting updated price targets.

- Reddit's IPO survives the first two trading sessions on a high note.

Thank you for reading. Feedback/comments are welcomed! Stjepan

p/stjepan-kalinic | |

| 1 | | The Federal Reserve has maintained its target interest rate, citing plans for future cuts to address economic concerns. The Fed increased its forecast for core inflation this year, and now it sees more upside risks to that projection than before. Why it Matters? Short-term rates, influenced by changes in the FED's benchmark funds rate, impact various financial aspects including bank deposits and money-market funds. However, the influence on longer-term rates, such as corporate bonds, can be less pronounced, potentially leading to discrepancies in borrowing costs for different entities. Despite keeping rates steady, officials reiterated plans to cut interest rates later in the year. Yet, their stances are starting to diverge, with consensus expectation shifting to three cuts, while the Bank of Atlanta President Raphael Bostic now projects just one cut in 2024. Zoom Out: - Switzerland's central bank, the Swiss National Bank (SNB), cut its key interest rate to 1.5% from 1.75%, contrasting with Japan's decision to end negative rates after over a decade.

- The SNB's move signals a broader trend towards easing monetary policy globally despite concerns about inflation, fueling a rally in financial markets.

- Factors such as sluggish economic growth, lower wage rises, and indications of a looser labor market influenced the Bank of England's stance, edging towards a potential rate cut.

- Central banks' decisions to adjust rates reflect a shift towards normality in monetary policy after periods of extreme measures triggered by economic shocks.

- Expectations for rate cuts indicate a global trend towards easing monetary policy, although uncertainties remain regarding the extent of rate cuts and their impact on inflation and economic growth.

|     | |

| 2 | | FedEx reported Q3 Non-GAAP EPS of $3.86, beating expectations by $0.38, with revenue of $21.7B (-2.3% YoY) missing by $380M. Despite mixed company-wide results, the Express segment showcased notable improvement, leading to an 8% gain in the stock, fueled by cost-saving initiatives and margin expansion. More: - The company's operating income increased significantly by 19% year over year and 16% on an adjusted basis, reflecting improved operational efficiency and cost-saving measures.

- FedEx announced plans to reduce its capital spending and initiate an additional $500M share repurchase in the fourth quarter, indicating confidence in its financial position and commitment to enhancing shareholder value.

- Despite headwinds in its Freight and Ground segments due to weak global trade and inflationary pressures, FedEx's DRIVE initiative, which aimed to optimize business operations through automation and cost reduction initiatives, contributed to margin expansion across segments.

- Wall Street analysts, including those from Morgan Stanley, UBS, and BMO, raised their price targets on FedEx, acknowledging the company's progress on cost-saving initiatives and expressing confidence in its ability to achieve long-term earnings growth targets.

|     | |

| |

|

| 3 | | Reddit's IPO debut week saw shares surge 35% closing at $46 on the New York Stock Exchange (NYSE), a strong endorsement for the social-media company. This success signifies a positive trend for new IPOs, with Reddit's performance likely to encourage investor interest in upcoming offerings. More: - Reddit's IPO marks the first for a social media company since Pinterest's 2019 debut, underscoring its cultural significance and expanding influence as a platform for news analysis and discussion.

- Reddit's shares closed at $50.44 on their first day of trading, significantly higher than the IPO price of $34 per share, indicating strong investor demand.

- The IPO success follows a recent trend of high-performing debuts in the market, with Astera Labs, a technology company, witnessing a more than 70% increase in its share price on its debut day.

- Despite challenges in the IPO market since late 2021, few debuts have been definitive successes initially, making Reddit's surge a notable achievement.

- The company, valued at around $6.4B during its IPO, boasts approximately 73 million daily users and over $800M in revenue, mainly generated through advertising.

Zoom Out: - The company, which sits on a treasure trove of user-generated data, has attracted attention from third parties interested in training AI models.

- This fast has also prompted the Federal Trade Commission (FTC) to conduct a non-public inquiry focusing on such practices. FTC is asking to meet Reddit's management to investigate the situation further.

|     | |

| 4 | | Alaska Governor Mike Dunleavy is seeking $700B from the Federal Government, quoting economic losses from mine permitting. The governor is pleading for a streamlined mine permitting process amidst a legal battle for the milestone Pebble Mine project. More: - Dunleavy called out President Biden for pushing the greater adoption of electric vehicles while blocking a project like Pebble, which would provide critical minerals necessary to build those vehicles. In 2023, he unsuccessfully tried appealing to the Supreme Court to overturn Biden's decision.

- Northern Dynasty Minerals, the mine developer, also mounted a legal offense, filing lawsuits to overturn the Environmental Protection Agency's decision, and seeking compensation for incurred expenses related to the project.

- The project includes 55 billion pounds of copper, 3.3 billion pounds of molybdenum, and 67 million ounces of gold, as well as smaller amounts of silver, rhenium, and palladium.

- Pebble Mine would directly impact the world's greatest sockeye salmon run, consequently placing the fishing industry in jeopardy. Jason Metrokin, CEO of Bristol Bay Native Corporation estimated that fishing businesses create 15,000 jobs and provide over $2B in annual economic activity.

|     | |

| 5 | | Galderma Group AG experienced a 21% surge on its initial public offering, reaching a valuation of over $16.7B (15B Swiss francs). The successful IPO marked a significant win for Europe's equity markets, contrasting with recent lackluster regional performances. More: - Galderma's origins trace back to 1981 as a joint venture between L'Oreal SA and Nestle, known for its skincare products like Cetaphil and Alastin, as well as its revenue-generating injectables segment, encompassing treatments such as Botox and fillers.

- The company, backed by EQT AB, raised nearly $2.2B by selling 37.2 million new shares, with plans to utilize the proceeds for debt repayment and refinancing.

- Galderma's success comes amid a recovering European IPO market, which volatile markets and rising interest rates have impacted since early 2022. The company's growth prospects were highlighted by its 2023 net sales of over $4B, driven by strong performances in international markets, particularly in China, India, Brazil, the U.K., and Mexico.

- Galderma's IPO is Switzerland's largest IPO in two decades. It rivals Landis+Gyr Group AG's 2017 offering, marking Switzerland's most substantial listing in franc terms since 2006.

|     | |

| 6 | | Egypt received an $8.1B (€7.4B) funding package from the European Union as part of an effort to curb migration, with an emphasis on boosting cooperation in areas such as renewable energy, trade, and security. A sharp downturn in Suez Canal revenues and rising import costs have devastated the Egyptian economy, causing a rapid devaluation of the Egyptian pound. More: - The funding package includes $5.4B in concessional loans, $1.95B in investments, and $650M in grants. A portion is allocated for managing migration, reflecting the EU's strategic partnership with Egypt.

- European leaders, including Italian Prime Minister Giorgia Meloni and EU Commission President Ursula von der Leyen, visited Cairo to unveil the agreement, highlighting the importance of such deals in addressing migratory flows.

- Regional conflicts, including the war in Gaza and the conflict in neighboring Sudan, have underscored Egypt's strategic significance, leading to increased multilateral support and economic reform efforts, including cooperation with the IMF.

- While Egypt had largely shut off irregular migration from its north coast in 2016, recent surges in migration attempts via Libya have prompted renewed efforts to prevent the opening of new migration routes, with support from the EU aimed at reducing those flows.

- The EU's expanded partnership with Egypt aims to promote democracy and freedoms but has faced criticism from activists who argue that financing in return for migration curbs overlooks human rights abuses and lacks sufficient democratic oversight.

|     | |

| 7 | | Quick Hits: - Apply to see if you are entitled to a portion of this $5.66B payout from Mastercard or Visa.*

-

Home sales rebounded in February, marking the first time in over two years that they increased for two consecutive months. National Association of Realtors estimates a 9.5% surge in February, in contrast with economists surveyed by The Wall Street Journal, who predicted a fall of 1.3%. -

NVIDIA Corporation insiders have accelerated selling their shares as the stock closes in on a milestone $1,000 mark. A recent notable sale includes Tench Coxe, Nvidia's board member since 1993, who sold 210,000 shares for over $170M. -

Digital World Acquisition Corp shareholders voted to approve the SPAC deal to take Trump Media & Technology public. Trump's stake could be valued at as much as $3B, but he can't sell or pledge any shares for six months owing to the deal's lock-up period unless he receives permission from the board of directors. -

We can help you track changes to your business credit scores and ratings and alert you to which ones could potentially impact your company.* *This is a sponsored listing. |     | |

| Upcoming Events | | MAR

27 | | Buy-ology: How Today's Consumers Buy Online w/Mike Felix of Act-On | | | | | | | SEP

1 | | Join the $1M prize AI Challenge: Unleash your creativity and push AI Agents beyond today's limits. | | | | | | * This is a sponsored event | | | |

| Freelance Writer | | Stjepan Kalinic is an analyst and writer with a background in institutional investment research. He's passionate about reading, playing music, lifting weights, and practicing martial sports. He values interesting books above everything else, and you can send recommendations through LinkedIn. | | This newsletter was edited by Megan LaBruna | |

| |

|  Act-On is a marketing automation that is easy to use without sacrificing the power and precision you expect. | |

|

| |