Weekly BulletinAs we approach the New Year, let us remember to celebrate the empirically observed anti-fragility of Bitcoin. Bitmain confirms 'adjustment to their staff'Looks like Bitmain management wanted to curtail redundancies in the human resources area so many people are no longer viable members of the workforce (RIP George Carlin). It was reported that Bitmain is dismissing almost half of its entire workforce in an attempt to restructure itself in order to "build a long-term, sustainable and scalable business."

Maybe this is THE LAST AND BIGGEST Bitmain drama of the year ⚠️⚠️⚠️ Local source said " BOTH Jihan and Zhan will step down" !!! 🚨🚨🚨 The original plan according to IPO filing is Jihan & Zhan will be co-CEOs, but now the source said "The successor maybe Mr. Wang" �sfbbSp Maybe this is THE LAST AND BIGGEST Bitmain drama of the year ⚠️⚠️⚠️ Local source said " BOTH Jihan and Zhan will step down" !!! 🚨🚨🚨 The original plan according to IPO filing is Jihan & Zhan will be co-CEOs, but now the source said "The successor maybe Mr. Wang" �sfbbSp

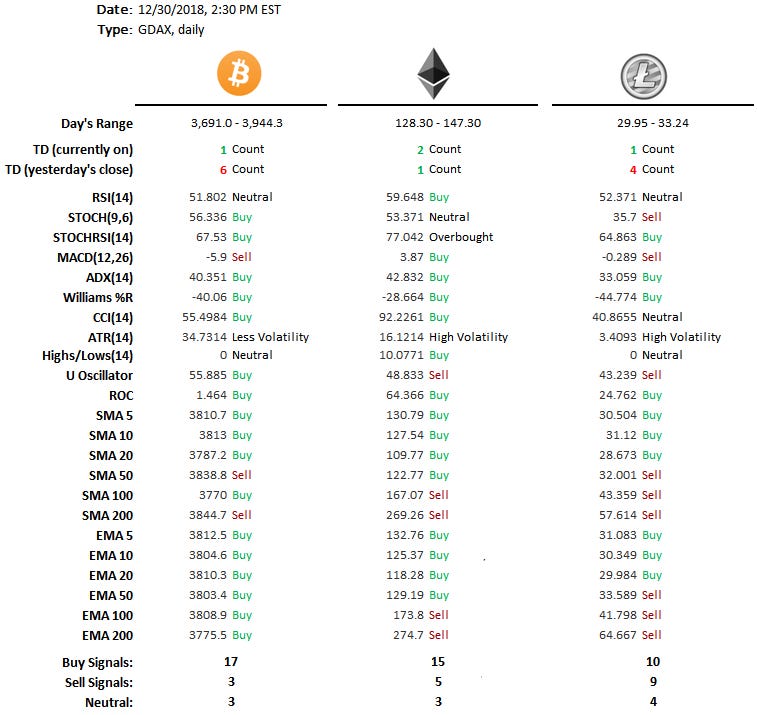

You see that? Those are folks talking about all that mining centralization (told you it was a meme). Market SentimentTechnicals

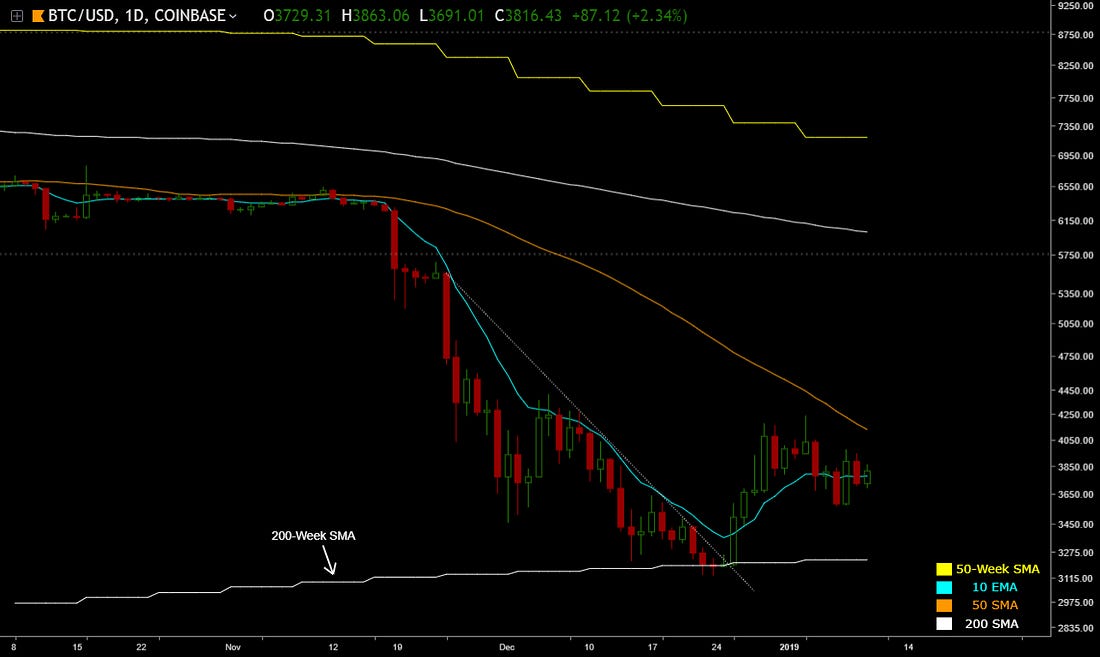

Bitcoin (Daily Overview)There is a this meme going around that we're going to see a green candle on January 1st (because folks are capitulating, funds are finished realizing their yearly loses, etc…). I don't know how I feel about that. We're probably going to see another attempt at that 50-SMA line. I'm also still waiting to see what happens with the Bakkt futures launch.

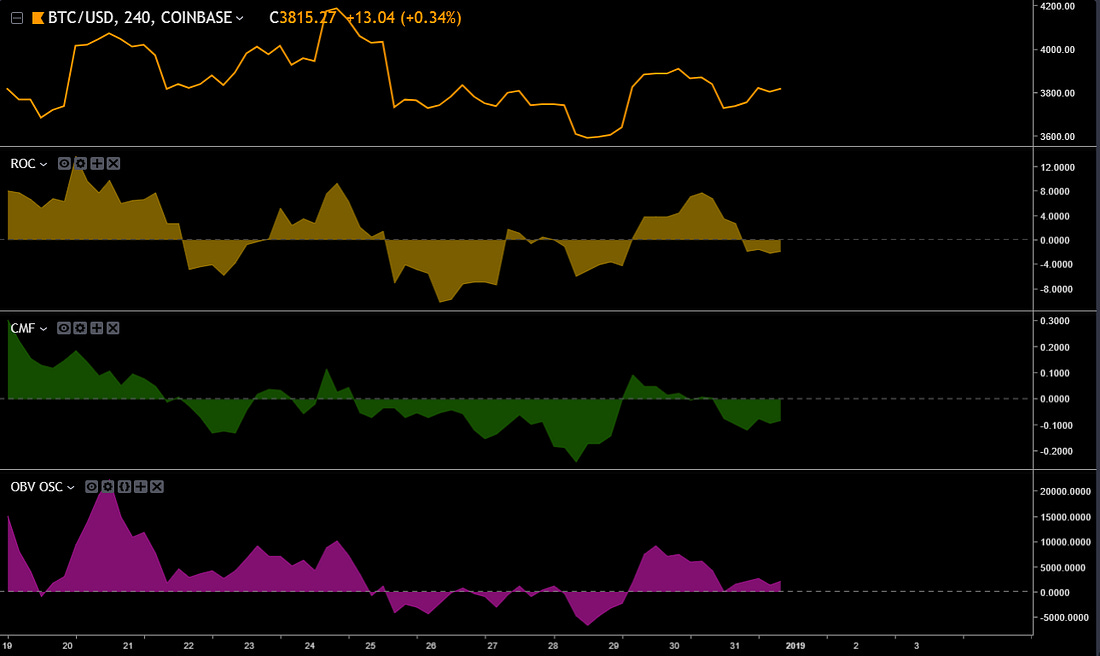

Bitcoin (4h Volume)Nothing too exciting on the volume (there was some CMF divergence on the daily candles).

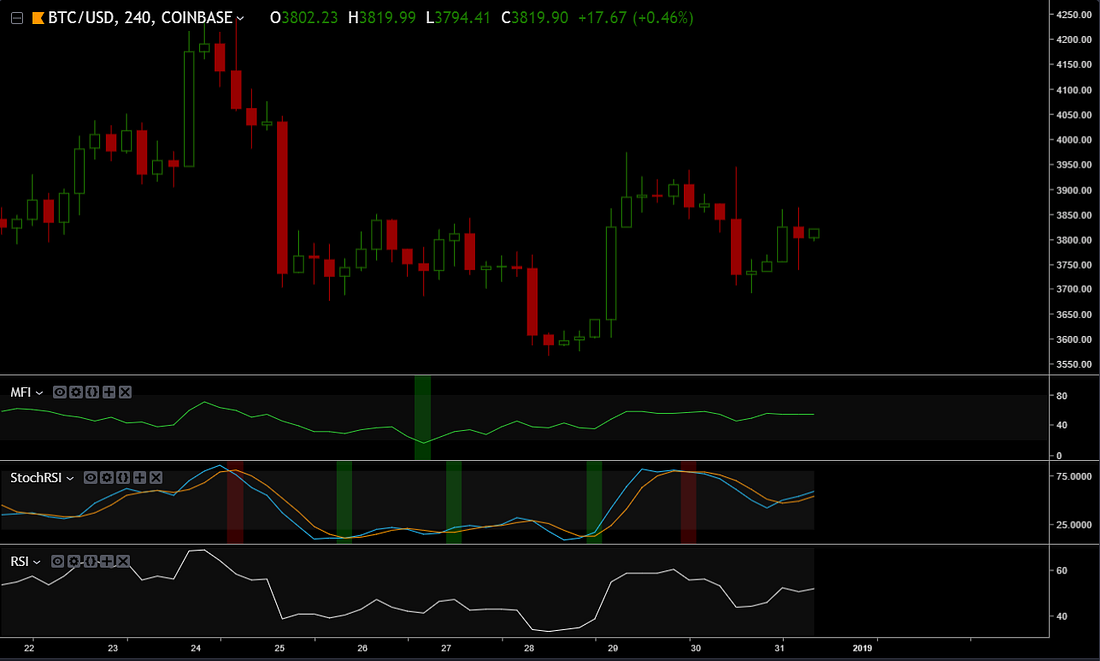

Bitcoin (4h Oscillators)

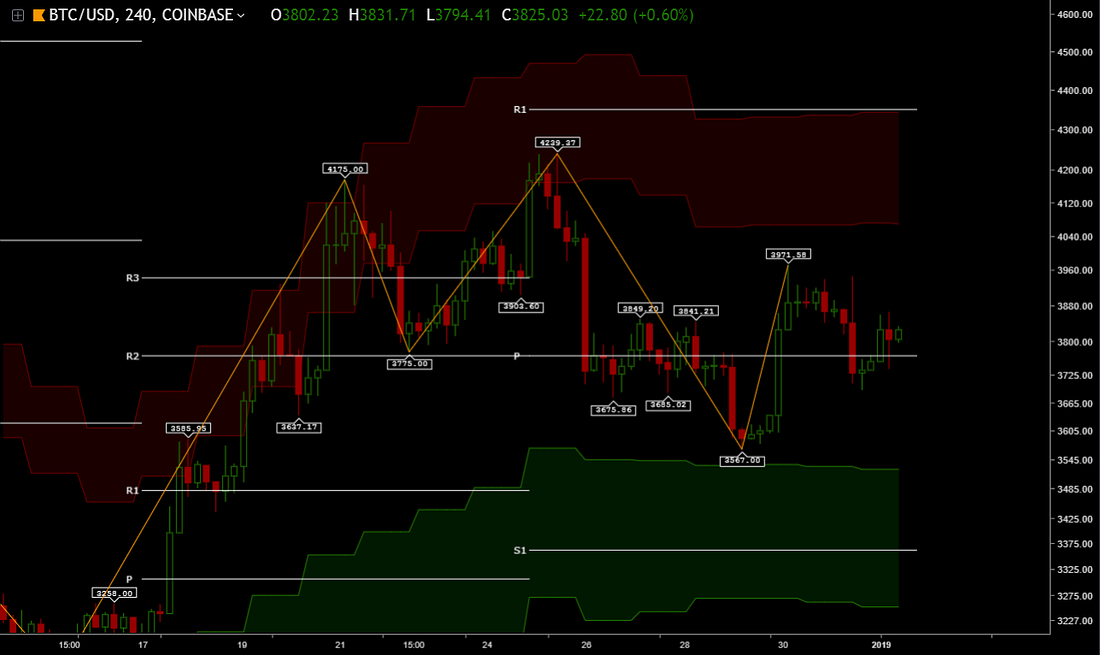

Bitcoin (4h Support/Resistance Levels)

Bitcoin (Macro Overview)Below are the 3 most common scenarios I've seen being discussed.

Recommended ReadingsDon't trust, verify: a Bitcoin Private case studyFascinating case study about a covert premine in project that had a ton of hype. The folks at Coinmetrics started exploring the possibility of a convert premine after they found discrepancies between the supply data pulled from their Bitcoin Private node and the estimated outstanding supply of BTCP. You can read the full report here.

And here are some relevant tweets from Nic Carter.  We found the irregularity by looking at on-chain transaction volume and then running a few queries to audit the supply when it hit red flags. The extra 2.04m was hidden in plain sight, mostly held in the shielded pool. We found the irregularity by looking at on-chain transaction volume and then running a few queries to audit the supply when it hit red flags. The extra 2.04m was hidden in plain sight, mostly held in the shielded pool. Interestingly, running a full node wouldn't have exposed the premine through its typical validation checks - the reason being that the premine was inserted through the irregular BTC UTXO set import. The actual mining process on BTCP retained its integrity. Interestingly, running a full node wouldn't have exposed the premine through its typical validation checks - the reason being that the premine was inserted through the irregular BTC UTXO set import. The actual mining process on BTCP retained its integrity. The surprising thing here is that the third party data sources which supposedly audit supply failed in their duty, and that no one in the BTCP community independently audited the supply. The surprising thing here is that the third party data sources which supposedly audit supply failed in their duty, and that no one in the BTCP community independently audited the supply. This is a lesson not only to run full nodes AND perform additional supply audits, but to be extra careful when there are atypical chain initiation protocols. It's also cause to inspecting the usage of the chain to spot large movements. This is a common way to spot irregularities This is a lesson not only to run full nodes AND perform additional supply audits, but to be extra careful when there are atypical chain initiation protocols. It's also cause to inspecting the usage of the chain to spot large movements. This is a common way to spot irregularities Something interesting I learned in the course of this investigation — bitcoin assumes supply starts at 0 and then checks that inflation is correct on a per block basis. There's no "total supply check" it's all in the issuance schedule + difficulty adjustment Something interesting I learned in the course of this investigation — bitcoin assumes supply starts at 0 and then checks that inflation is correct on a per block basis. There's no "total supply check" it's all in the issuance schedule + difficulty adjustmentIf you think something important happened last week and we missed it, let us know! Continue the discussion in our Telegram group. That's all for now. See you all in the New Year. You're on the free list for CoinSheet. For the full experience, become a paying subscriber. |